Altcoin bull market isn’t over, says analyst – Here’s why

- The altcoin market cap showed a slight recovery to $867 billion after a significant drop.

- The weekly 200 EMA line was tested.

In recent months, the altcoin market has witnessed a significant shift. After reaching a high of $1.26 trillion in March, the market capitalization for altcoins has faced a steep decline, plummeting to as low as $723 billion.

Despite this downturn, the latest figures indicate a recovery, with the market cap rebounding to $867 billion.

Altcoin market movements

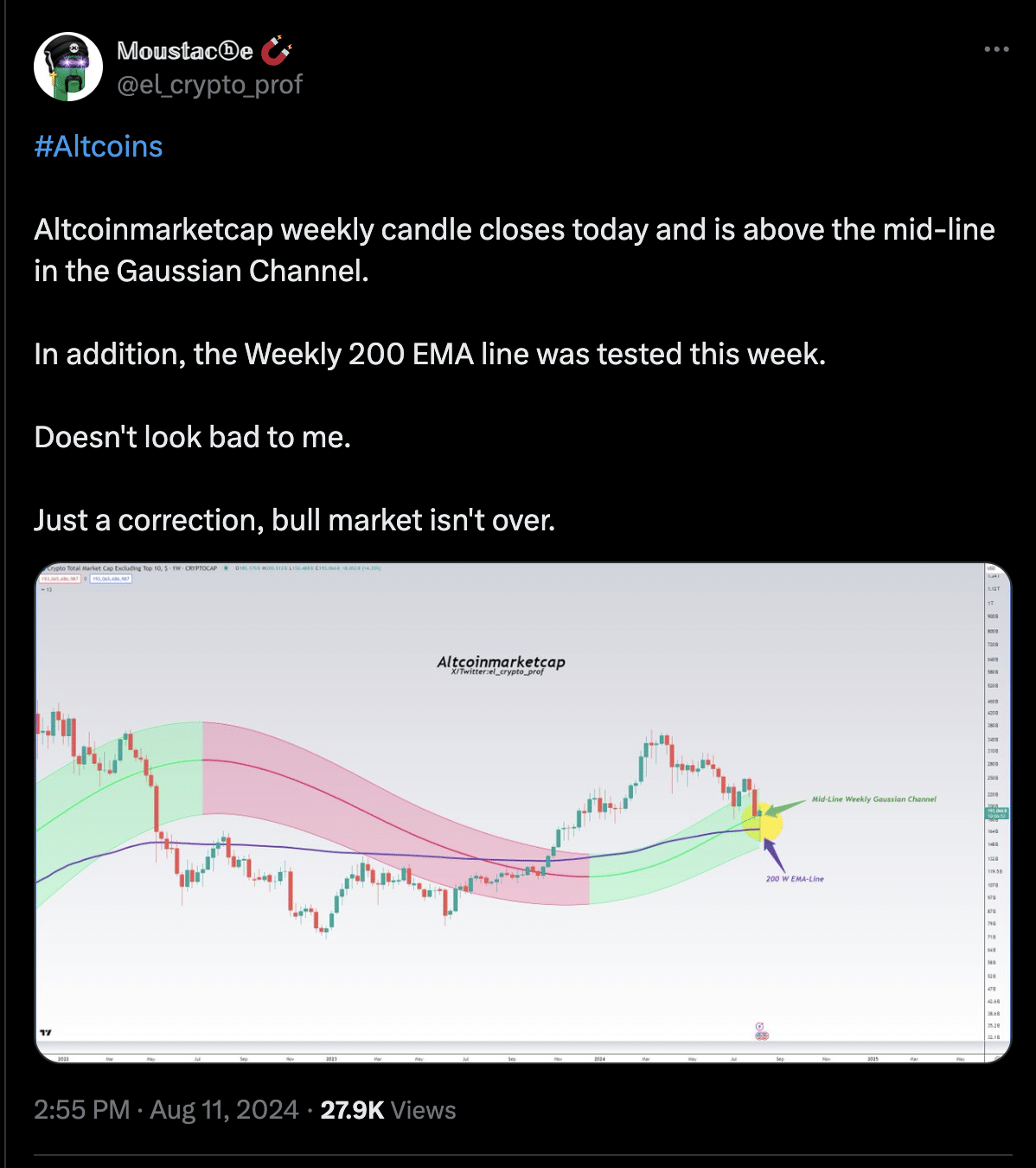

Moustache, a prominent crypto analyst, provided insights into the current market dynamics through a recent analysis.

Observing the altcoin market capitalization, Moustache pointed out that the weekly candle was closing above the mid-line in the Gaussian Channel.

This is a technical indicator used to determine the moving averages that mark the highs and lows of price movements over a specified period.

Furthermore, the Weekly 200 EMA (Exponential Moving Average) was tested, suggesting a potential stabilization or even a rebound.

Moustache suggested that the fact that the market cap is consolidating above these critical technical levels could indicate that what we’re seeing is merely a correction rather than the end of the bull market.

Case study: Cardano’s market performance

Focusing on individual altcoins provides further clarity on the broader market trends. Cardano [ADA], known for its technology and strong community, has not been immune to the market’s trials.

Trading at $0.335 at press time, ADA has experienced a 5.7% decline in the past 24 hours and a more considerable 20.2% drop over the past week.

This case highlighted the sharp correction that recently occurred in the overall altcoin market.

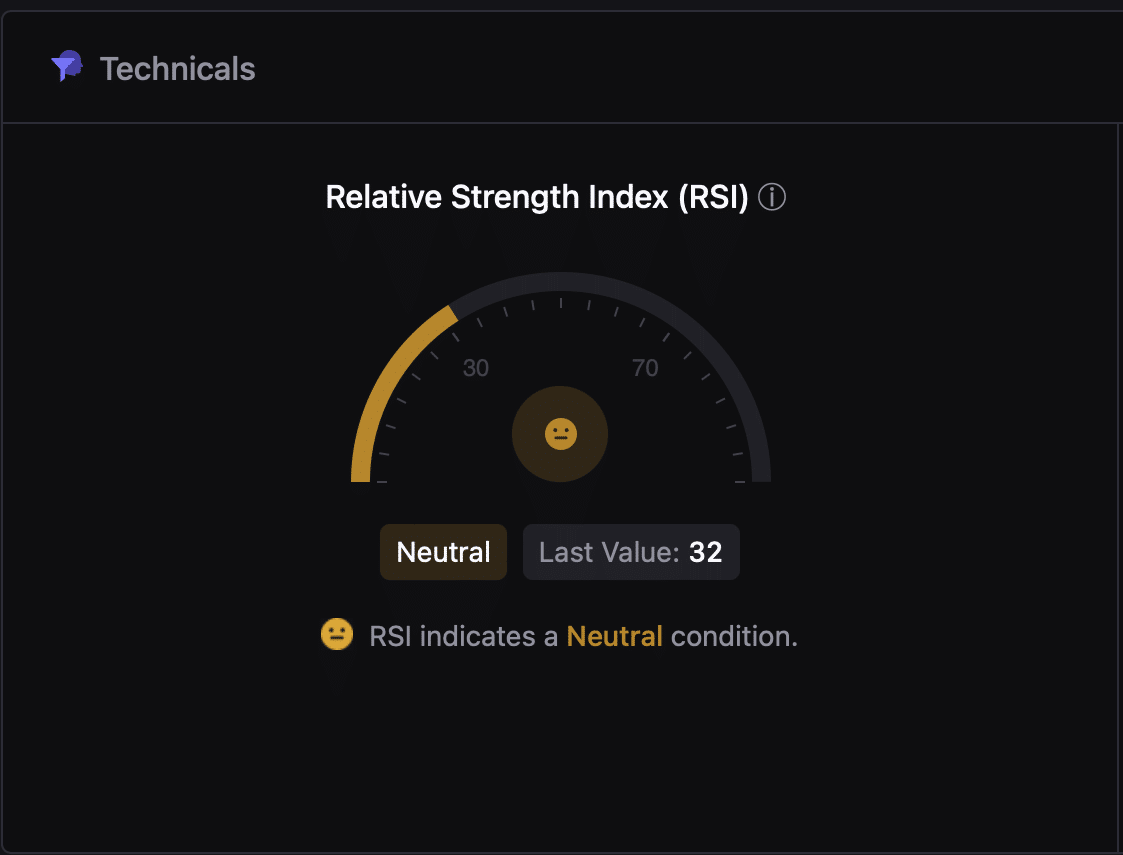

From a fundamental perspective, the Relative Strength Index (RSI), a momentum oscillator that measures the speed and change of price movements, is crucial.

For Cardano, the RSI was 31, which typically indicates that the asset is neither overbought nor oversold, providing a neutral signal to market observers.

This suggests that while immediate prospects might seem bearish, there is potential for recovery depending on broader market movements.

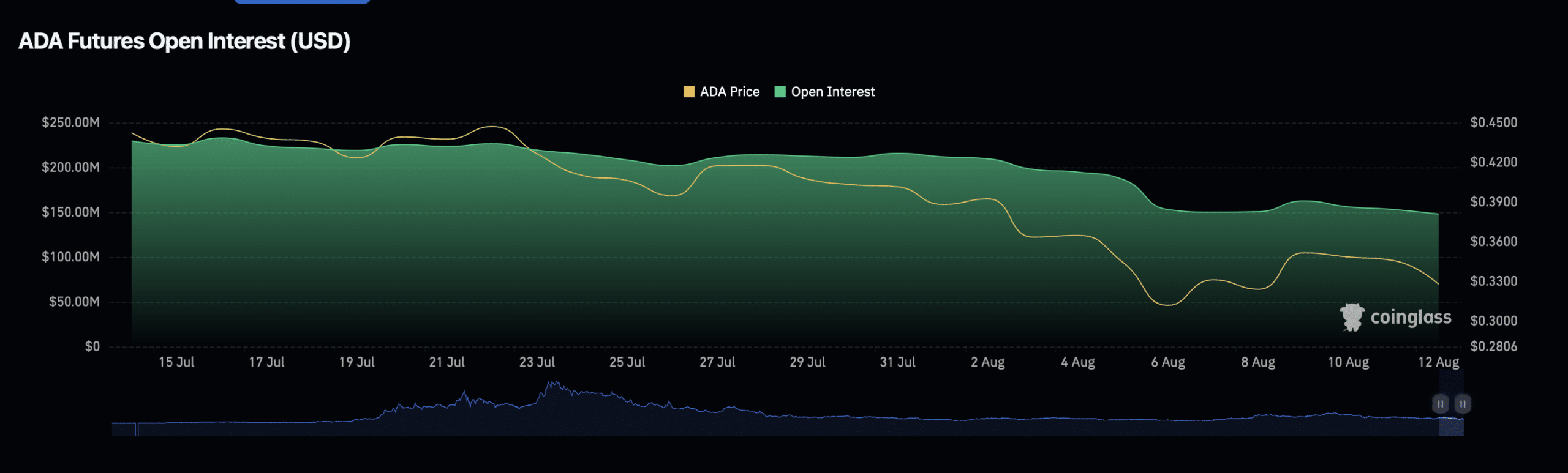

Moreover, the Open Interest in Cardano, which reflects the total number of outstanding derivative contracts, such as Futures and options, that have not been settled, has seen a significant shift.

It increased by 4.77% in the past 24 hours to $161.27 million, while the total value locked in these contracts surged by 86% to $236.86 million.

These metrics are indicative of increasing trader engagement and can often precede volatility in price movements.