Assessing why POPCAT’s price may be at risk of 15% decline

- POPCAT’s long/short ratio, at press time, stood at 0.91, indicating strong bearish sentiment

- On-chain metrics and technical analysis suggested that bears are dominating POPCAT

POPCAT, the Solana-based memecoin, may be poised for a significant price decline as its daily chart and on-chain metrics flashed a bearish signal. Over the past few days, POPCAT has surged by more than 100%.

However, it now appears that traders and investors might be booking profits, resulting in the formation of a bearish pattern.

POPCAT’s price momentum

At press time, POPCAT was trading near $0.91 following a price decline of over 8% in the last 24 hours. Meanwhile, its trading volume dropped by 20% during the same period, indicating fear of further price drop in the coming days.

Technical analysis and key levels

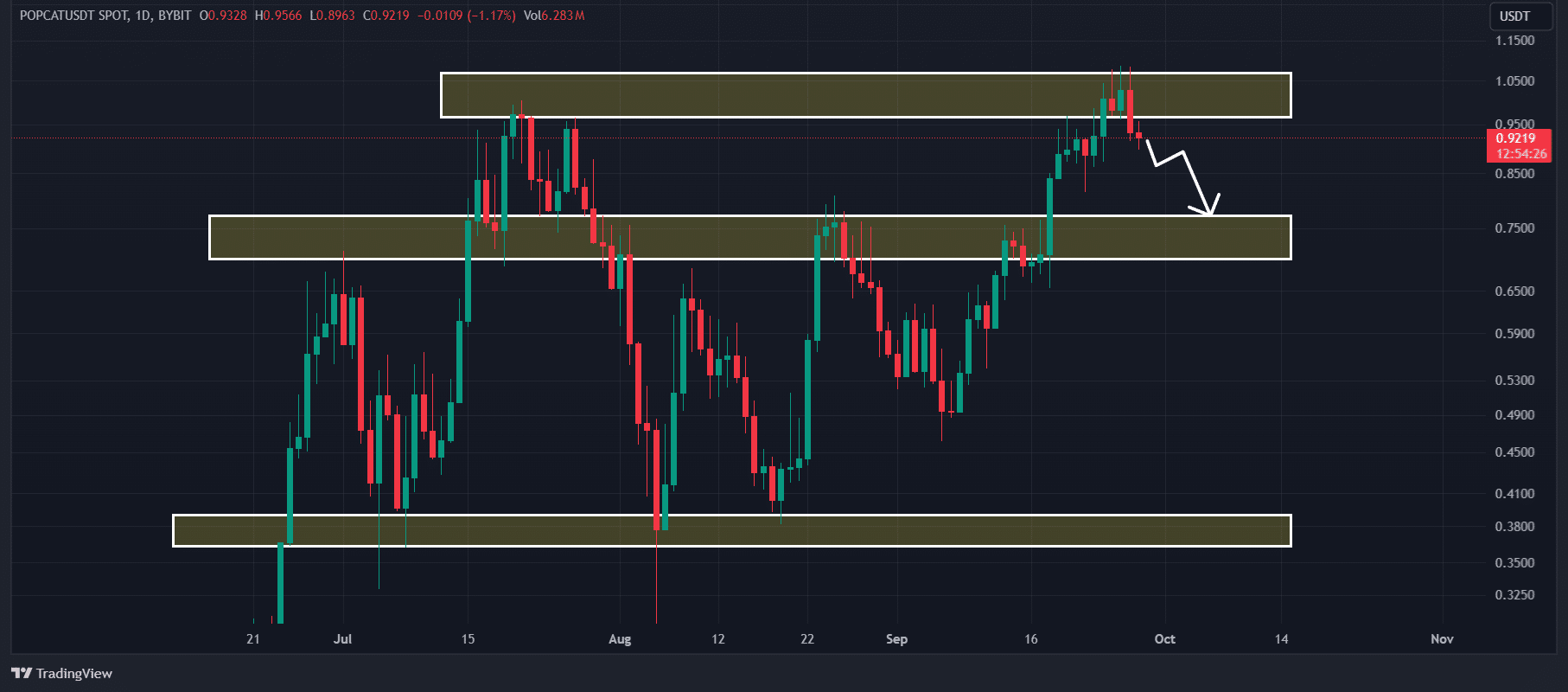

According to AMBCrypto’s technical analysis, POPCAT appeared bearish as it recently broke down from two days of consolidation at the resistance level of $1 with a large red candle. In technical analysis, a consolidation breakout at the resistance level is considered a bearish signal.

Based on its recent price action, there is a strong possibility that POPCAT’s price could decline by 15% to hit the $0.78 level in the coming days.

However, the memecoin’s Relative Strength Index (RSI), at press time, was in an overbought area, signaling a potential price reversal.

Bearish on-chain metrics

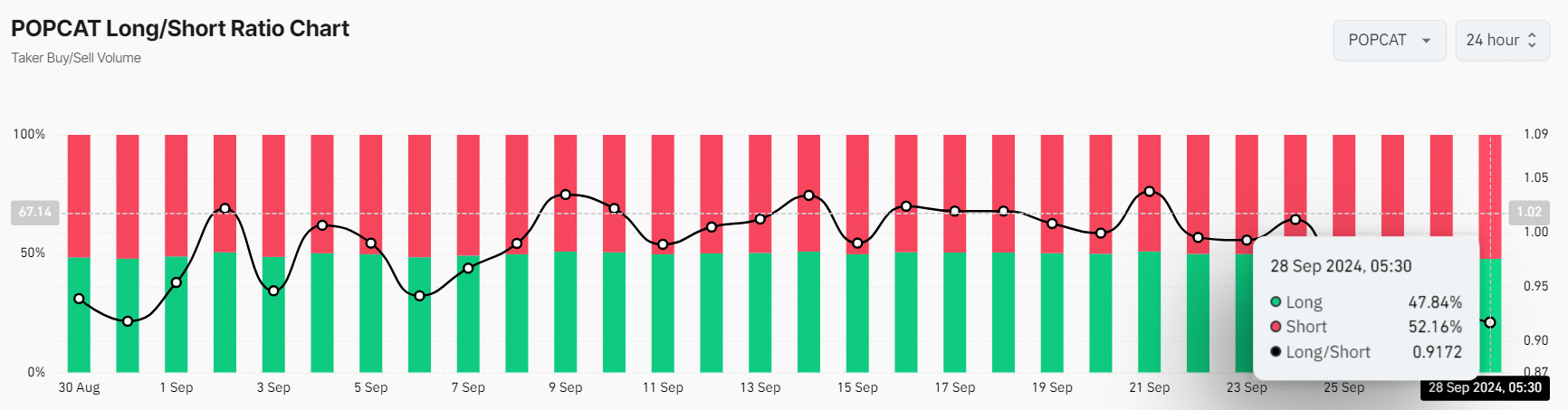

In addition to the price action, POPCAT’s on-chain metrics further supported this negative outlook. According to the on-chain analytics firm Coinglass, POPCAT’s long/short ratio stood at 0.91 – Its lowest since the beginning of September 2024. This implied strong bearish sentiment among traders.

Additionally, POPCAT’s Futures Open Interest has remained unchanged over the past 24 hours, indicating that no new positions are being built or liquidated. This underlined a neutral signal for the popular memecoin.

At the time of writing, 52.16% of top traders held short positions, while 47.84% held long positions. These on-chain metrics and technical analysis suggested that bears are currently dominating the asset. This could lead to further price declines in the coming days.