Bitcoin ‘God Candle’ coming? $220K price prediction could be next for BTC

- Analyst Max Keiser forecasted Bitcoin’s rise to $220,000 due to a supply-demand shock.

- Current data indicated rising short-term bearish pressure.

Amid fluctuating market conditions, Bitcoin [BTC] traded at $61,512 at press time, marking a 1.4% decrease in the past 24 hours but maintaining a 6.8% increase over the week.

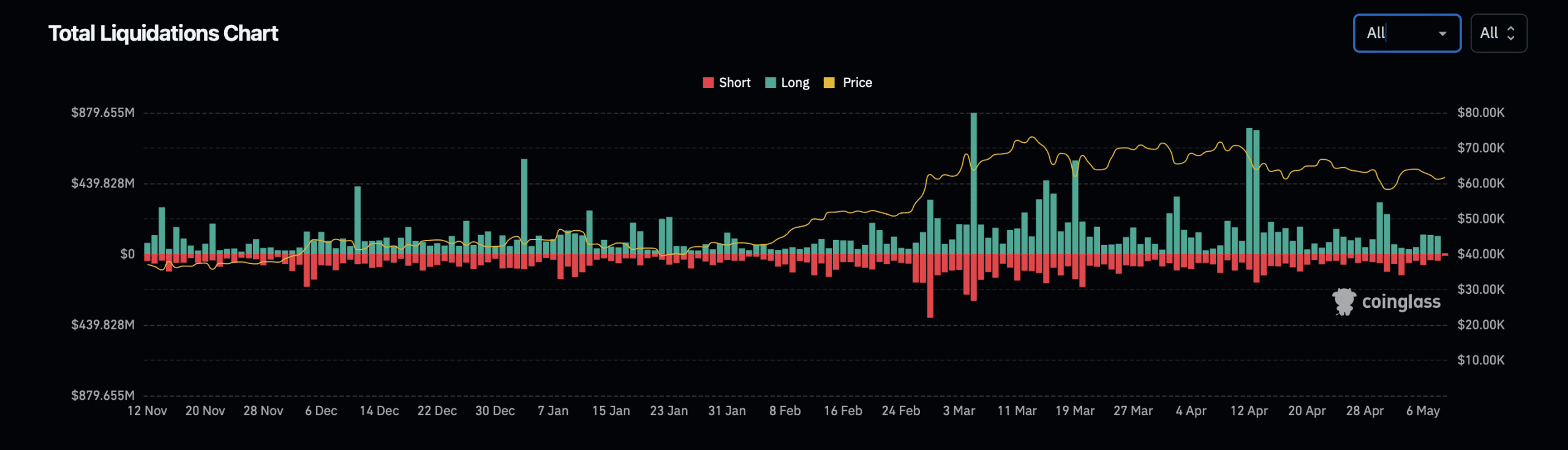

This period has not been without its challenges, as data from Coinglass revealed that the past day alone saw 61,419 traders liquidated, culminating in $133.87 million in total liquidations.

This volatility underlines the fragile state of the market, yet it doesn’t dampen the spirits of some industry stalwarts.

One notable voice, Max Keiser, a vocal Bitcoin advocate and former financial journalist, has reiterated his bullish stance on Bitcoin’s future.

Keiser took to his X (formerly Twitter) account to share his belief that Bitcoin could soar to the $220,000 mark, a prediction he has consistently been pushing out over the years.

This latest forecast is driven by what Keiser identifies as a crucial dynamic in the market: a “demand shock meets supply shock” scenario, indicating a tightening of Bitcoin’s supply at a time of increasing demand.

A deep dive into Bitcoin’s potential

Keiser pointed to the decreasing Bitcoin supply on cryptocurrency exchanges, which he notes are hitting all-time lows, signaling a “supply shortage incoming,” as stated by X user Vivek.

This supply contraction, paired with growing demand, forms the basis for Keiser’s prediction of a ‘God candle’ on Bitcoin charts — a dramatic price surge that could potentially elevate Bitcoin to the $220,000 level.

This isn’t the first time Keiser has projected such highs for Bitcoin. So far, it appears the Bitcoin advocate keeps predicting this price mark for the asset at any catalyst in sight.

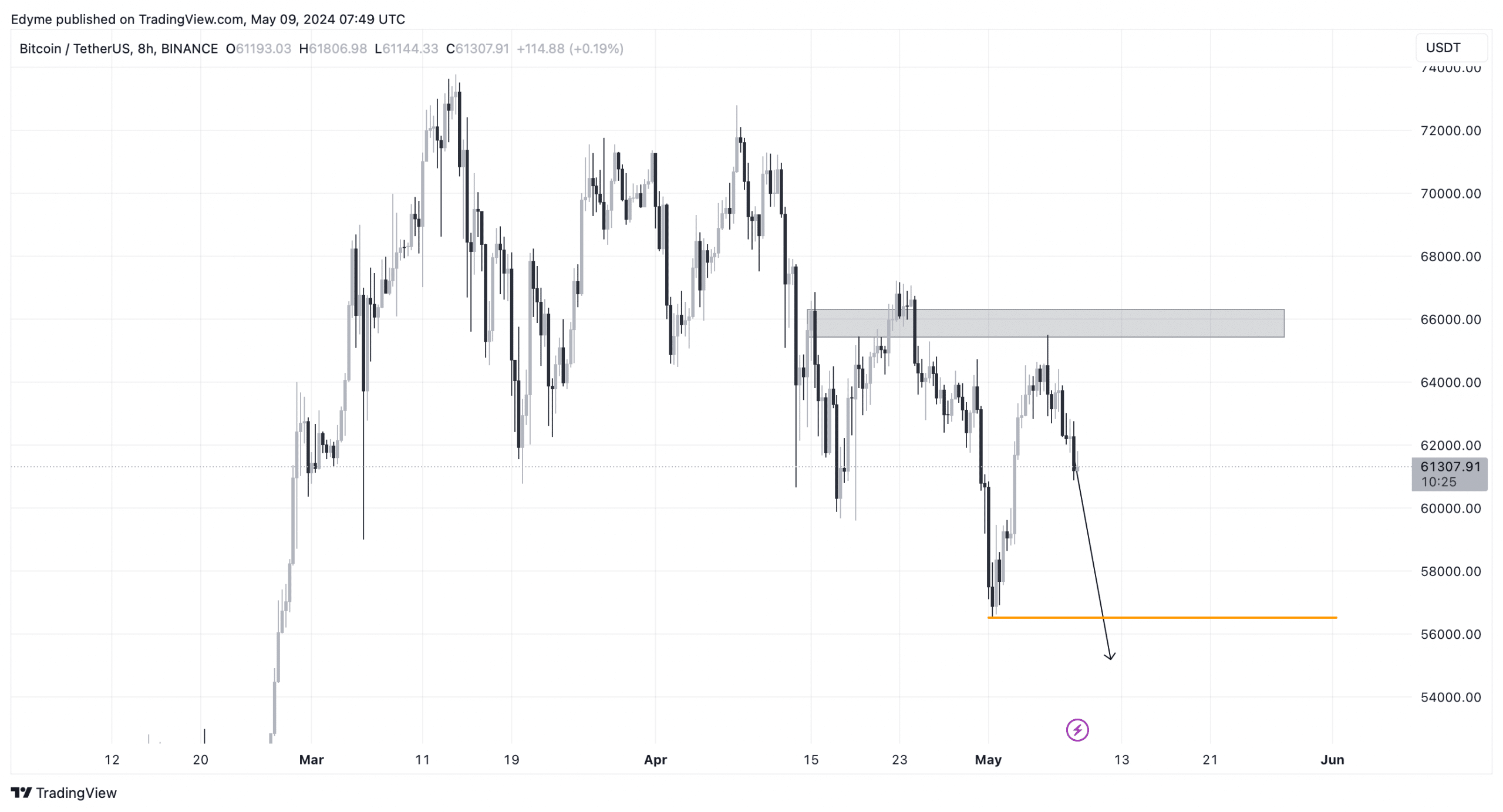

Regardless, a closer examination of Bitcoin’s daily chart shows the asset gradually breaking structure to the downside over recent months, leading to liquidity accumulation at each structural break.

Recently, Bitcoin surged to capture this liquidity at the top, which suggests that the asset is seeking a potential continuation of the downtrend, indicating bearish pressure ahead.

Market data echoes bearish sentiments

Supporting this bearish outlook, data from Glassnode revealed a decline in the number of active Bitcoin addresses and a slowdown in new address momentum.

This suggested that the market might be losing hope in a short-term bullish recovery, leading to a decline in these critical areas.

Read Bitcoin’s [BTC] Price Prediction 2024-25

AMBCrypto recently reported that the recent market correction has led to a decrease in Bitcoin’s supply in profit, shaking investor confidence.

This trend is a clear indicator of the market’s skepticism about an imminent bullish turnaround, despite optimistic predictions from figures like Keiser.