Bitcoin Ordinals becomes a hotbed of NFT trading, will the trend sustain?

- Ordinals grew faster in its early stages than NFTs launched on other networks.

- Bitcoin clocked the third-highest NFT trading volume in the first three quarters of 2023.

A year ago, nobody would have imagined Bitcoin [BTC] becoming a favored network for facilitating non-fungible token (NFT) transactions. However, things took a sharp turn in 2023 with Ordinals emerging as one of the year’s biggest success stories in the blockchain space.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Ordinals make a fantastic debut

In simple terms, Ordinals are NFTs that can be minted directly onto the Bitcoin blockchain, as opposed to NFTs on Ethereum [ETH], which point to off-chain data and rely on token standards to create a collection of tokens.

Ordinals focus on BTC’s smallest units, satoshis. The protocol allows users to inscribe each satoshi with data. This data can include smart contracts, which are then used to enable NFTs.

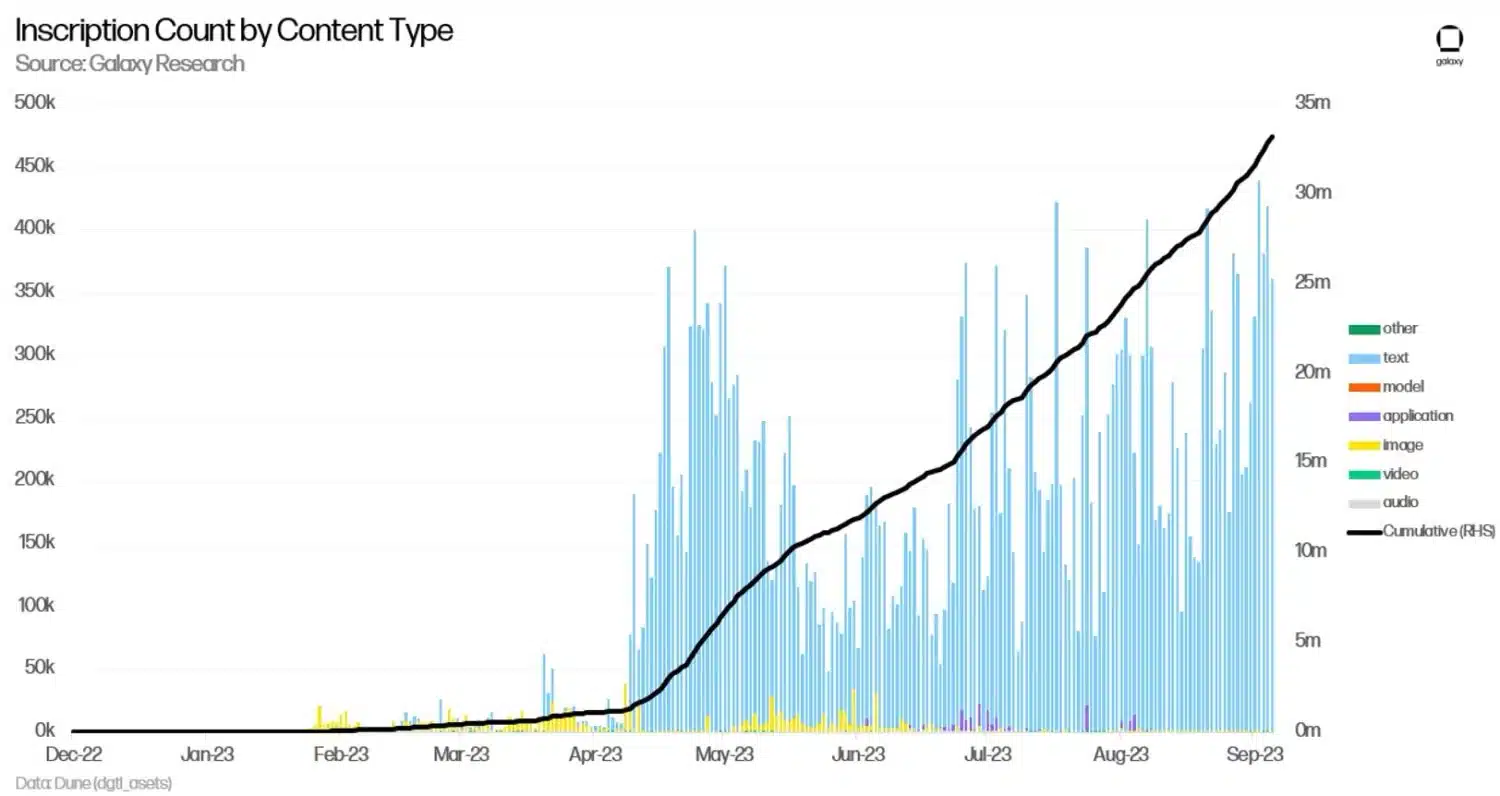

Introduced in January, Ordinals saw moderate growth in the first few months. However, the ecosystem has exploded since March, with nearly 35 million inscriptions getting minted until September, as per a report by blockchain analytics firm Galaxy Research.

It was worth noting that text-based inscriptions accounted for 95% of all mints. This was despite the fact that much of the hype surrounding Ordinals was fueled by digital artifacts or image-based files.

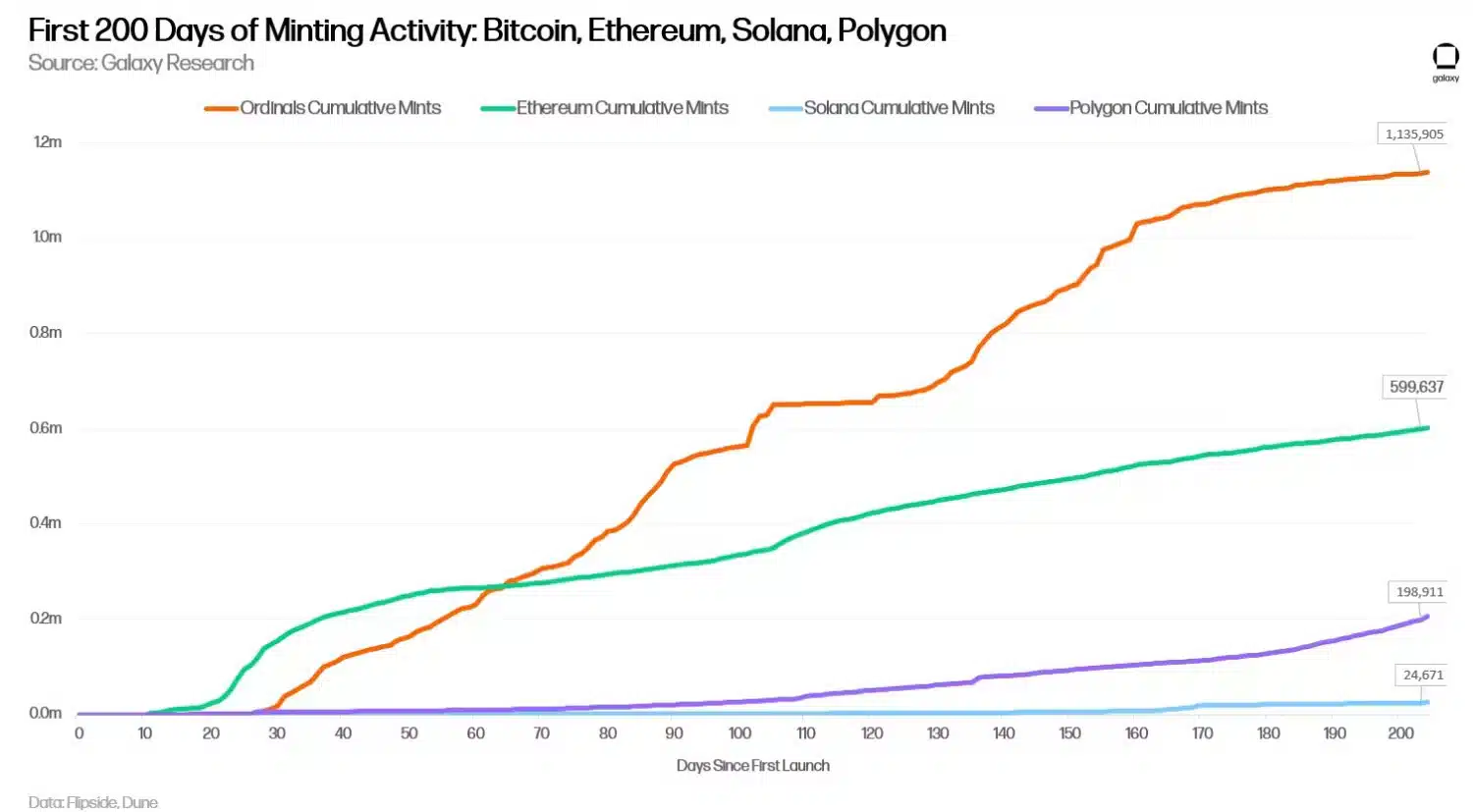

However, when focusing just on image-based inscriptions, Bitcoin Ordinals grew faster in its early stages than NFTs launched on other networks.

As shown below, about 1.14 million digital artifacts were minted on Bitcoin during the first 200 days of activity. In contrast, Ethereum and Solana [SOL] experienced much slower minting activity on their respective networks since the debut of NFTs.

Oasis of growth amidst a NFT desert

The striking feature of Ordinals’ growth trajectory was that it came during the NFT crypto winter. As part of the analysis, Galaxy Research noted,

“Despite the broader NFT market struggling to pull itself out of a bear market, Ordinals have gained significant traction and the idea of digital artifacts on Bitcoin has flourished.”

Indeed, NFT trade volumes dramatically plunged in 2023, with monthly figures steadily going downhill since the peak in February. However, amidst the gloom, Ordinals scripted a winning chapter.

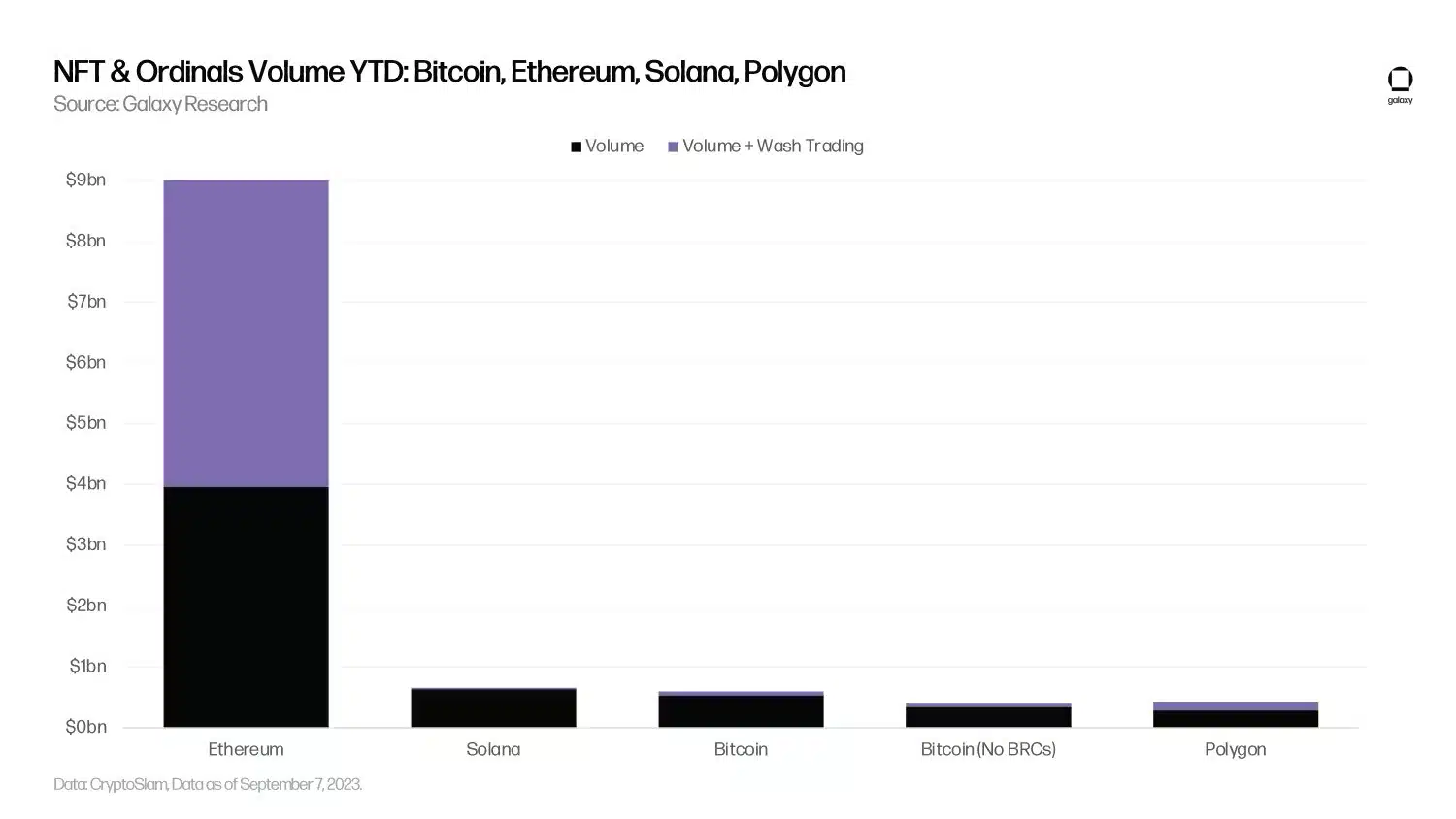

Evidently, Ordinals constituted 18% of all NFT volumes in May. And, although dropping out of the spotlight since then, Ordinals managed to provide a big impetus to Bitcoin’s NFT activity.

The payments settlement network turned into a hot spot for trading digital artwork overnight. Bitcoin clocked the third-highest NFT trading volume in the first three quarters of 2023, eclipsing biggies like Polygon [MATIC] and trailing only Ethereum and Solana.

Ordinals mania pushes up transaction fees

Ordinals’ frenzy also propelled network activity on the Bitcoin network to unprecedented levels. As mentioned earlier, Ordinals trading volume peaked in May, boosted majorly by the bulk minting of BRC-20 tokens.

For the uninitiated, BRC-20 is a token standard that enables users to issue transferable tokens directly through the network.

Because of the high demand for blockspace, a transaction jam choked the Bitcoin mempool. In fact, Galaxy Research noted that the jam hasn’t cleared for about four months.

This was the longest running streak for a backlogged mempool since the bull run-induced spike in on-chain activity in 2021.

The increase in the number of unconfirmed transactions in the mempool prompted users to bid up fees in order to jump the queue. This is because miners would most likely include transactions with higher fees into the block and ignore the ones below a certain threshold.

The findings were verified by the dramatic increase in transactions and fees displayed in Glassnode’s data above.

A bright future ahead?

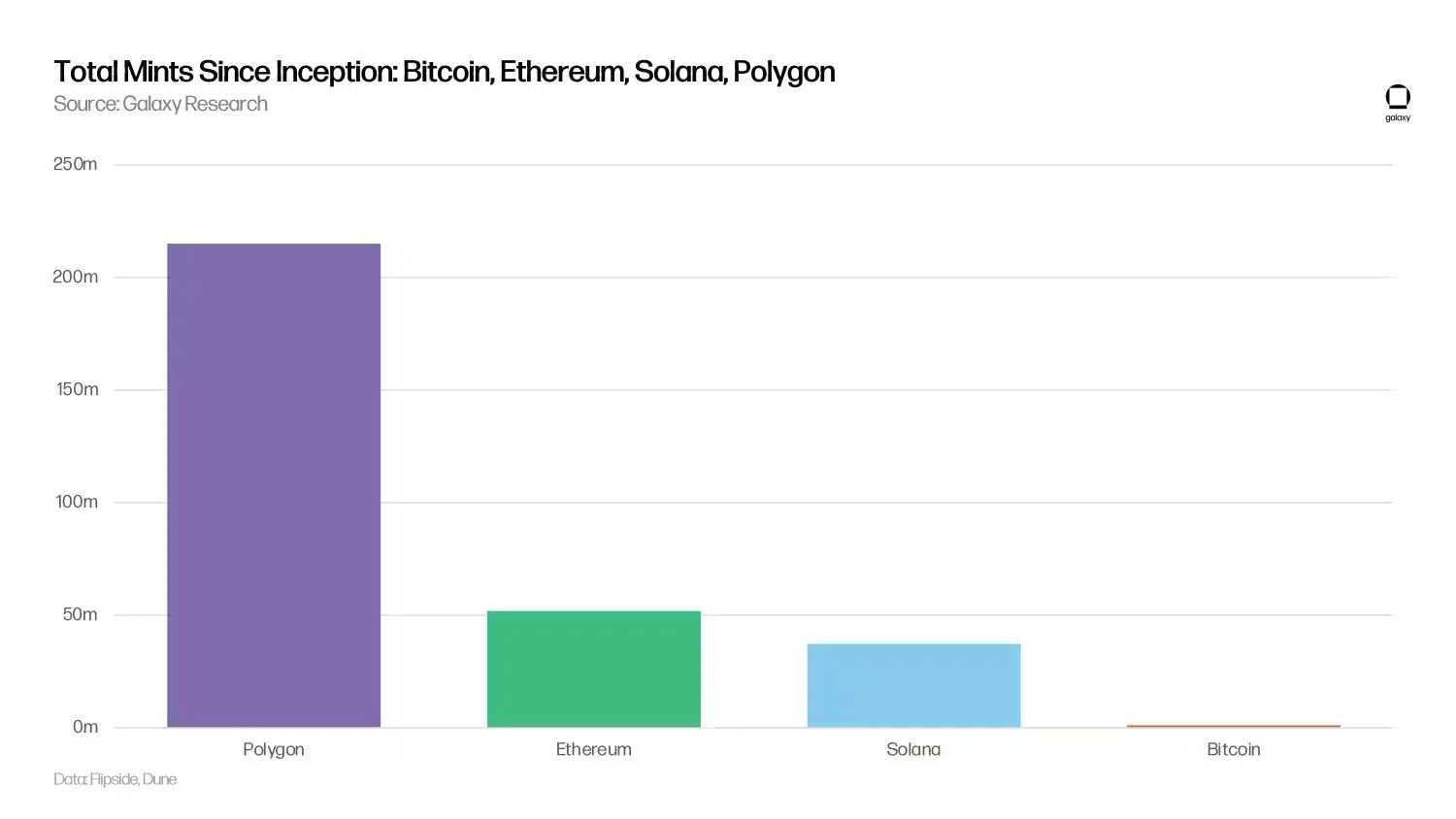

While Ordinals had a promising debut, they still had a long way to go. Bitcoin’s minting activity in the first 200 days was significantly less than other chains. The fact that other networks had experience and a well-developed ecosystem for NFT trades helped.

Is your portfolio green? Check out the BTC Profit Calculator

Moreover, the BRC-20 standard was found to be an inefficient method to mint inscriptions as per the report. To make it easier for users, more efficient token standards were proposed.

Furthermore, a substantial push was required to place a greater emphasis on minting image-based NFTs.