Bitcoin: Why this might be the right time to ‘buy the dip’

- Bitcoin’s liquidations rose when its price neared the $44,000-mark

- Market indicators mostly remained bearish for Bitcoin

As the market leader, Bitcoin [BTC] has always played a major role in shaping the rest of the crypto-market. For instance, when BTC’s price dropped significantly over the last few hours, other cryptos simply followed suit.

This fuels an important question though – Should investors take it as an opportunity to buy more BTC?

Bitcoin’s price is dropping again!

After a comfortable rally, Bitcoin finally registered a price depreciation. According to CoinMarketCap, at press time, BTC was down by more than 4% in the last 24 hours alone. In fact, WhaleWire revealed that BTC wiped out an entire week’s worth of gains in just 6.4 minutes.

#Bitcoin wiped an entire week’s worth of gains in 6.4 minutes.

People are slowly becoming worried and moon boys are going silent again — but we’ve seen nothing yet.

This is just a tiny teaser for what’s to come. The full extent of this blood bath will be 1000x bigger.

Don’t…

— WhaleWire (@WhaleWire) December 11, 2023

At the time of writing, it was trading at $42,048.39 with a market capitalization of over $822 billion. The bad news was that the king of crypto’s trading volume surged while its price dropped, which is a common bearish signal.

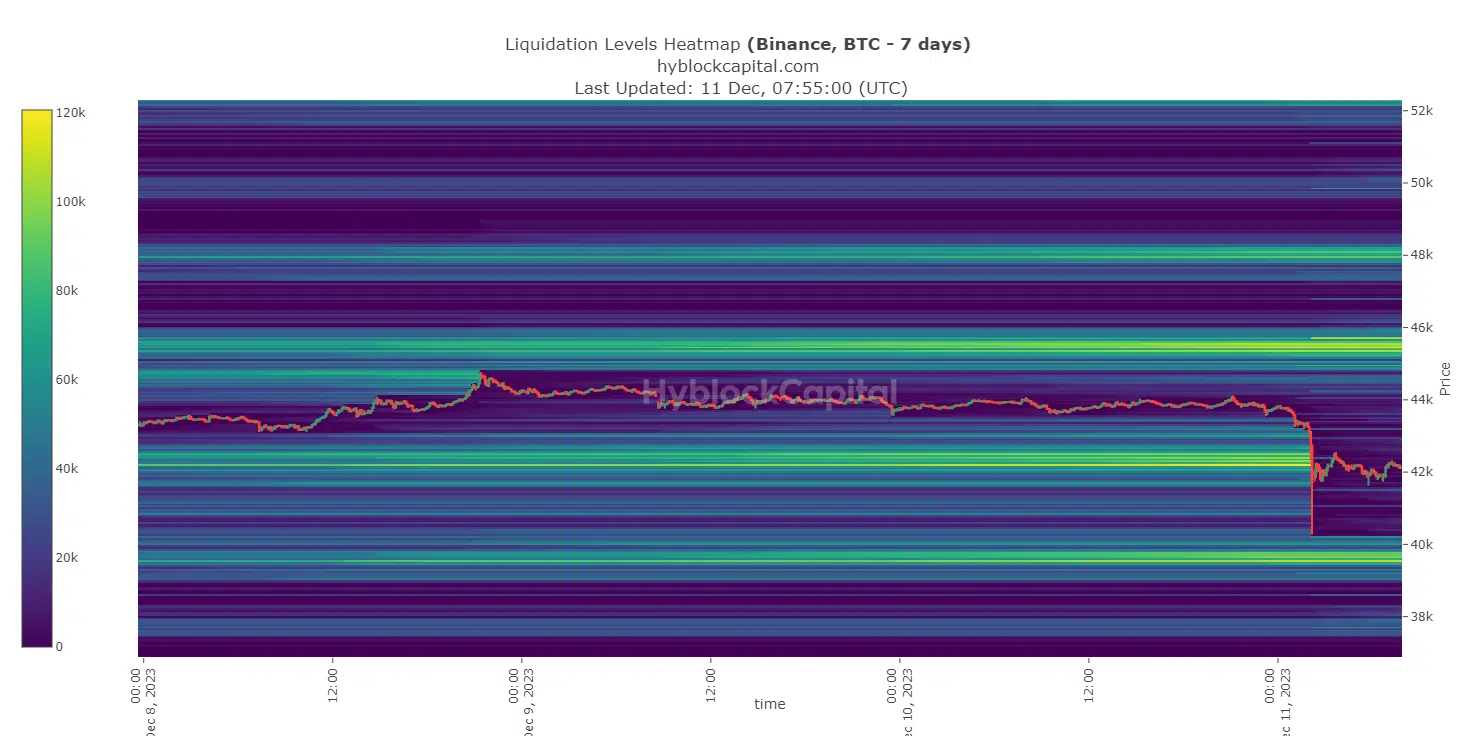

AMBCrypto then had a look at BTC’s liquidation levels to better understand at what time the coin’s price dropped. As per our analysis, BTC’s liquidation levels rose when its price hit the $44,000-mark. During that time, investors started to sell, causing the price to drop, which actually precipitated a bearish market condition for the rest of the crypto-market.

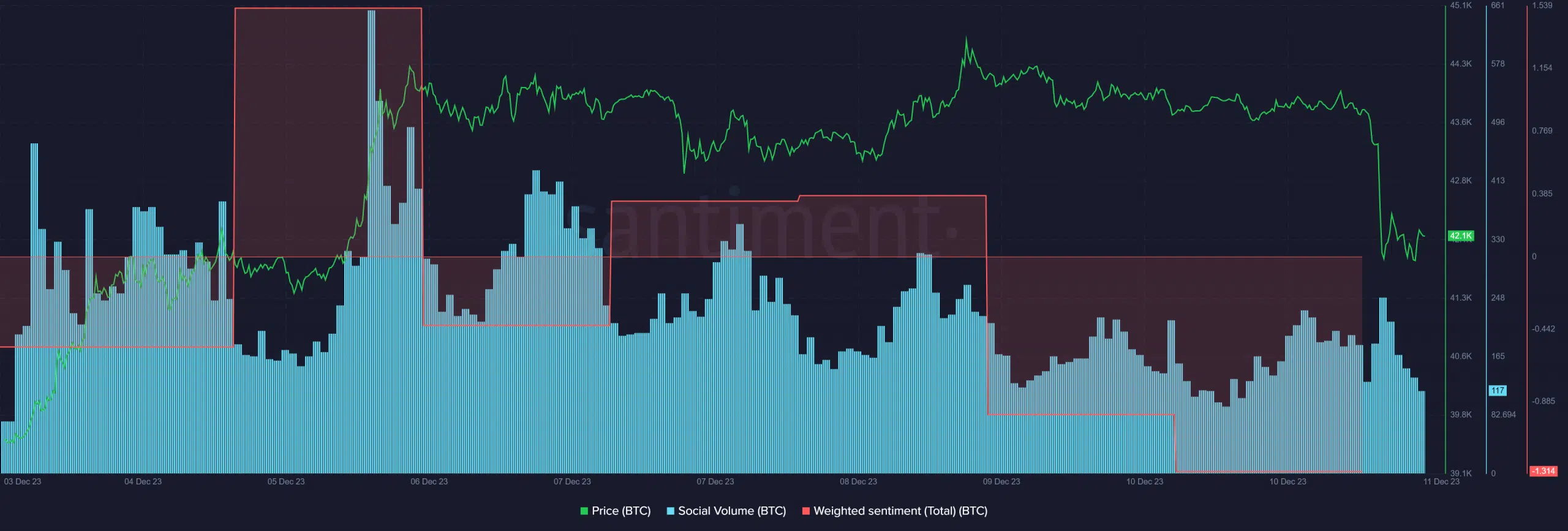

The prevailing downtrend also had an effect on the crypto’s social metrics. For example, BTC’s social volume dropped slightly. Additionally, its weighted sentiment also declined, meaning that negative sentiments were dominant across the market.

Should investors buy the dip?

While the king of cryptos’ price is down, it might open the right window for investors to accumulate more BTC. In fact, Santiment recently highlighting the same fact too. The crypto-analytics platform claimed,

“Crypto has experienced its fastest drop in 4 months as markets have corrected and caused mild trader concerns. There is a high level of buythedip calls, which typically means that there is a bit of overeagerness and FOMO on these low prices.”

Read Bitcoin’s [BTC] Price Prediction 2023-24

Therefore, it is worth taking a look at Bitcoin’s daily chart to see whether investors should actually accumulate BTC in the first place.

As per AMBCrypto’s analysis, BTC’s MACD clearly projected the possibility of a bearish crossover. Its Bollinger Bands suggested that the coin’s price was in a high volatility zone too. On the contrary, its Chaikin Money Flow (CMF) remained bullish as it gained upward momentum on the charts.