Bitcoin: Why traders should be cautious of the BTC price surge

- Bitcoin’s price surpassed $45,000, raising concerns amid imbalanced profit and loss realization trends.

- Traders profited while mining revenue declined.

Bitcoin [BTC] was on an upward trajectory recently as it surpassed the $45,000 barrier. While this may signal optimism for some, there are growing concerns among holders as various market dynamics unfold.

Profits and losses

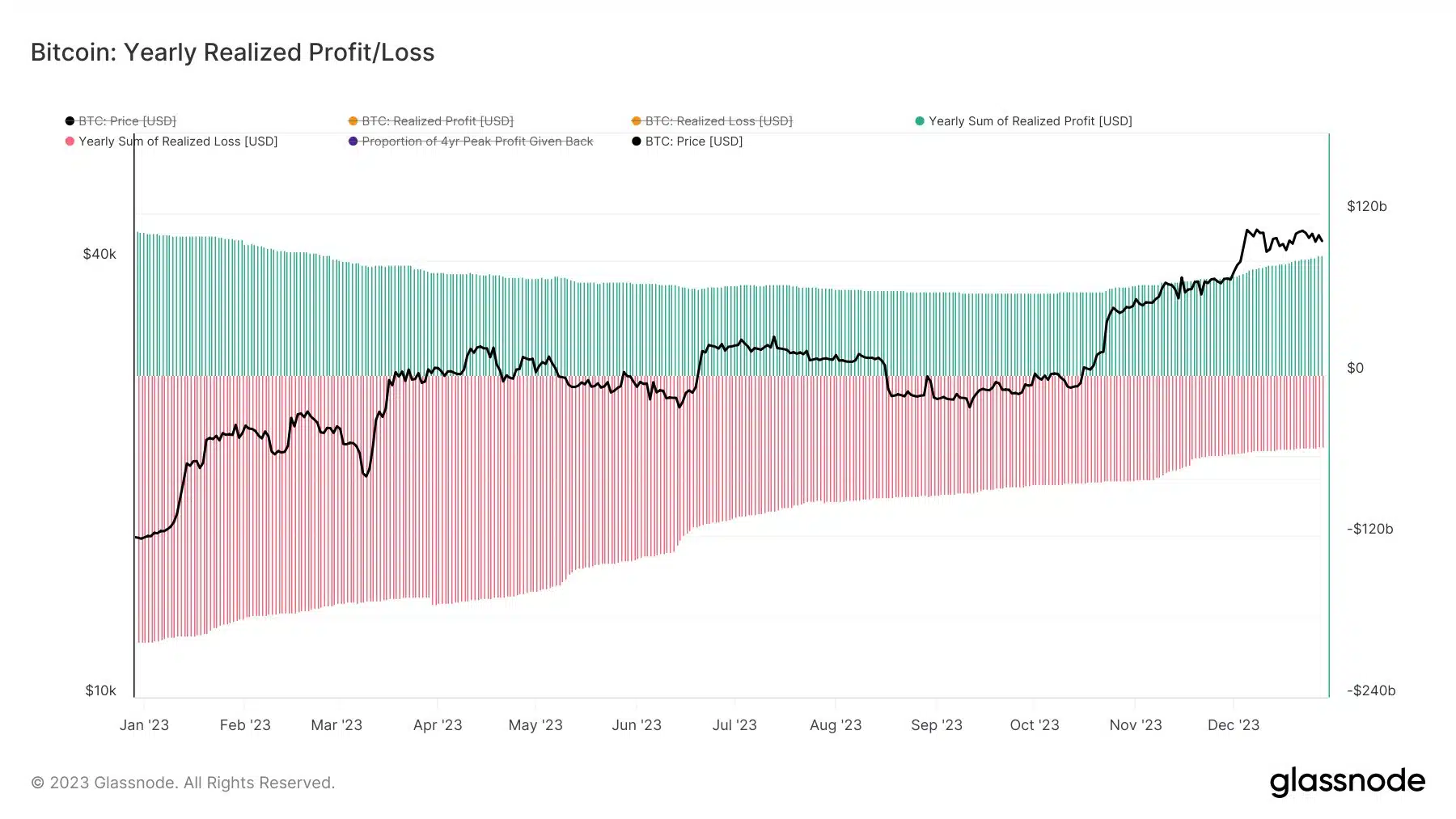

In the realm of profit-taking, 2023 has seen Bitcoin realizing profits exceeding $90 billion, yet, somewhat alarmingly, realized losses have reached $53 billion.

This stark contrast to 2022, where Bitcoin recorded approximately $200 billion in realized losses, surpassing the realized profit of $106 billion, raises apprehensions about the overall health of BTC’s market.

The significant imbalance between profits and losses could potentially impact Bitcoin negatively, reflecting a scenario where more holders are experiencing losses compared to those enjoying profits. This trend might contribute to a cautious sentiment among investors.

Traders, on the other hand, are capitalizing on BTC’s recent surge. With Bitcoin breaking through the $45,000 mark, a prominent trader has made a noteworthy profit of over $1.47 million, as reported by lookonchain’s data.

This trader’s successful long position initiated on the 14th of May, involving nine strategic trades, boasts a 100% win rate, accumulating a total profit of approximately $3.6 million.

While this showcases profitable opportunities for some, it also highlights the potential for increased market volatility.

With the price of $BTC breaking through $45K, this smart trader currently has a profit of over $1.47M!

This trader started long $BTC on May 14 and traded 9 times.

The win rate is 100% and the total profit is ~$3.6M!https://t.co/MlPmFL54I8 pic.twitter.com/gR0kpNDbNy

— Lookonchain (@lookonchain) January 2, 2024

Miners see turbulence

Mining behavior plays a pivotal role in Bitcoin’s ecosystem.

Daily miner revenue, however, has experienced a decline from $60 million to $47 million. This drop in mining revenue may inadvertently exert selling pressure on BTC as miners may find themselves compelled to sell their holdings to compensate for reduced profits.

The additional selling pressure could contribute to a further dip in Bitcoin’s price.

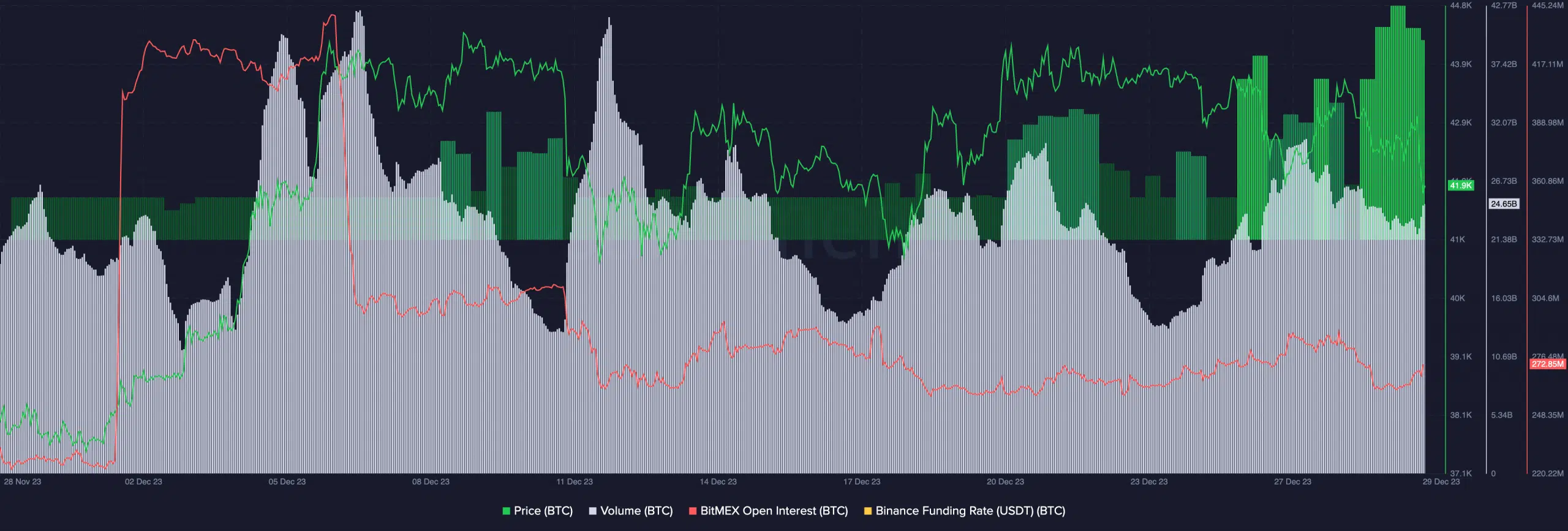

Speaking of BTC’s current price, it stands at $42,544.09, reflecting a modest decline of -1.13% in the last 24 hours. Concurrently, the trading volume also decreased.

Notable movements on Bitmex and Binance added another layer of nuance to the situation. Bitmex’s open interest grew, accompanied by a surge in Binance funding rates.

Read Bitcoin’s [BTC] Price Prediction 2023-24

In essence, Bitmex’s increased open interest signifies a rising number of outstanding derivative contracts, while heightened funding rates on Binance suggest an increased cost of holding long positions.

These trends might indicate heightened speculation and potential risk, warranting vigilance from market participants.