BNB can break $600, reach $715 – But on THIS condition

- BNB has been testing the $599.9 resistance but faces the risk of a double top formation.

- Momentum indicators suggest a potential breakout above $600.

Binance Coin [BNB] was showing resilience as it approached a critical level, trading at $597.2 with a marginal decline of 0.08% at press time.

The primary question for traders and investors is whether BNB can decisively break through the $600 resistance and ignite a stronger rally.

Let’s analyze the current price action, key technical levels, and momentum indicators to understand if this breakout is possible.

BNB current price structure: Are we heading higher?

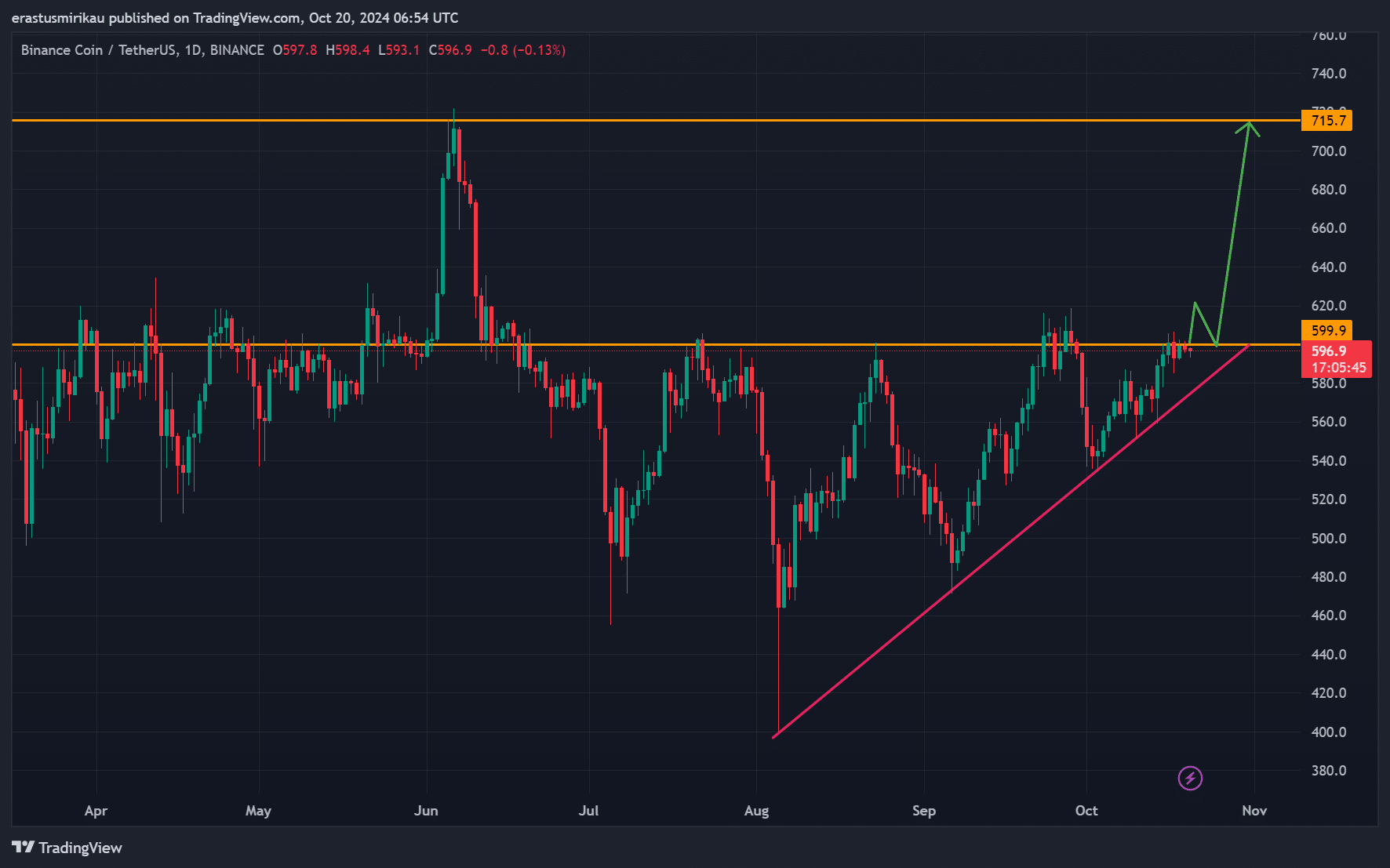

BNB has been trading within a range-bound structure, moving between $560 and $600 for several weeks. This follows a consistent uptrend from August’s low of around $500, reflecting increasing buying pressure.

However, BNB has faced repeated rejections around the $599.9 level. Despite this, there is growing optimism that BNB could break above this key resistance, potentially opening the door for a rally toward the $715.7 level seen in June.

Key resistance and support levels to watch

The $599.9 level remains the critical resistance, acting as a strong barrier to further upward momentum. Should BNB break through this level with a strong close above $600, a surge toward $715.7 could follow.

Conversely, the $560 support level remains intact for now, providing a safety net should the price pull back. Failure to hold $560 could lead to a deeper decline toward the $500 mark.

One potential bearish signal to consider is the double top formation around the $599.9 resistance. This pattern could indicate a trend reversal, and if BNB fails to break higher, it might trigger a corrective move.

However, a strong breakout above $600 would invalidate this formation, consequently setting up a potential bullish extension.

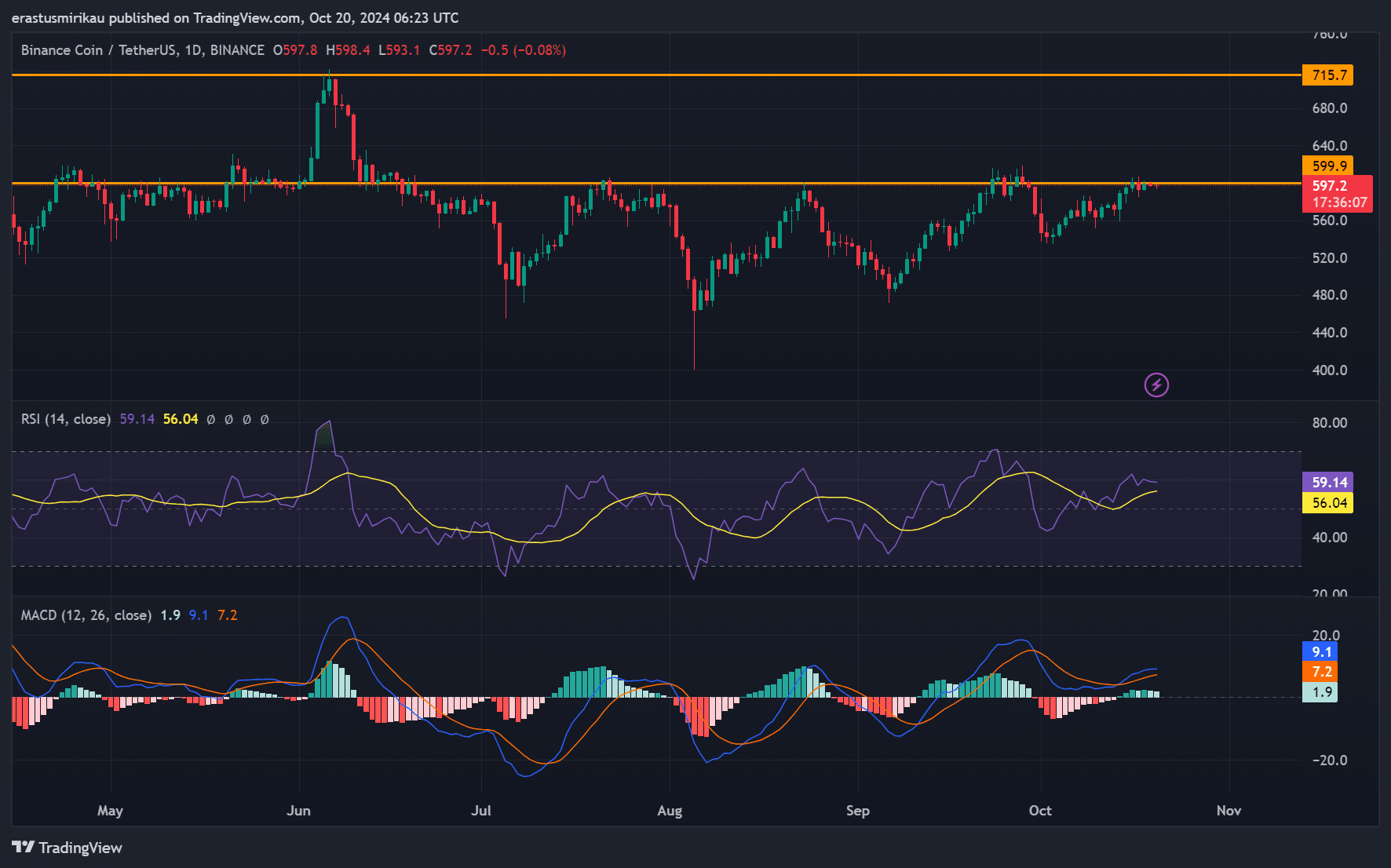

BNB technical indicators: RSI and MACD in focus

The Relative Strength Index (RSI) currently sits at 56, indicating neutral momentum with room for further upward movement.

Meanwhile, the MACD was providing a bullish crossover, as it was above the signal line at press time.

Therefore, both indicators suggested that upward momentum was building, increasing the likelihood of a potential breakout.

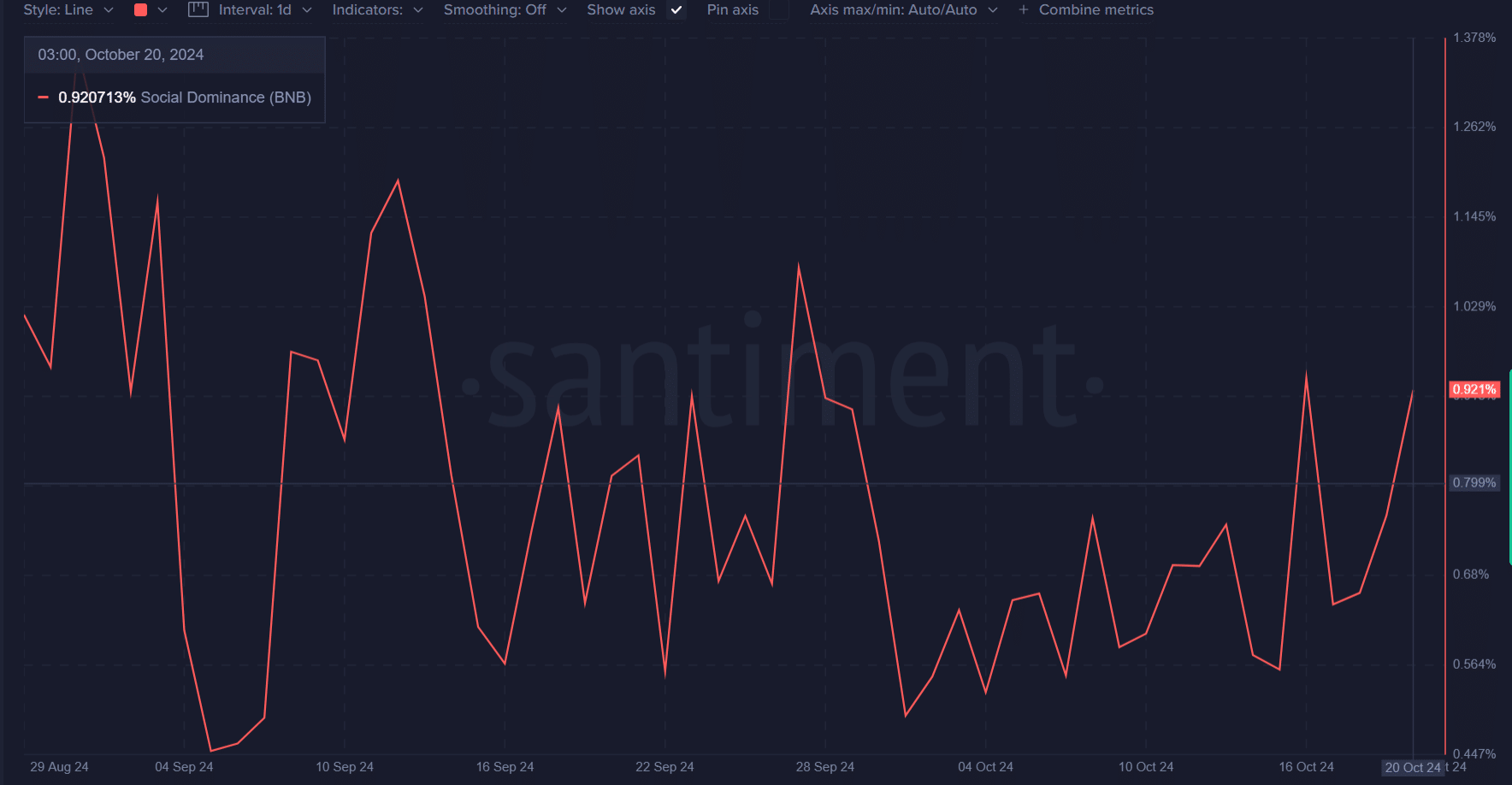

BNB’s Social Dominance: A bullish sign?

Additionally, BNB’s Social Dominance was rising at press time, at 0.92%. This increase in attention could further fuel buying interest.

Historically, higher Social Dominance has often led to increased price volatility and, consequently, stronger price movements.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Is a breakout imminent?

BNB is at a pivotal moment. While the $599.9 resistance remains a formidable hurdle, bullish technical indicators and rising social interest suggest a breakout could be on the horizon.

If BNB can close above $600, the next target would likely be $715.7. Therefore, traders should closely monitor price action in the coming days for a decisive move.