BNB drops below this key support level as Binance halts…

- Binance halts deposits from 10 networks albeit temporarily.

- Assessing BNB’s fate after crashing through the ascending support line.

The Binance Smart Chain’s native cryptocurrency has been on a bearish trajectory for six weeks. Its performance in the last two days has been particularly noteworthy because of its ascending support line. Should investors anticipate more BNB price weakness after failing to secure bullish momentum?

Read BNB price prediction for 2023/2024

Let’s take a look at some of the most noteworthy observations regarding Binance before assessing BNB’s prospects. According to the latest Binance announcement, the BSC temporarily suspended deposits from multiple networks in the last 24 hours at the time of writing.

We'll be temporarily suspending deposits for the following bridged tokens-network while we await clarity from the Multichain team.

POLS-BSC

ACH-BSC

BIFI-FTM

SUPER-BSC

AVA-ETH

SPELL-AVAXC

ALPACA-FTM

FTM-ETH

FARM-BSC

DEXE-BSCDeposits of the above assets on other networks are…

— Binance (@binance) May 25, 2023

Binance did not disclose whether the decision was based on a threat to its operations or whether it was due to routine maintenance. However, it did reveal later that it resumed deposits from Ethereum and FTM.

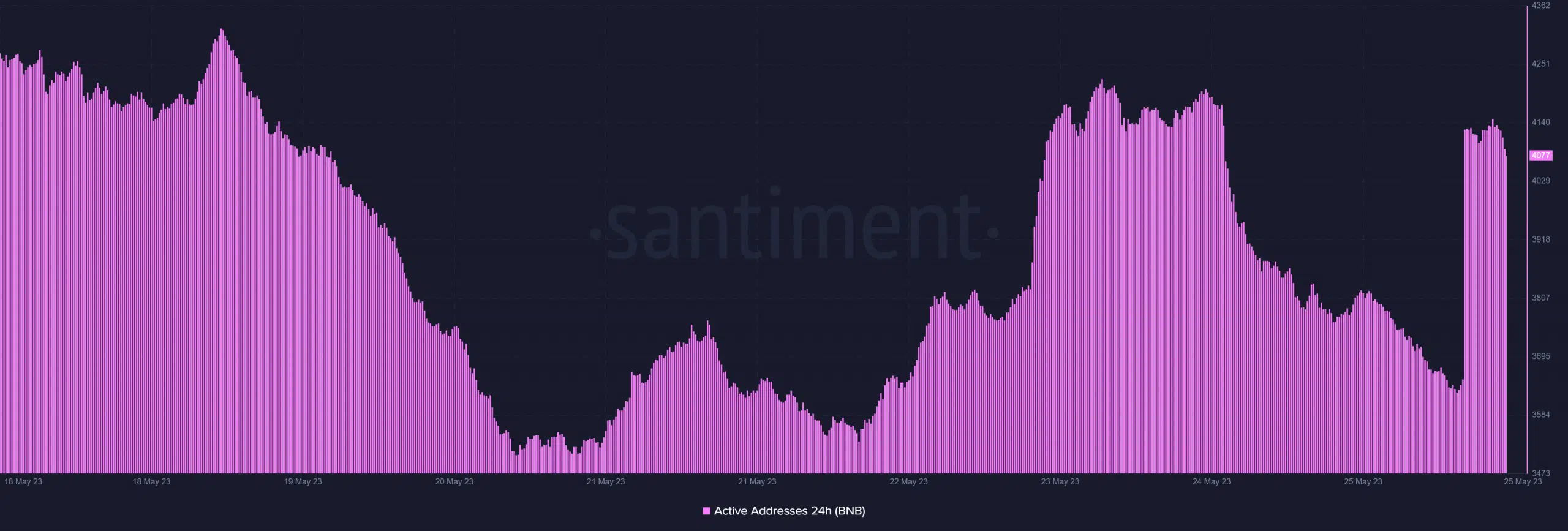

We observed a significant dip in the number of active addresses in the last 24 hours in hours after Binance made the announcement. This was followed by a sharp bounce back presumably due to the reactivation of deposits.

Is there still hope for BNB bulls in the short run?

The likelihood that the halting of deposits may have had an impact on BNB’s price action was quite low. This was because the cryptocurrency maintained the same bearish momentum it was on 24 hours prior to the announcement about the temporary suspension of deposits.

BNB’s price action was particularly notable because the selling pressure in the last two days broke through a key ascending support line. It traded at $304 at press time which is slightly above its 200-day moving average.

The 200-day MA will likely act as the next support range to bear the $300 price level. This was largely because the MA may act as a psychological buy zone and the fact that the same price is within a zone of short-term support. Also, what was worth noting was that the MFI indicated that buying momentum was already building up.

Is your portfolio green? Check out the BNB Profit Calculator

Some on-chain data also backed the bullish expectations. For example, the mean coin age has been on a steady upward trajectory for the last seven days. This confirmed that most investors were still holding their tokens. Additionally, investor consensus expectations have been on the rise for the last seven days indicating bullish expectations.

Based on the above analysis, buying pressure was slowly building up and might soon lend favor to the bulls. However, this outcome was still subject to overall market conditions which may pull a surprising instance of capitulation if BNB fails to secure enough bullish momentum.