Can Solana bulls push SOL above $150 this week?

- Solana’s price continues to hit lower lows despite increased trading volume.

- A correction might be on the horizon for SOL, with recent bullish momentum needing to sustain to change the trend.

Solana [SOL] was recently grappling with intense bearish pressure, which has pushed its price to lower lows despite attempts by bulls to maintain momentum.

Increased trading volume suggests heightened market activity, but the overall sentiment remains cautious as traders await signs of a potential turnaround.

Solana bulls remain cautious

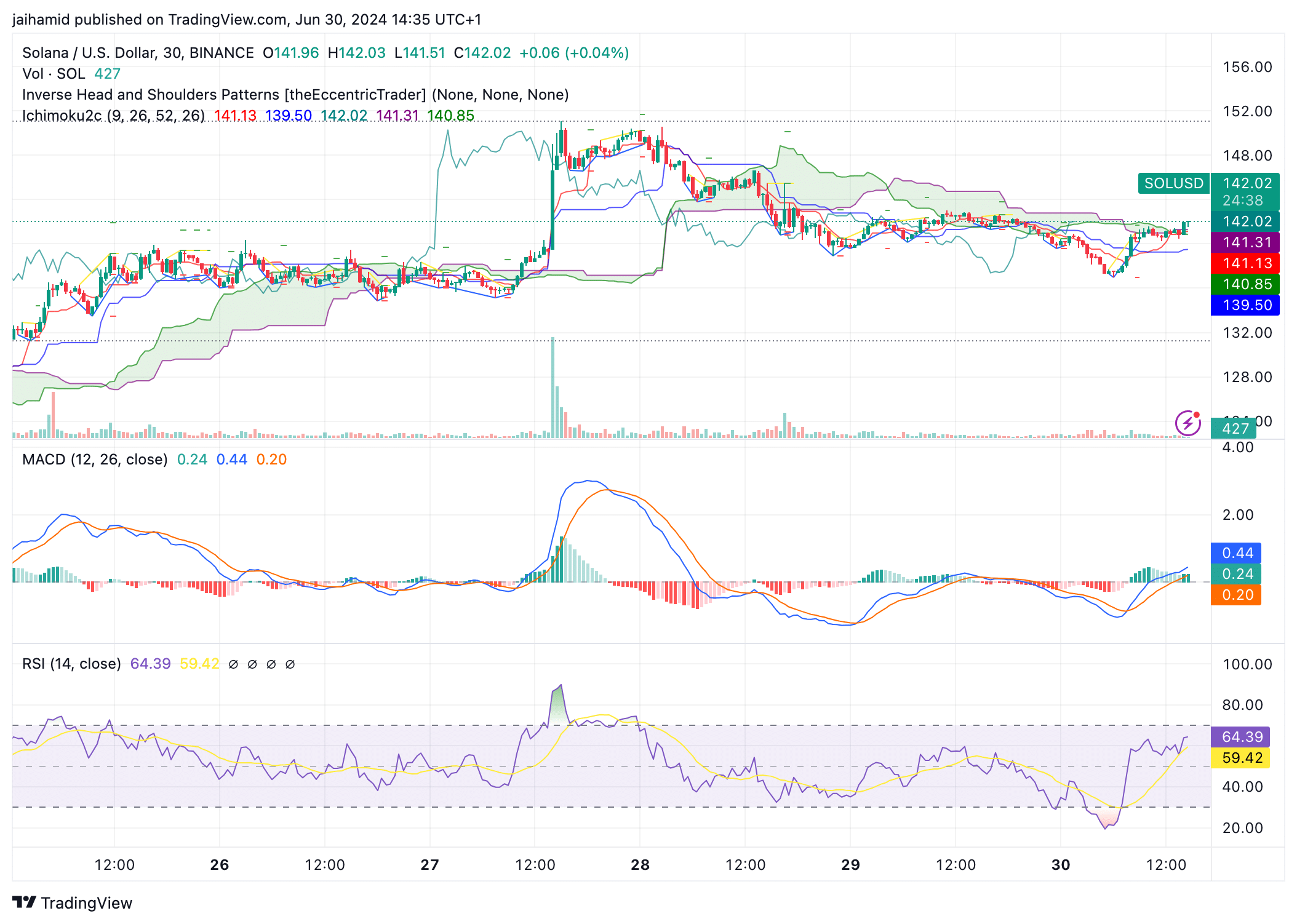

Over the past five days, SOL has seen multiple annotations of an Inverse Head and Shoulders (IH&S) pattern, which is typically a bullish reversal pattern.

However, the success of this reversal pattern relies on a strong breakout above the neckline (the resistance line formed at the tops of the heads).

As for the Ichimoku Cloud, SOL’s price is currently trading within the cloud, which generally indicates a zone of indecision or potential trend change.

The cloud acts as a support/resistance area, with its color turning from red to green, suggesting a shift toward bullish conditions in the short term.

The Tenkan-sen and Kijun-sen lines are relatively close together under the price, indicating short-term momentum is slightly bullish but still lacks strong conviction.

The MACD histogram, which measures the distance between these two lines, has moved from negative to positive values, suggesting an increase in bullish momentum, albeit cautious.

The RSI was around 59 at press time, which is neither overbought nor oversold. The RSI’s recent peak just below the overbought threshold (70) and subsequent downturn reflects the increase in selling pressure after attempts by bulls to push the price up, aligning with the cautious sentiment.

Is SOL headed for a correction?

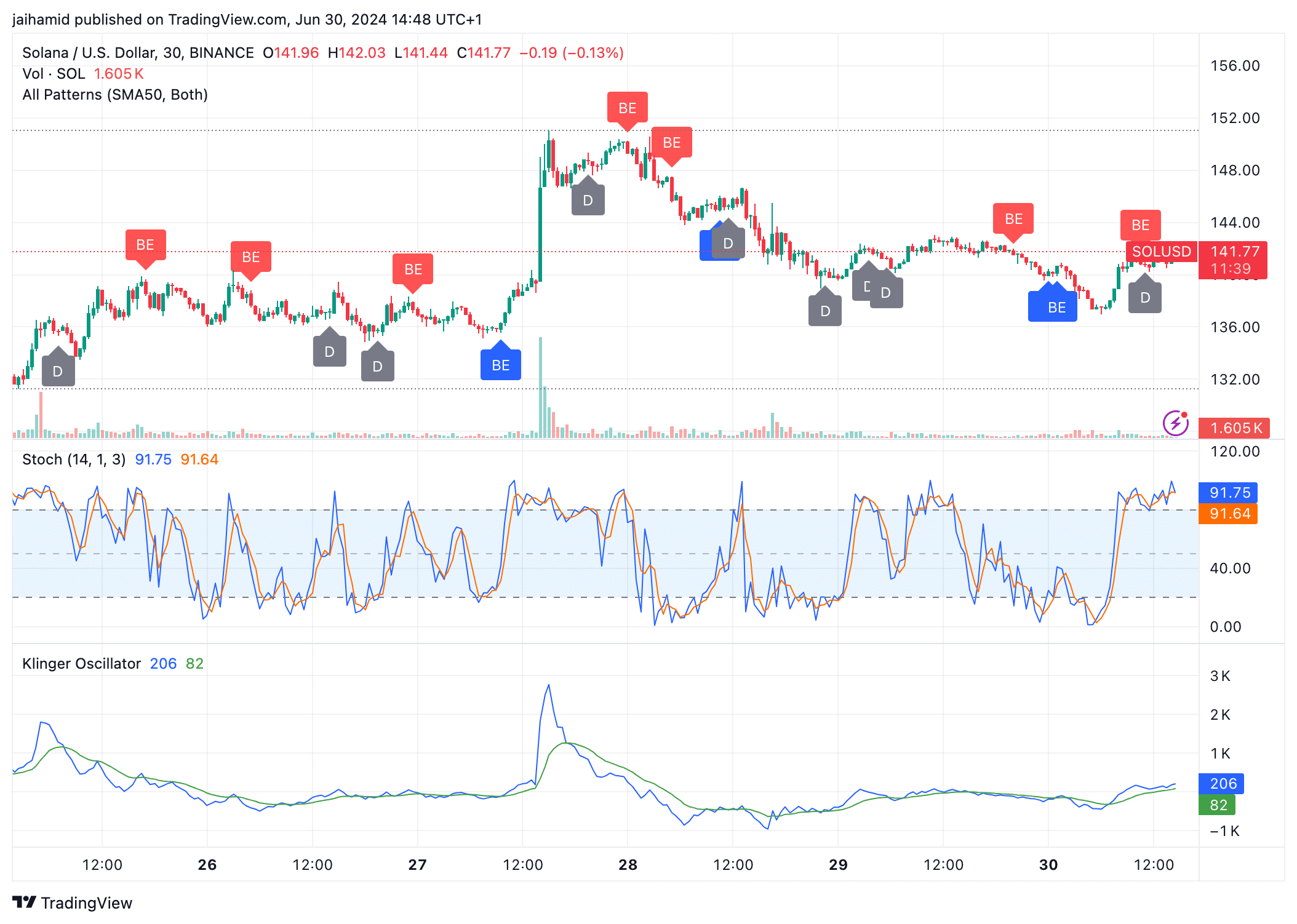

As the bulls attempt to unsuccessfully flip the narrative, another one is forming. The Stochastic Oscillator tells us that a correction might be underway.

Solana might be due for a correction as the price could be perceived as relatively high compared to its recent trading range.

Is your portfolio green? Check out the SOL Profit Calculator

The Klinger Oscillator shows a crossing where the faster line (green) moves above the slower line (blue), indicating a potential bullish momentum in the short term.

This is a positive sign for bulls if sustained.