Cardano’s 6% drop makes NOW the best time to buy ADA, here’s why

- ADA’s MVRV ratio has flashed a buy signal.

- Its current holders are dealing with significant losses.

Cardano’s [ADA] 6% price decline in the past seven days has presented a buying opportunity for those looking to trade against the market.

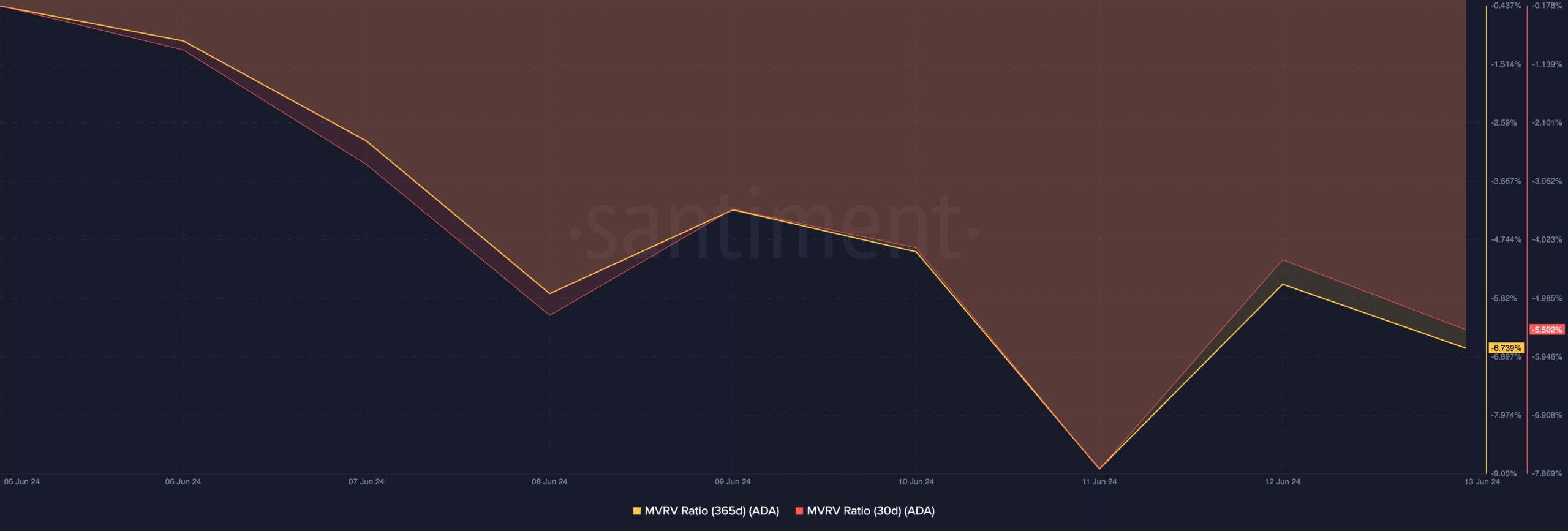

According to Santiment’s data, the altcoin’s Market Value to Realized Value (MVRV) ratio assessed over different moving averages returned negative values, thereby flashing a buy signal.

ADA’s MVRV ratios on the 30-day and 365-day moving averages were -5.44% and -6.72%, respectively, at the time of writing.

This metric tracks the ratio between an asset’s current value and the average price at which each of its coins or tokens was acquired.

When its value is above one and in an uptrend, the asset trades significantly higher than the price at which most investors acquired their holdings.

It is considered overvalued and due for a correction as traders sell off their coins to book profits.

Conversely, a negative MVRV value indicates an undervalued asset. It suggests that the market value of the asset in question is below the average purchase price of all its tokens that are in circulation.

Negative MVRV ratios generally present a buying opportunity because they signal that the asset trades at a discount relative to its historical cost basis.

ADA holders deal with losses

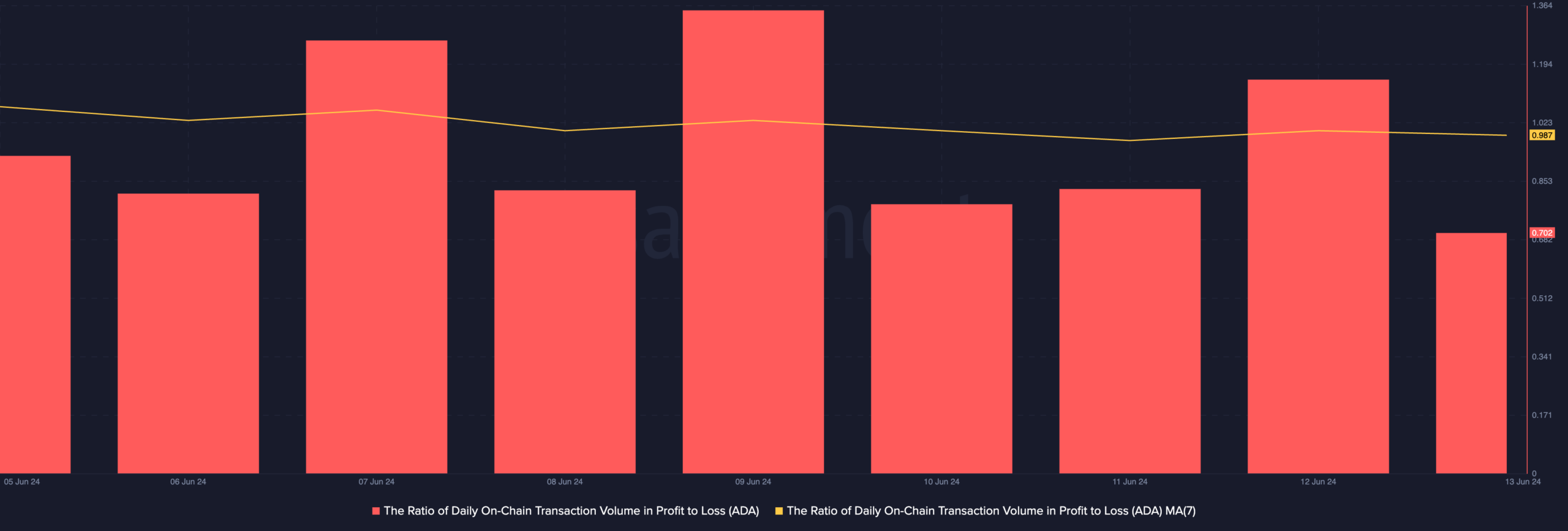

ADA’s price decline this past week has made it a less profitable investment for holders. A look at the coin’s daily ratio of transaction volume in profit to loss confirmed this.

Assessed using a seven-day moving average, the value of this metric was 0.98 as of this writing.

This showed that for every transaction that ended in a loss during the period under review, only 0.98 transactions returned a profit. This suggests that more ADA transactions have resulted in losses than profits.

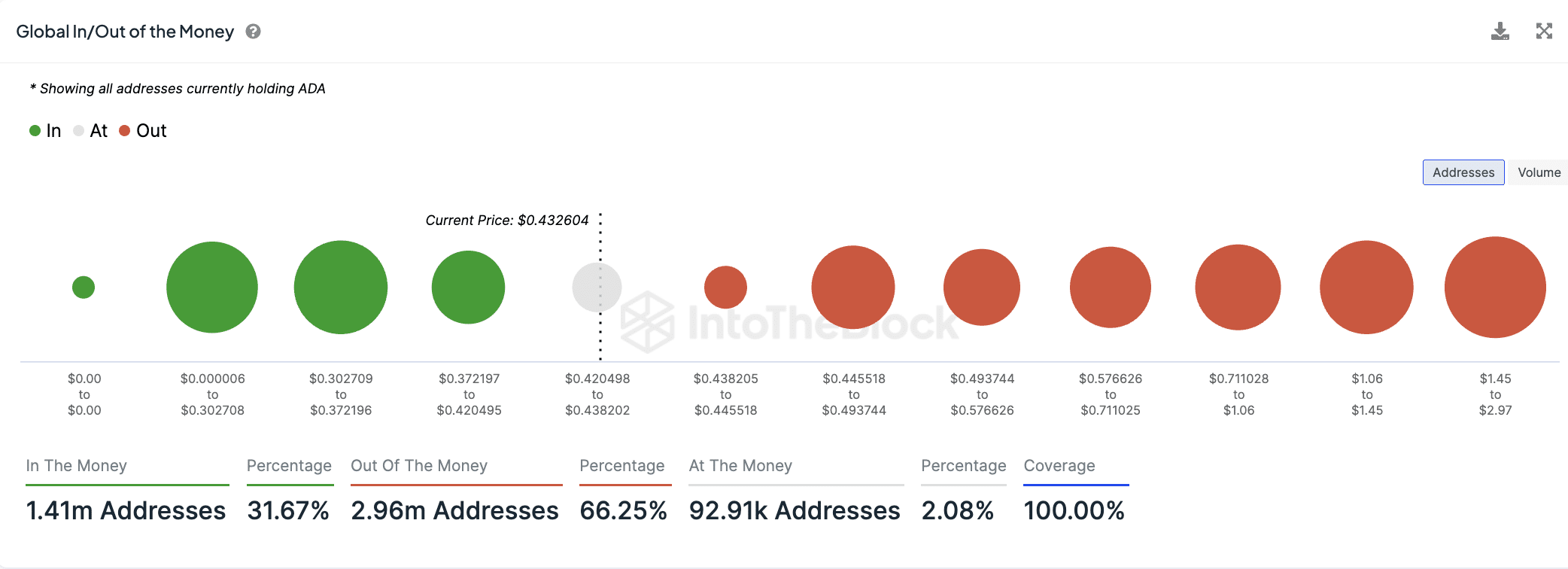

According to IntoTheBlock, 2.96 million ADA addresses, which represent 66.25% of all holders, are “out of the money.”

Is your portfolio green? Check out the ADA Profit Calculator

An address is “out of the money” if the average price at which it acquired its holdings is higher than the asset’s current market price. Put simply, almost 3 million ADA addresses hold the coin at a loss.

Conversely, only 1.41 million addresses, which comprise 31.67% of all ADA holders, are in profit or “in the money.”