Dogecoin: Why a 90% rally could be next for DOGE this quarter

- Historical pattern for DOGE/BTC suggest bullish Q4 for Dogecoin.

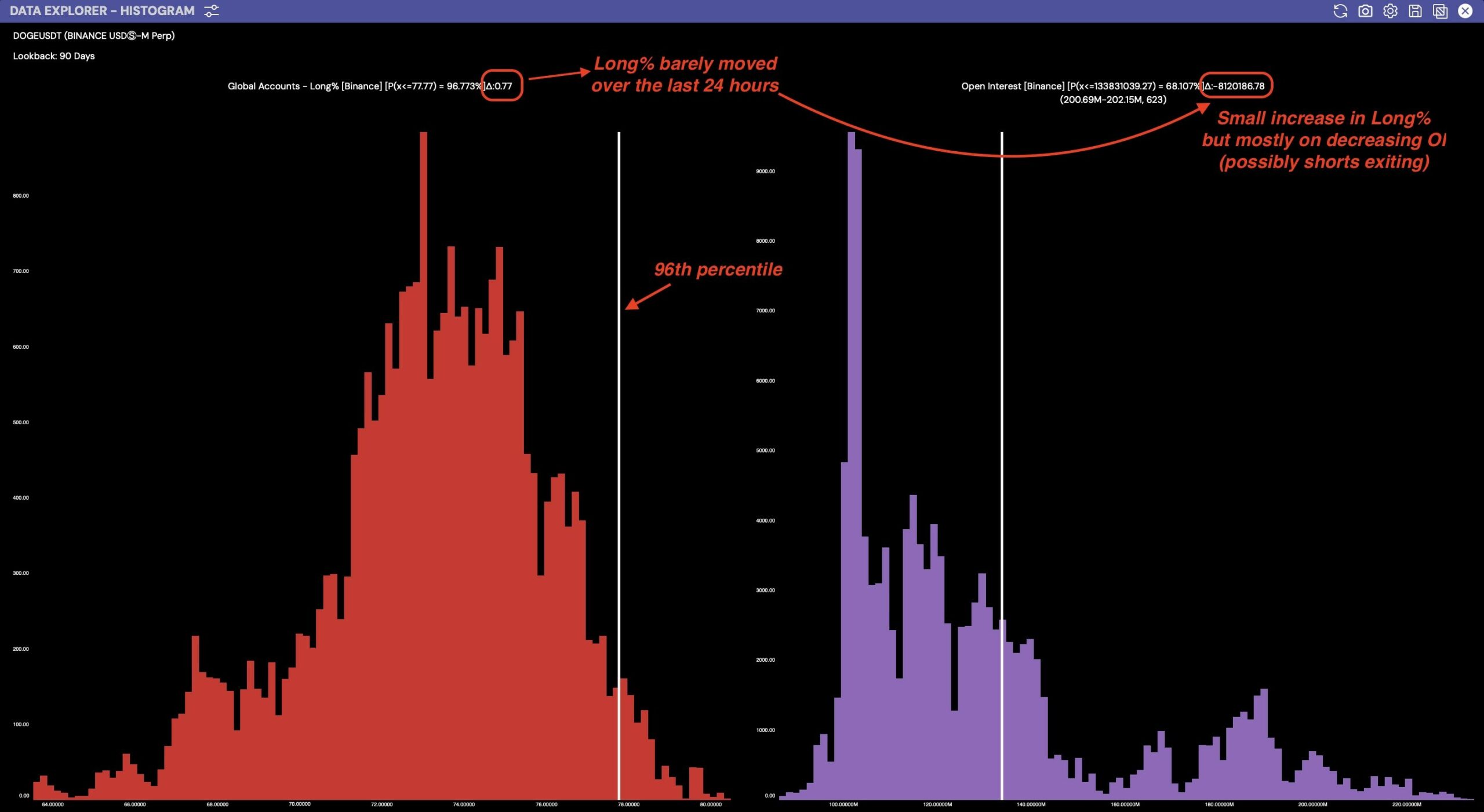

- Dogecoin’s long accounts % is in the 96th percentile.

Dogecoin [DOGE], the largest memecoin, is gearing up for the last quarter of the year as the overall crypto market recovers from a recent crash triggered by geopolitical tensions between Israel and Iran.

DOGE is expected to lead other memecoins in a rally during this period. Historical patterns in the DOGE/BTC pair suggest the market may be entering an interesting phase for Dogecoin.

In the past, DOGE pumps started 235 days after Bitcoin halving, twice leading to significant gains.

This year, a similar pattern has emerged, raising the question of whether gains over 90% are on the horizon for DOGE in this final quarter.

The repetition of these patterns strongly suggests a bullish outlook for Dogecoin in Q4.

Dogecoin RSI bounce

One key factor supporting this bullish outlook is the appearance of a divergence signal, often indicating a potential reversal or continuation of trends.

In this case, traders are anticipating a reversal towards bullish momentum for DOGE. This divergence occurred when Dogecoin traded below the 200-week moving average.

However, the Relative Strength Index (RSI) bounced from the oversold zone, signaling that now could be the ideal time to enter long positions, with expectations of DOGE seeing gains similar to previous cycles—potentially exceeding 90%.

Long accounts percentage

Another key indicator pointing to a positive Q4 for DOGE is the recent percentage of long accounts.

According to data from Hyblock, the percentage of long accounts trading Dogecoin has remained stable over the past 24 hours, trading in the 96th percentile. This stability suggests that long traders are in control, reinforcing the bullish sentiment surrounding DOGE.

Additionally, a small increase in the long account percentage has impacted Dogecoin’s open interest, which has seen a slight decline. This reduction in open interest often indicates that short positions are exiting the market, further supporting a bullish outlook for Dogecoin.

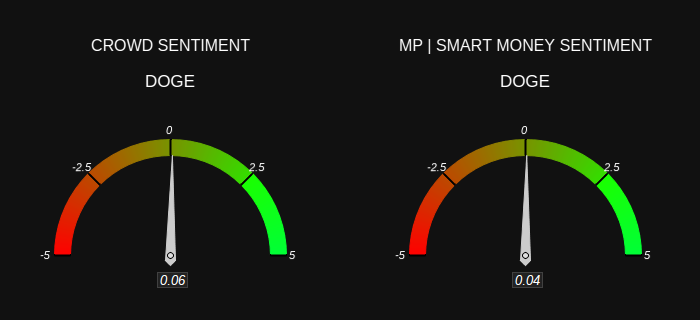

Crowd vs. Smart Money sentiment

The sentiment among both big money traders and the general crowd aligns, with both groups leaning towards a bullish outlook for DOGE. This sentiment adds further confluence to the idea that Dogecoin is set for gains in the last quarter of the year.

However, as with any market, external factors, such as geopolitical tensions, could influence the direction of DOGE’s price movement. Recent tensions between Israel and Iran had a noticeable impact on the overall crypto market, highlighting the unpredictable nature of financial markets.

Read Dogecoin [DOGE] Price Prediction 2024-2025

Dogecoin appears poised for significant gains in Q4, with historical patterns, technical indicators like the RSI, and market sentiment all aligning in favor of a bullish trend.

While external factors remain a variable, the current setup suggests that DOGE may repeat its past performance, potentially leading to gains exceeding 90% by the end of the year.