Examining if AVAX can rally to $40 and beyond

- Having recently rebounded from a key support level, AVAX is on track to break through its descending trend line.

- This current upward trend could see AVAX reach as high as $40, fueled by increasing momentum.

Avalanche [AVAX] registered a 13.68% increase over the past month, and chart analysis indicated that the rally was likely to continue, further boosting its gains.

AMBCrypto provides detailed insights into why this rally is on the horizon.

Bullish prospects for AVAX

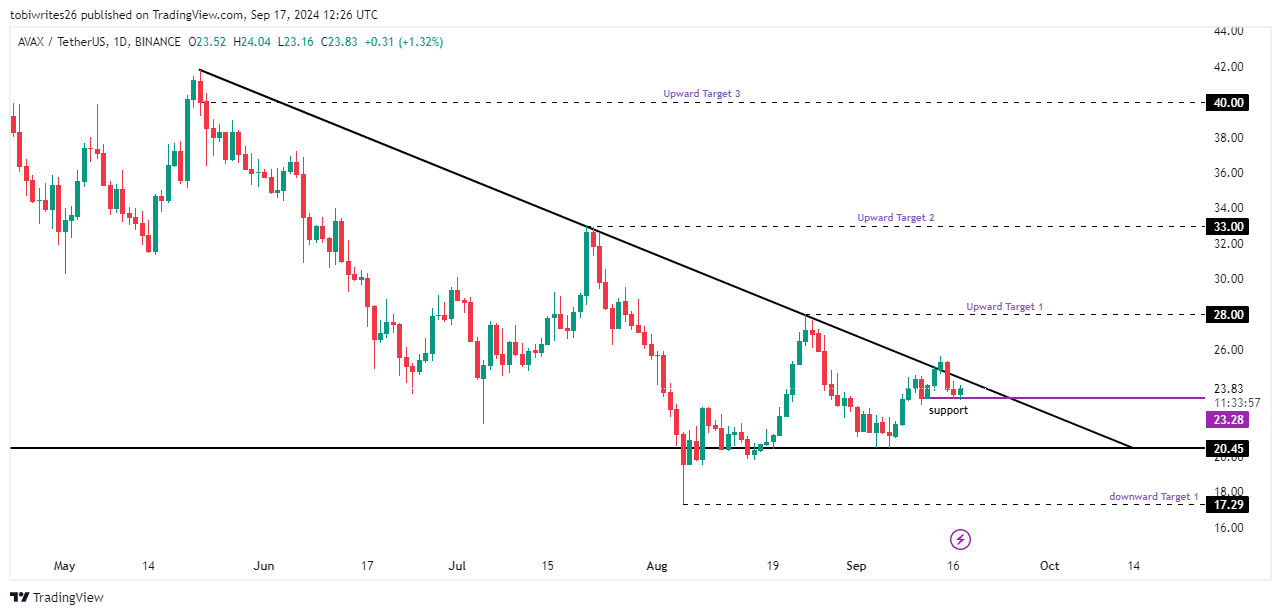

AVAX is currently trading within a bullish triangle pattern on the daily timeframe, marked by an upper diagonal boundary and a base support line.

Recently, AVAX broke above this upper boundary and returned to the support level at $23.28, a move that has been met with a positive market reaction.

If buying pressure at this level persists, AVAX could target three key price points: $28, $33, and ultimately $40. Conversely, a drop in buying pressure might see its price decline to $20.45 and potentially even $17.29.

This significant bounce and subsequent upward trend provide a strong indication that AVAX could see higher prices in the upcoming trading sessions.

Retailers support market rally

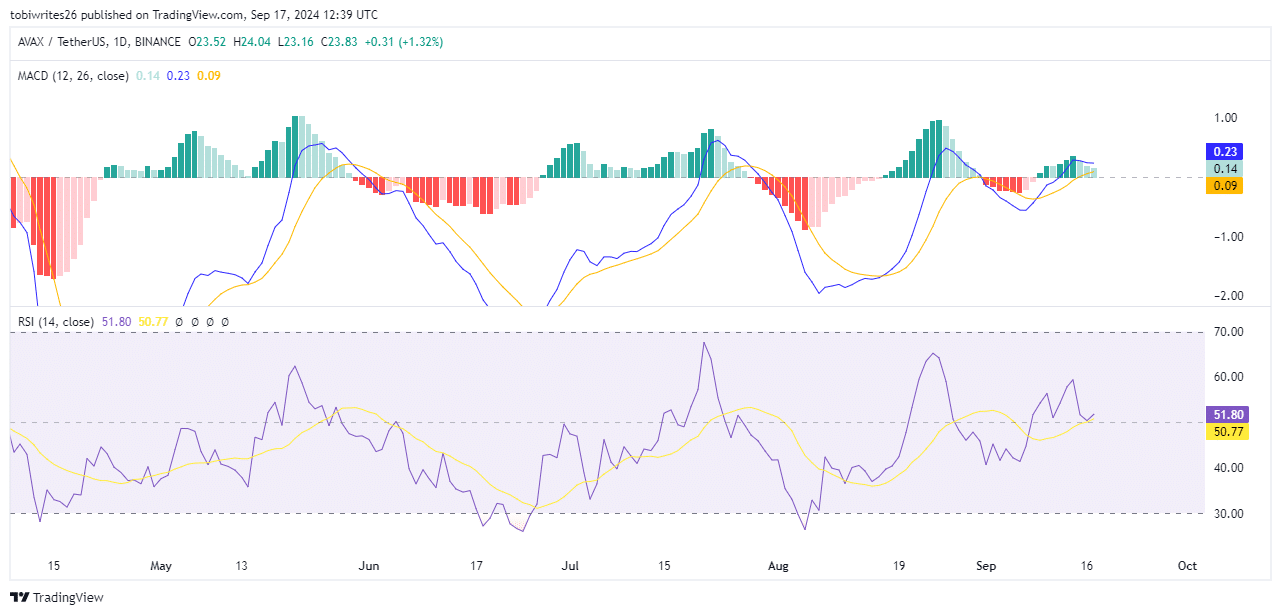

The Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) indicated strengthening market sentiment among traders.

The MACD has recently exhibited a Golden Cross, often a precursor to a rally, with the MACD line now positioned positively at 0.23, suggesting further price increases.

Furthermore, the RSI, a momentum oscillator that assesses the velocity and magnitude of price movements on a scale from 0 to 100, has rebounded from its neutral position at 50.

Such a bounce, which is now trending upward, signals a positive market trajectory, indicating potential price increases in the coming trading sessions.

Market interest intensifies

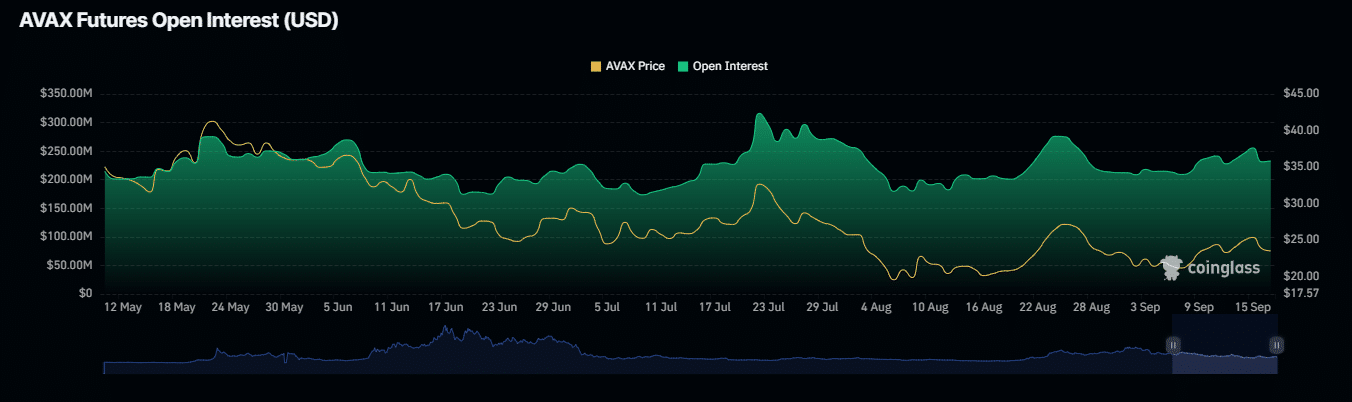

According to Coinglass the inflow of money into the market has significantly increased, showcasing the market’s strength.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

This surge is mirrored in the Open Interest (OI), which tracks the total number of unsettled derivative contracts. THE OI witnessed a 3.58% rise until press time.

Such increases typically lead to higher asset prices. If OI continues to climb, AVAX will likely trend toward the $40 mark.