FET crypto gains steam: Key factors driving its ascend to $3.48 are…

- A market expert has pinpointed several factors to sustain FET’s status as a leading performer.

- Complementary data reinforces FET’s upward trajectory which strengthens its appeal.

FET crypto has witnessed an 11.92% increase in price and a 138.25% spike in trading volume over the past 24 hours. This surge builds on the positive outlook previously detailed by AMBCrypto.

This significant uptick in FET’s value is a strong indicator of bullish momentum, suggesting that reaching, or even surpassing, the $3.48 mark may be close by.

This outlook is supported by insights from analysts, who cite various key on-chain metrics.

Can FET trade past $3.48? Analyst weighs in

According to popular crypto analyst Doctor Profit, FET is primed for a rally. In a recent tweet, he outlined four key factors that could propel FET to achieve a staggering 312.43% gain in the upcoming days, provided current price actions maintain their course.

A chart he provided visually emphasizes his predictions, suggesting that the current setup is one of the most promising in the cryptocurrency market today.

He noted key price levels for taking profits while labeling the chart as “one of the best looking charts” in the current landscape.

While he holds a long-term optimistic outlook, with FET potentially trading at $3.48, this forecast is based upon several fundamental factors, including Bitcoin’s performance and other variables that could either hold up or hinder FET’s rise to new highs.

In contrast, a short-term analysis by AMBCrypto suggests that FET is more likely to peak at $1 soon.

Rising interest among traders and growing scarcity

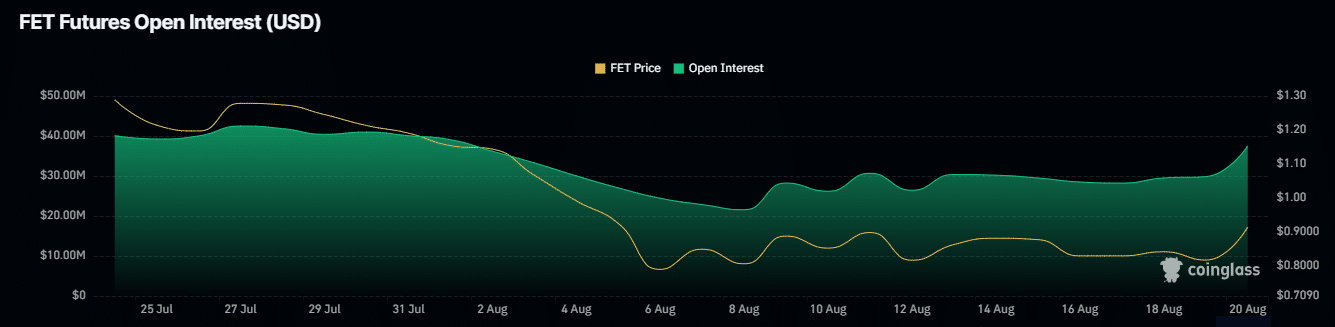

According to data from Coinglass, both Netflow and Open Interest indicate strong bullish sentiment in the market.

Open Interest has spiked by 29% over the past 24 hours, amounting to an increase of $38.8 million. This significant rise suggests that numerous traders are willing to pay a premium to maintain their long positions.

Conversely, spot exchange Netflow has shifted to negative. A negative net flow—more FET being withdrawn from exchanges than deposited—diminishes the available supply of FET on exchanges.

This scarcity can drive the price of FET higher, as less of the token is readily available for sale.

FET scarcity meets growing market participation

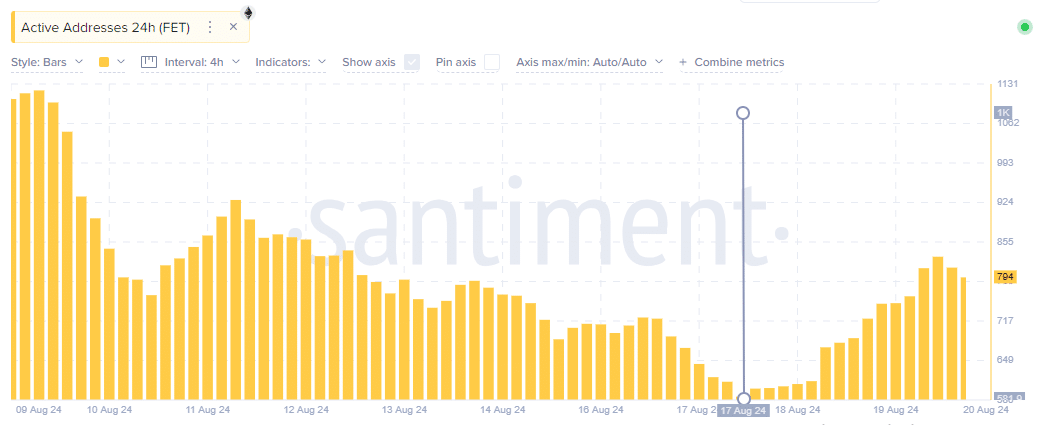

Despite a noticeable scarcity of FET on exchanges, interest among market participants continues to grow.

Data from Santiment reveals a substantial increase in the number of active addresses since August 17, as indicated by the grey line in the accompanying image.

A significant rise in active addresses coupled with a reduced circulating supply of FET on exchanges suggests a strong potential for increased demand.

If the number of active addresses continues to grow alongside a high outflow of FET, this could serve as a necessary catalyst, potentially driving the price to its nearest high point on the analyst’s chart.