MATIC price’s breakout odds depend on THESE key metrics

- Historical data using the MVRV ratio indicated a possible 31% hike for MATIC in the mid-term

- Old tokens have refrained from moving – A sign that another correction might be unlikely

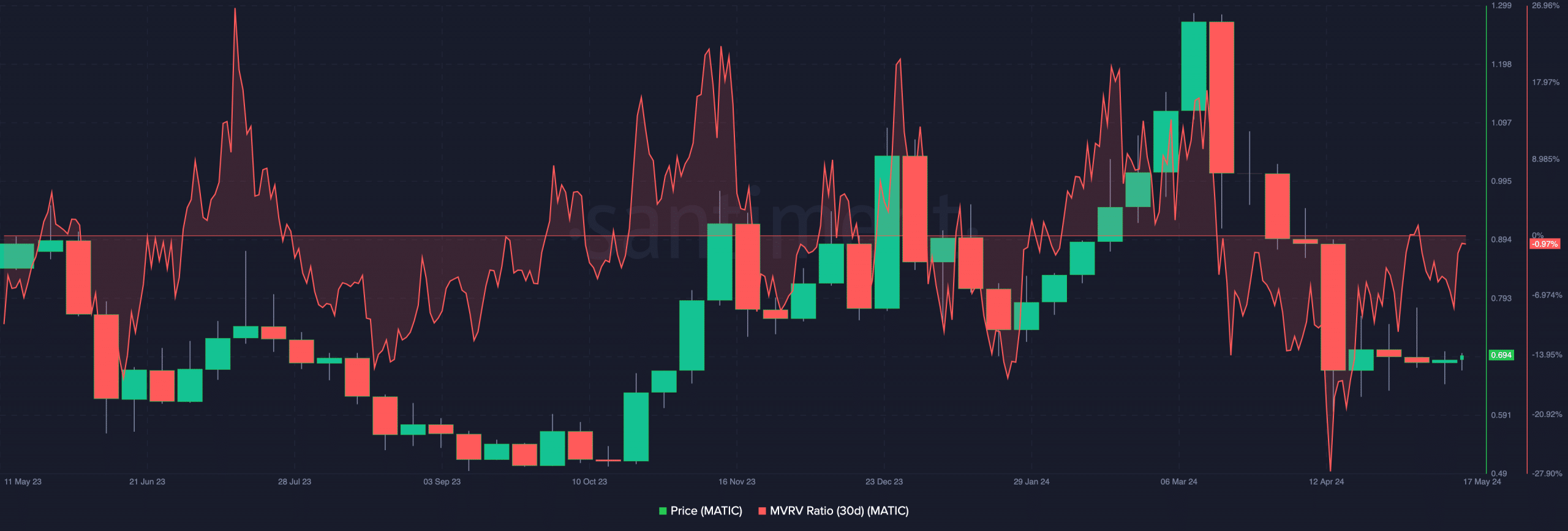

A crucial MATIC on-chain metric has shown signs that the token could be ready to reverse its losses of the last few months. At press time, MATIC was valued at $0.69 on the charts following a depreciation of 26.38% over the last 90 days.

The metric that flashed the aforementioned sign was the Market Value to Realized Value (MVRV) ratio. The MVRV ratio determines if an asset is undervalued or overvalued, depending on investor profitability in the market.

At press time, the 30-day MVRV ratio for MATIC had a reading of -0.97%. Historically, the price of MATIC bounces when the metric is between -8% and -16%.

After the lows, come the highs

This, because many holders are holding at a price lower than the historical cost basis. Thus, instead of realizing losses, market participants may take advantage of the decline and accumulate. Most times, this results in a higher value.

On 14 May, the MVRV ratio was -8.22%. However, the price of MATIC rose from that zone, pushing the metric to a much higher level.

In February, when a similar thing happened, MATIC’s price went on to hit $1.20. In this market, history does not exactly repeat itself. However, trends tend to be similar.

Therefore, if the ratio breaks into the positive zone, it is likely that MATIC’s next target might be $1, considering that it is a key area of interest.

Whether MATIC would be able to hold on to the price depends on the holders. If some decide to book profits at the projected price, MATIC might retrace on the charts.

However, sustained demand at that level could trigger a further uptrend, one that could send the price to $1.30. However, this conclusion might sound too hasty without checking other indicators.

MATIC diamond hands are not quitting

Another metric AMBCrypto analyzed was dormant circulation. If the dormant circulation spikes, it means that tokens that have moved in a long while are being transacted. In this case, the token might face selling pressure.

However, a low reading of the metric seemed to indiate that long-term investors are sticking to HODLing, instead of liquidating. That was the case with MATIC.

If sustained, the price of MATIC might not fall. Instead, it will consolidate for some time before a breakout eventually comes to pass.

In the meantime, the ratio of on-chain volume in profit to loss fell to 0.42. Readings like this imply that most transactions involving the token ended up in red, rather than in green.

Read Polygon [MATIC] Price Prediction 2024-2025

From all indications, this on-chain volume in profit might begin to improve if MATIC validates the prediction above. However, should a change from the bullish bias appear, transactions in loss might continue to dominate.