PEPE price prediction – Profit-taking could stall uptrend, but…

- PEPE’s short-term holders in profit could impede uptrend recovery attempts

- Rising MDIA metric underlined network stagnancy

Pepe [PEPE] saw heightened volatility over the last ten days. The prices and sentiment plunged lower as Bitcoin [BTC] faced an 8.4% drop from 7-10 October. Among the top 5 popular memecoins, PEPE saw the second-largest gains over the past week.

Dogwifhat [WIF] was the first on that list after rising by 17.7% in 7 days. PEPE climbed by 5.5% during the same period. It also retained its bullish technical structure on the daily timeframe, but can buyers press onwards?

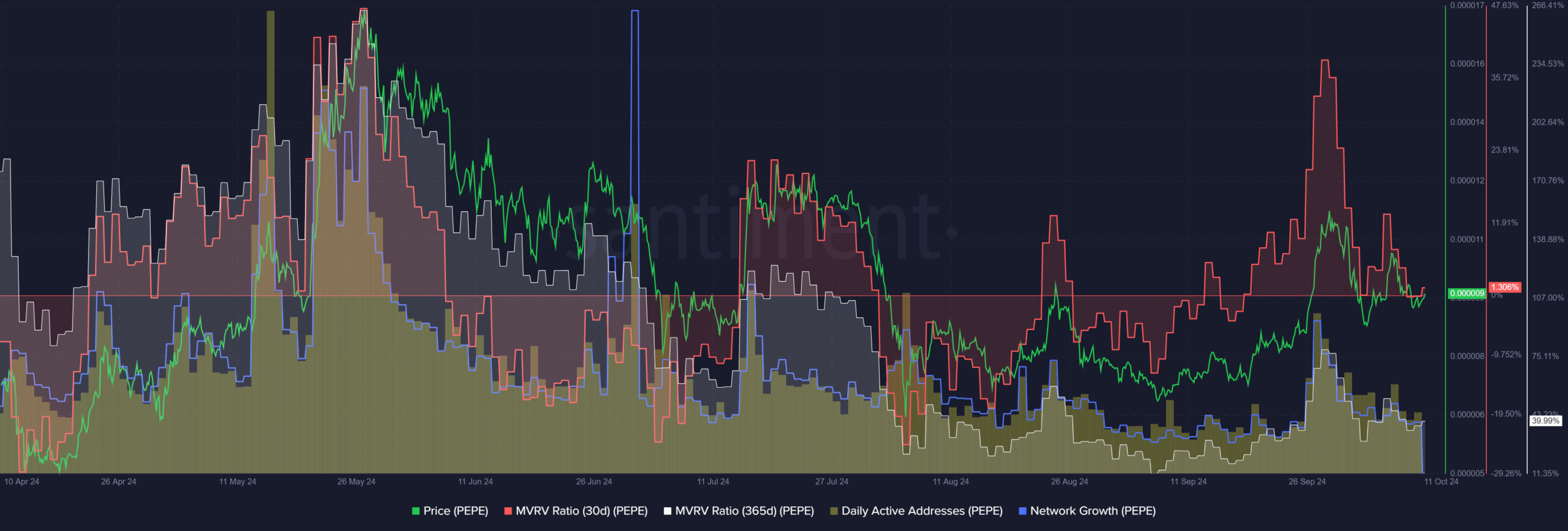

Network growth and activity fueled by price gains

Source: Santiment

Since memecoin prices and activity are primarily driven by their popularity, the bearish price action of the past few days has affected the daily active addresses metric. The network growth also saw a decline in October.

The selling pressure might not be at an end, at least in the short term. The 30-day MVRV was still around zero, despite the retracement over the past two weeks. Hence, any further price bounces would likely witness profit-taking activity and some sell volume.

The long-term MVRV was also positive, which is not a factor to be worried about. This metric has been positive since October 2023. It suggested that the performance of PEPE has generated a decent return for holders, even through all the turmoil.

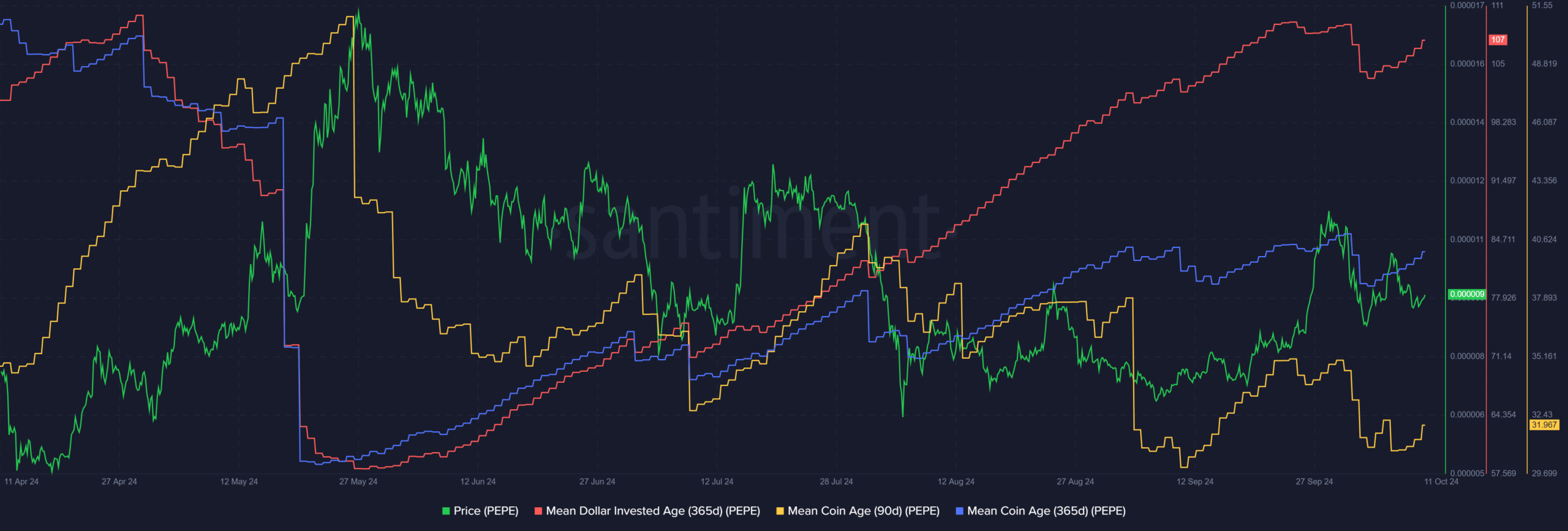

Concerns of market stagnation

Source: Santiment

The 90-day mean coin age has been on a steady downtrend since July. This signified a distribution phase among the 3-month holders. The 365-day mean coin age has been unable to trend higher since late August.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

This underlined steady token movement between addresses and is a clue for selling activity. At the same time, the mean dollar invested age continued to trend higher. A rising trend shows increasingly stagnant coins and old coins being held in the same wallets.

Once they start flowing into newer wallets, the metric can trend south. This would be an early sign of bullish pressure.