Recap of Ethereum’s profitability in Q1 and what to expect moving forward

- Q1 ETH holders reap rewards, courtesy of the overall bullish outcome thanks to more market confidence.

- ETH whales show mixed signals which coincided with the prevailing directional uncertainty.

Ethereum’s native cryptocurrency ETH failed to reclaim the $2,000 price level in Q1 2023 despite high expectations. However, it performed quite well during the first three months of the year.

Is your portfolio green? Check out the Ethereum Profit Calculator

ETH achieved a 55.71% bounce in Q1 this year which is still relatively low compared to the extreme selloff that occurred in 2022. But what can Q1 data reveal about ETH’s profitability? Well, according to the latest Glassnode data, ETH’s realized price recently soared to a 4-month high.

? #Ethereum $ETH Realized Price just reached a 4-month high of $1,398.02

View metric:https://t.co/9xWb0WuEGn pic.twitter.com/LWCdyrTZVP

— glassnode alerts (@glassnodealerts) April 2, 2023

The new realized price means anyone that bought ETH near the January lows is currently deep in profit. The Q1 rally also boosted ETH holders’ profitability.

Glassnode data revealed that roughly 66.83% of ETH holders were now in profit and that figure represented a 10-month high as far as profitability goes.

? #Ethereum $ETH Percent Addresses in Profit (7d MA) just reached a 10-month high of 66.832%

Previous 10-month high of 66.831% was observed on 24 March 2023

View metric:https://t.co/BUbkntqvVb pic.twitter.com/cg9Czbx7hc

— glassnode alerts (@glassnodealerts) April 2, 2023

The main reason for the 10-month high is that investors accumulated aggressively at a perceived bottom range. For perspective, June 2022 was 10 months ago and it marked the bottom of the June crash. Many people accumulated ETH after that crash and prices have since then remained above that range.

ETH’s Q1 performance was built on the accumulation that took place in June. However, the price upside took off at the start of January 2023 because of the perceived expectation of seller exhaustion.

Can ETH sustain the momentum in Q2?

Q1 data has so far revealed that the market regained some level of confidence. However, there are still many factors to consider as far as projections are concerned.

For example, the U.S. government has tightened its regulatory oversight on crypto. Meanwhile, the cracks in the traditional banking industry are starting to show which is likely to have some impact on the crypto sector.

How many are 1,10,100 ETHs worth today?

Smart money usually has an impact on price movements. A look at the biggest movers shows that ETH has been losing liquidity.

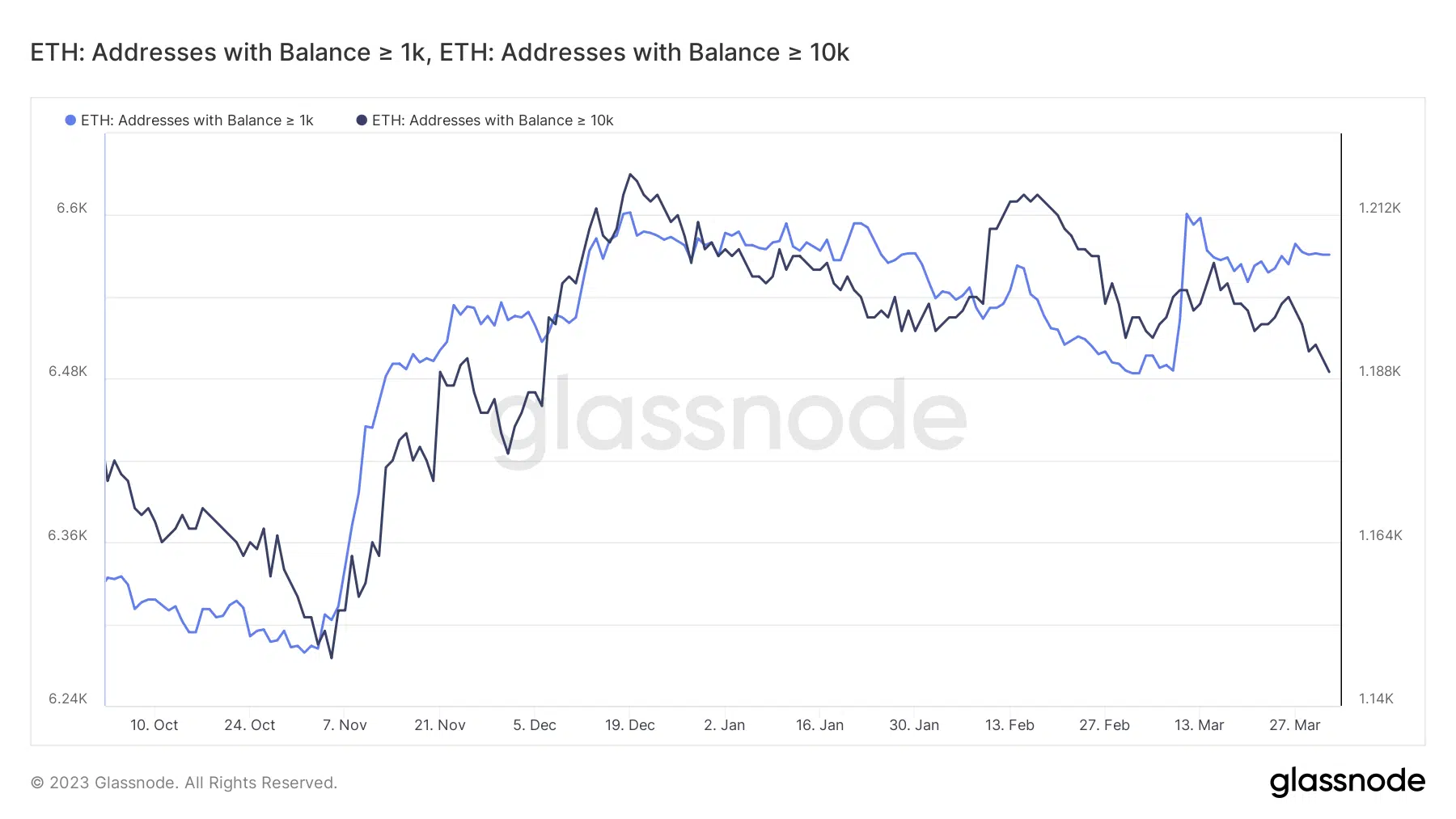

For example, at press time, the number of whale addresses was down slightly compared to December levels. Addresses holding over 1,000 dropped slightly between 11 March and 1 April. And addresses holding over 10,000 demonstrated a more pronounced decline.

Outflows from whale addresses make it harder for prices to rally and if strong enough, they may trigger a bearish outcome.

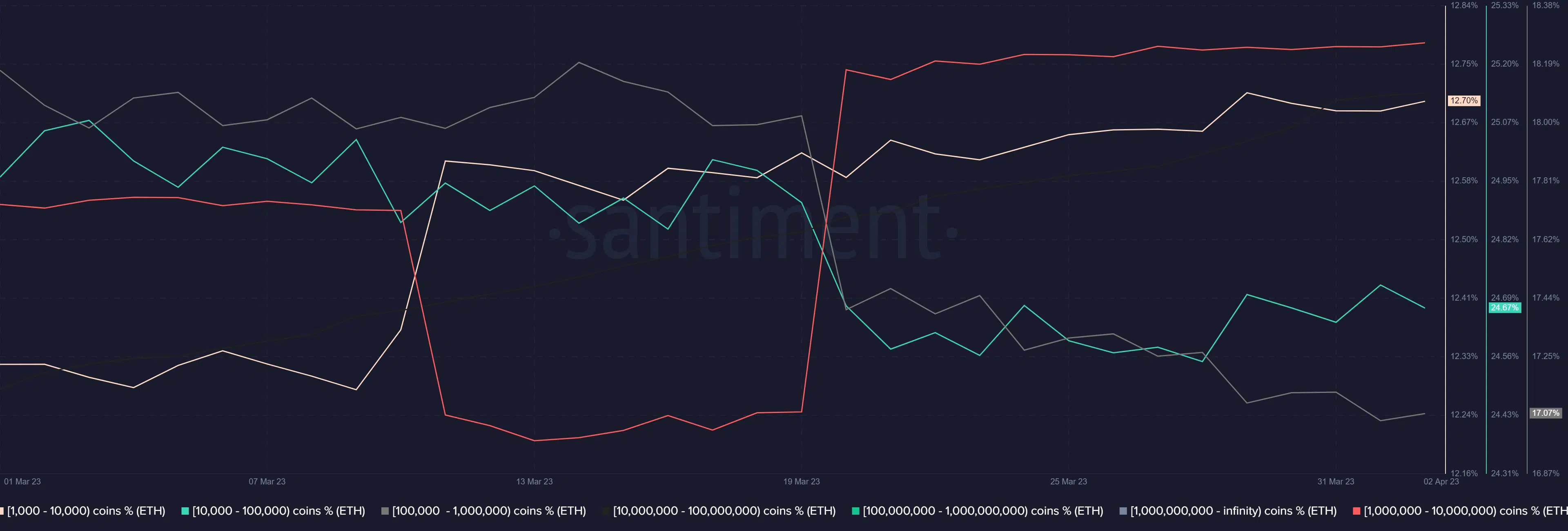

So why has it not crashed harder? ETH’s supply distribution revealed that addresses holding over 100,000 ETH aggressively added to their balances in the last two weeks of March.

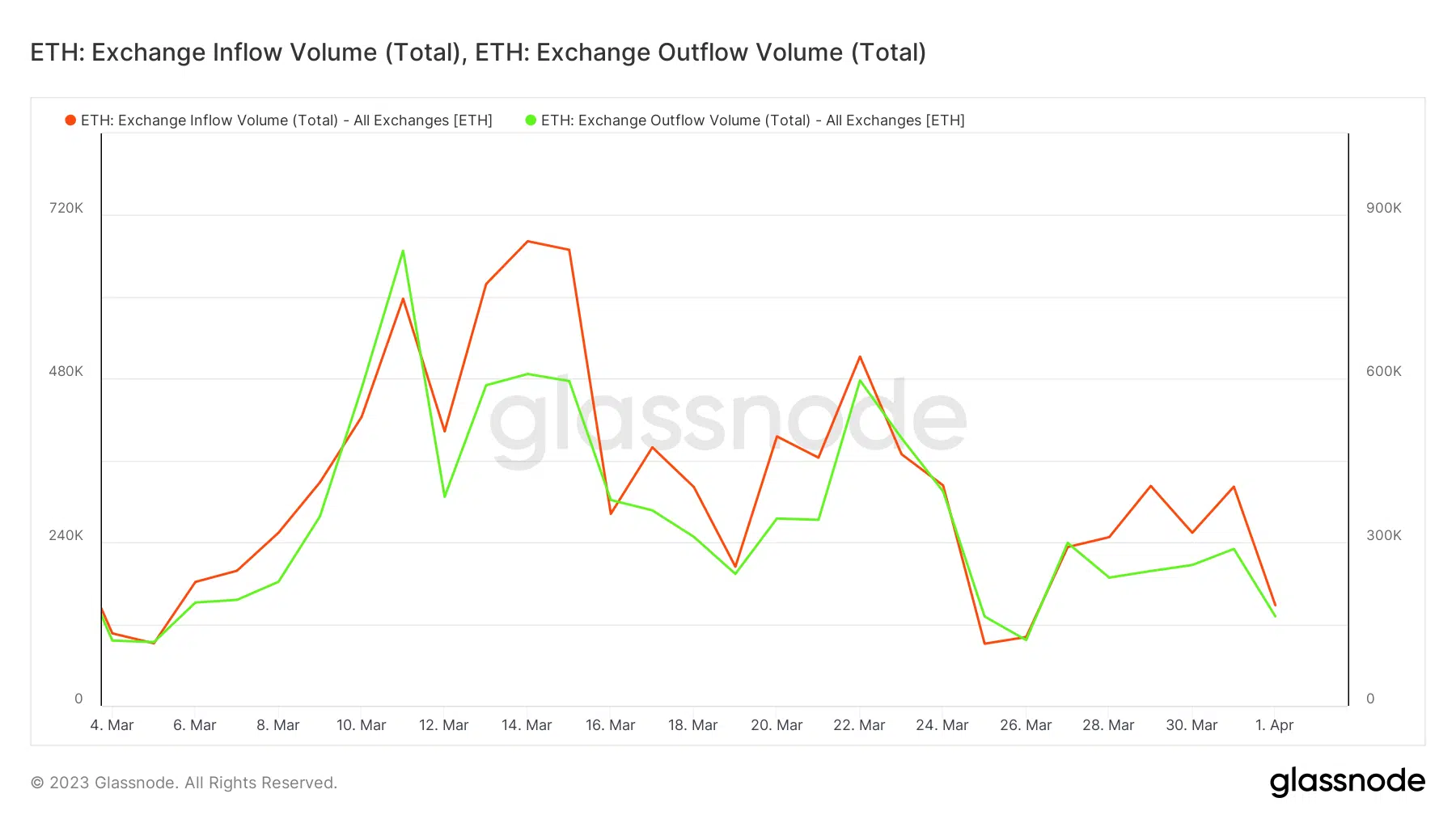

Note that the same address category (holding over 100,000 ETH) is yet to start dumping. ETH exchange flows confirm a drop in volumes, especially from mid-March. More notably, ETH kicked off April with slightly higher exchange outflows than inflows.

The above observations underscore the ongoing stalemate but that may not last long.