TRX’s ‘double-top’ dilemma: What next as bullish momentum falters?

- TRX sees increased social media activity and trading volume but fails to surge.

- The double-bottom pattern shows that there is still some underlying strength among bulls.

Despite recent bullish momentum, Tron [TRX] has struggled to maintain its upward trajectory, faltering in the face of heightened social media activity. What gives?

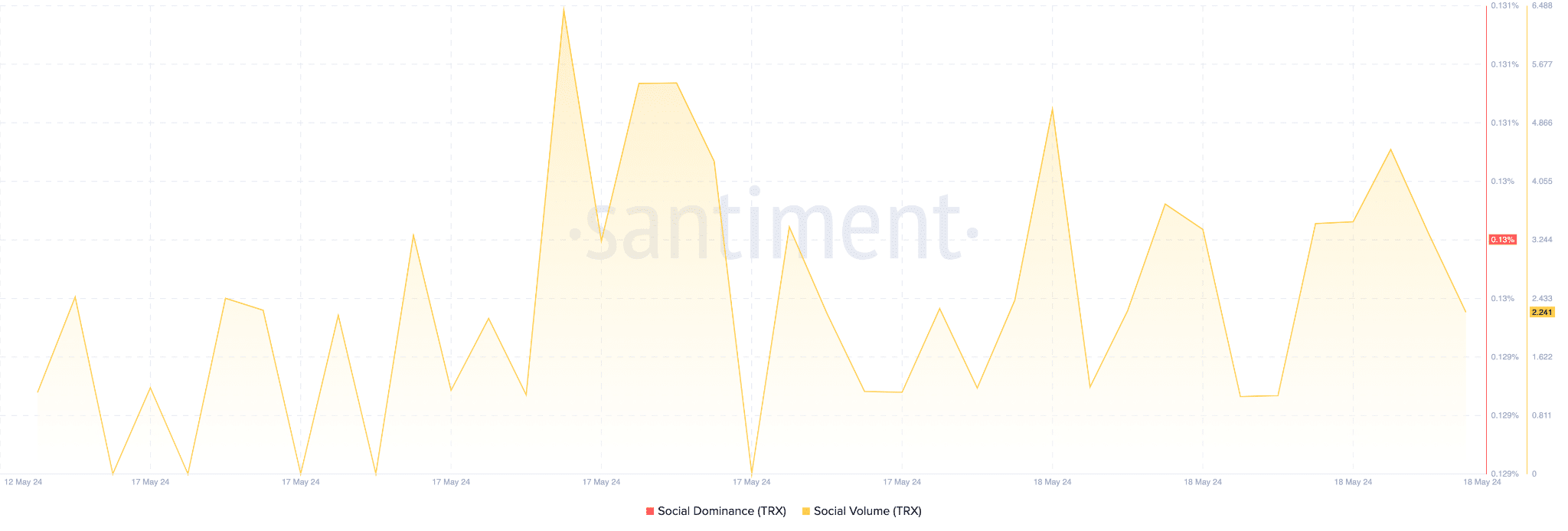

TRX’s social clout falls short

As the chart below shows, TRX has seen a notable increase in both social volume and sentiment. However, it still cannot sustain bullish momentum, as shown by the inability of its price to surge in the specified time.

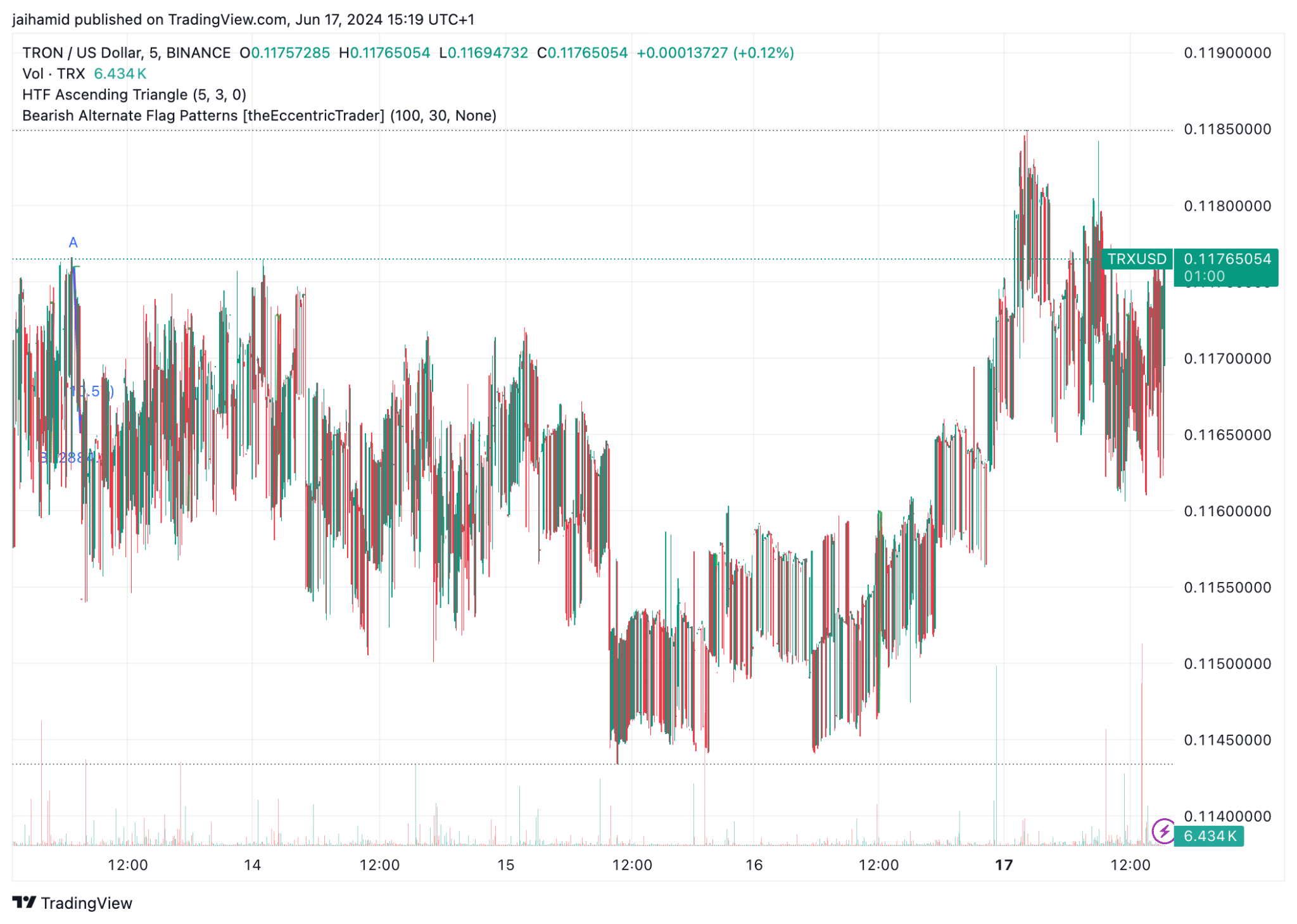

The price has exhibited considerable fluctuation, with rapid ups and downs, suggesting a highly volatile market environment.

The bear flags clearly show that despite attempts at recovery by the weak bulls, there is a far stronger underlying bearish sentiment among traders.

The bulls are losing the fight

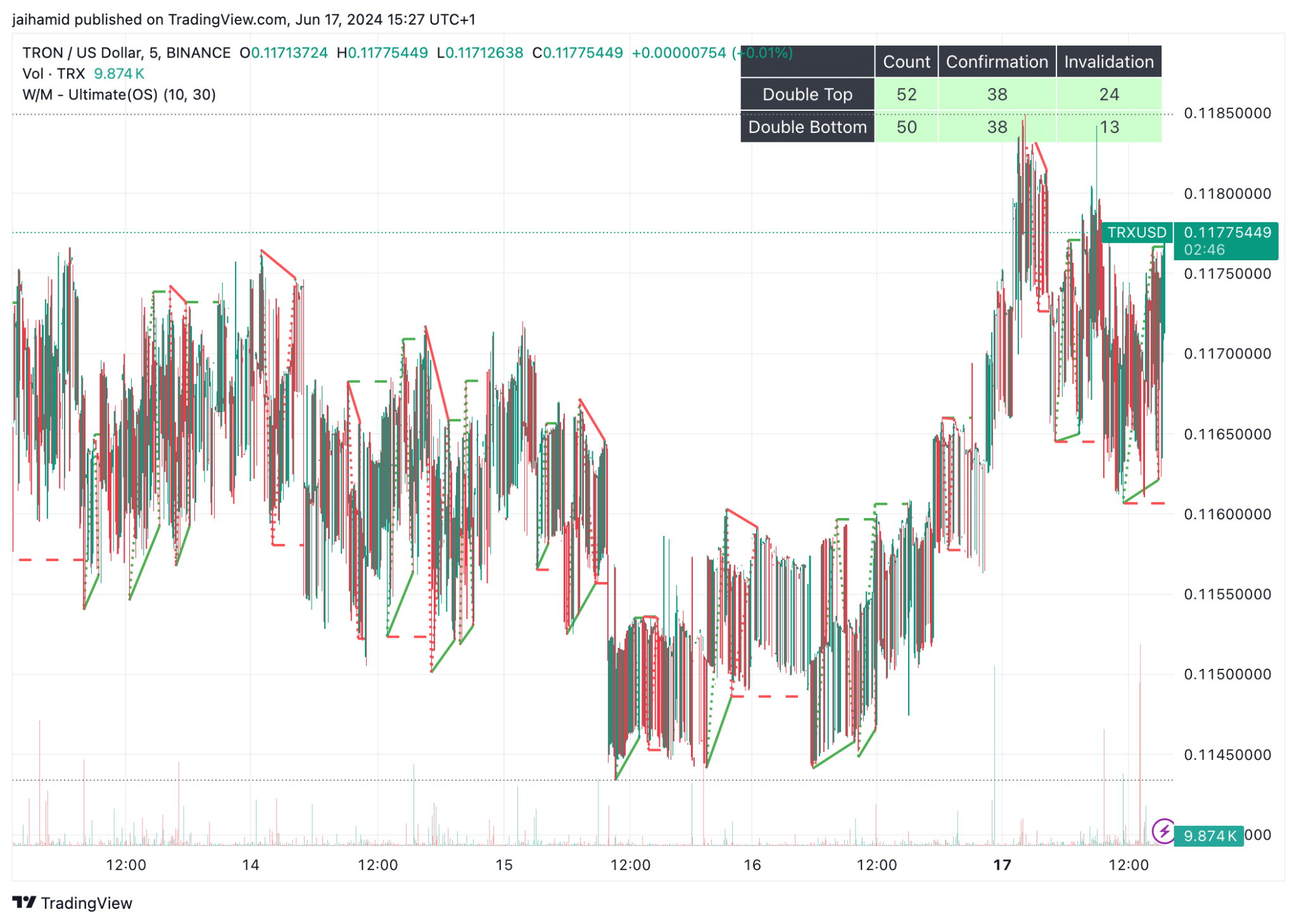

The double-top, an infamous bearish signal, was identified 52 times with 38 confirmations and 24 invalidations over the past five days, while the double-bottoms were seen 50 times.

This further confirms the strength of the bears. Notably, the risk/reward ratios for double bottoms seem generally favorable, indicating more consistent gains versus losses than double tops, including some highly unfavorable ratios.

So, the bulls might not be as weak as they seem.

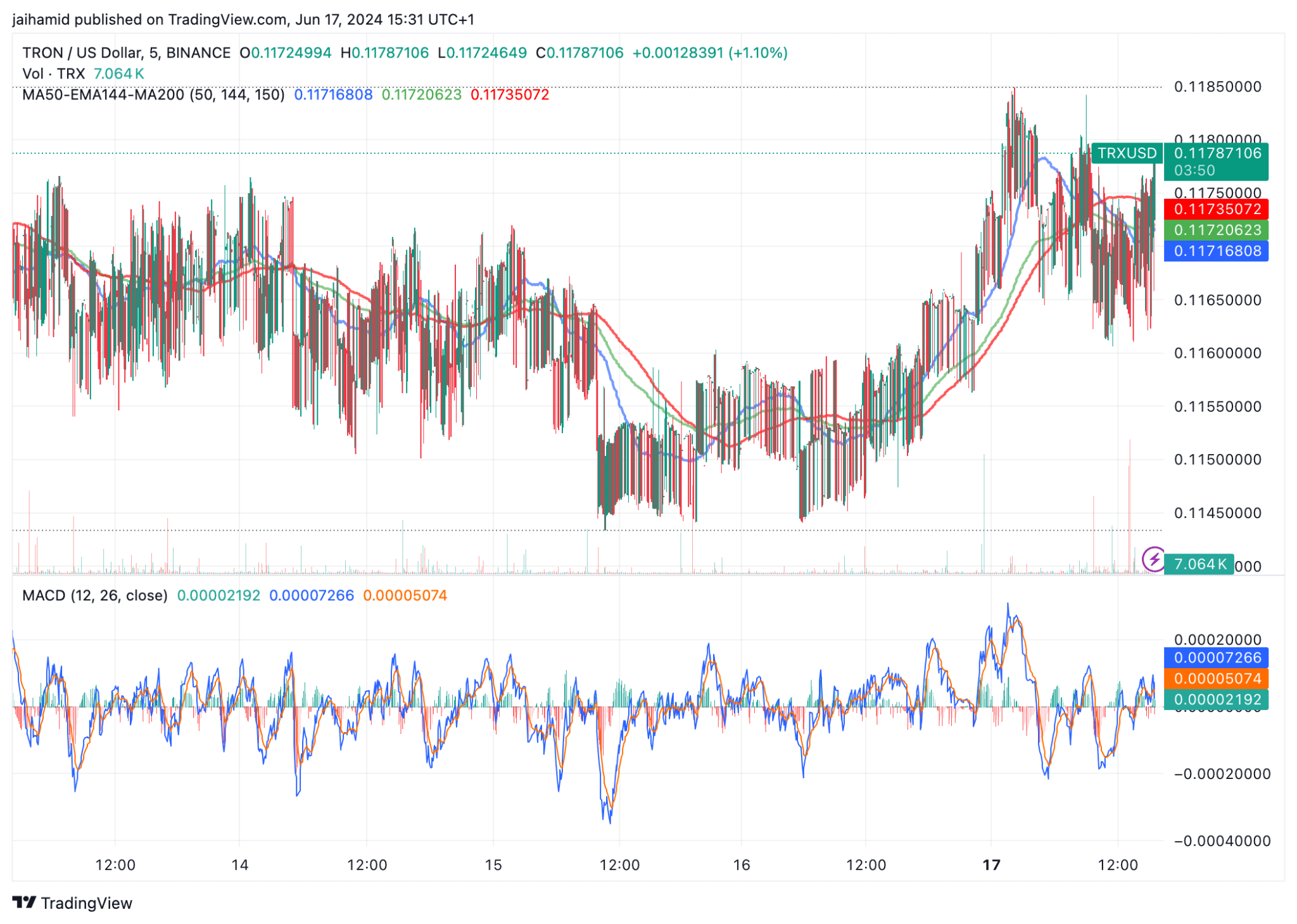

TRX has seen a series of oscillations between $0.1145 and $0.1385, showing a consolidation pattern.

The frequent crossing of the price above and below the moving averages (MA50 and EMA144) indicates a lack of strong directional momentum.

The MACD line oscillates around the signal line and the zero line, which often indicates a market without strong bullish or bearish momentum.

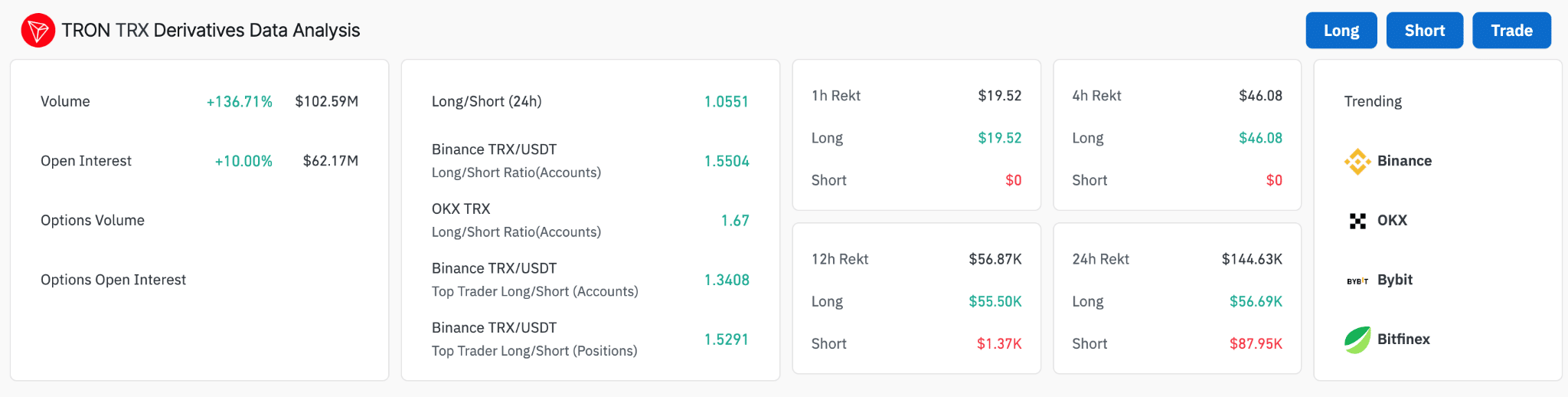

Oddly enough, the derivatives market has seen a significant increase in trading volume by +136.71%, suggesting a heightened interest by traders.

Realistic or not, here’s TRX market cap in BTC‘s terms

Open interest has increased by 10%. This is generally seen as a sign of new money coming into the market.

It would seem that TRX bulls need a lot more than they’re getting in order to successfully flip over the bears.