Why sticking with XRP, Cardano might not pay off

- XRP and ADA have shown minimal year-to-date growth compared to Bitcoin.

- Analysts advise considering the stagnant nature of these altcoins before investing.

The two prominent altcoins, XRP and Cardano [ADA] , have recently been spotlighted for their underwhelming market performance relative to their peers.

Despite the broader crypto market experiencing notable rallies since the year began, XRP and ADA have struggled to keep pace, raising concerns about their potential for future gains.

XRP and ADA, ranked 8th and 11th respectively in market capitalization, have not mirrored the explosive growth seen in other major cryptocurrencies this year.

While the crypto market has generally seen significant gains, XRP has only achieved a marginal increase of 0.9% year-to-date, and ADA has risen by 39%, a figure that pales in comparison to others in the top-tier of cryptocurrencies.

XRP was trading at $0.49 at press time, down by 1.5% over the last 24 hours, and ADA was at $0.38, experiencing a 1.8% decline in the same period.

XRP and ADA: Warning to investors

Jason Pizzino, a seasoned crypto analyst, has expressed skepticism regarding the investment potential of these two altcoins due to their stagnant performance.

Pizzino highlighted that both XRP and ADA have remained largely inactive in terms of price action, particularly in a market that rewards quick gains and robust activity.

He pointed out that XRP has been especially lackluster, with little significant movement and a tendency to return to lower price points after brief surges.

The scenario is slightly different for ADA, which Pizzino suggests might see sporadic recoveries, potentially rising from $0.30 to $0.90 in future cycles.

However, he cautions that even these gains might not suffice when compared to the astronomical rises experienced by foundational cryptocurrencies like Bitcoin, which has seen its value triple over a comparable timeframe.

Undervalued or not even worth it?

Further complicating the outlook for XRP and ADA is their current market sentiment and trading dynamics.

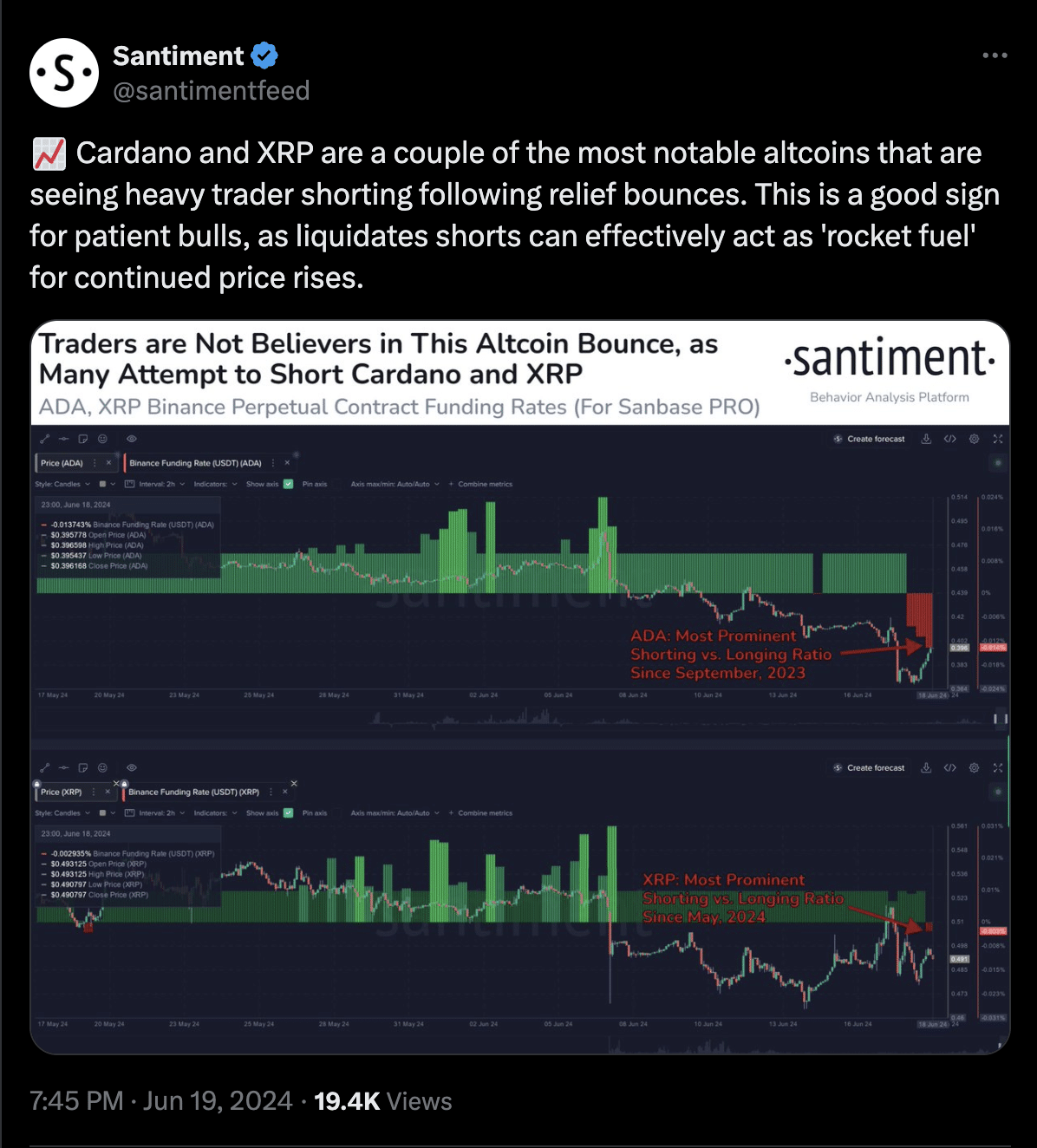

Data from Santiment indicates that both coins have been subject to considerable short selling following minor price recoveries, an action that might spell short-term opportunistic gains for contrarian investors if the market liquidates these short positions.

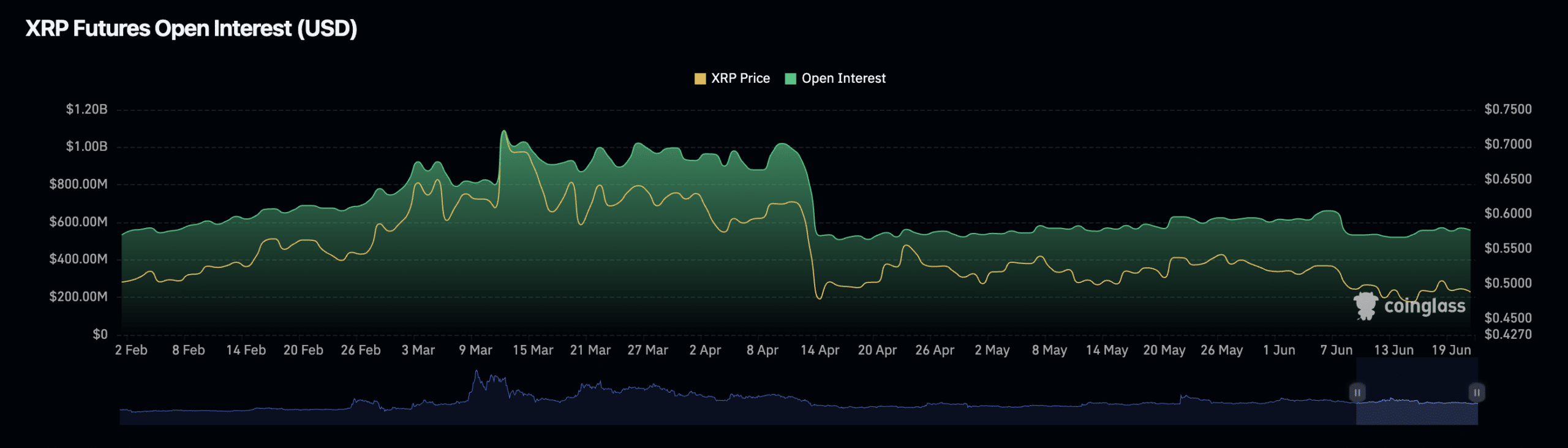

In terms of open interest, a critical indicator of market commitment and future price potential, both XRP and ADA are showing declines. XRP’s open interest has decreased by 1.56% in the last 24 hours, despite a slight increase in volume by 1.16%.

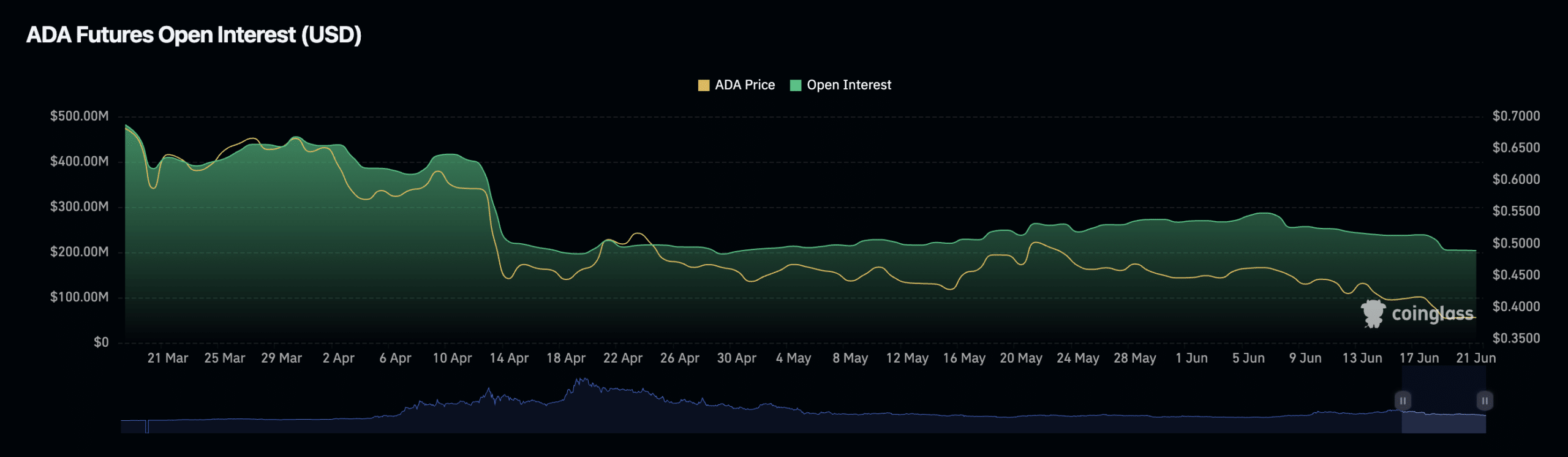

Conversely, ADA’s open interest and volume have both diminished, falling by 1.64% and 0.70% respectively, signaling a potential decrease in market confidence and trader involvement.

Realistic or not, here’s XRP’s market cap in BTC terms

Despite these challenges, there remains a glimmer of hope. AMBCrypto recently suggested that XRP could potentially reach $0.54, providing a small but notable upside to current holders.

However, the overall sentiment from market analysts suggests that investors might be better served by directing their focus towards more active and fundamentally robust assets within the crypto space.