Why Worldcoin will reach $7 soon despite price drop

- Holders are coping with unrealized losses, indicating a possible buying opportunity.

- Circulation decreased, suggesting validation of the bounce to $.7.46.

Worldcoin’s [WLD] price might have decreased by 45.17% in the last 30 days, but signals on-chain showed that the decline could be a blessing in disguise.

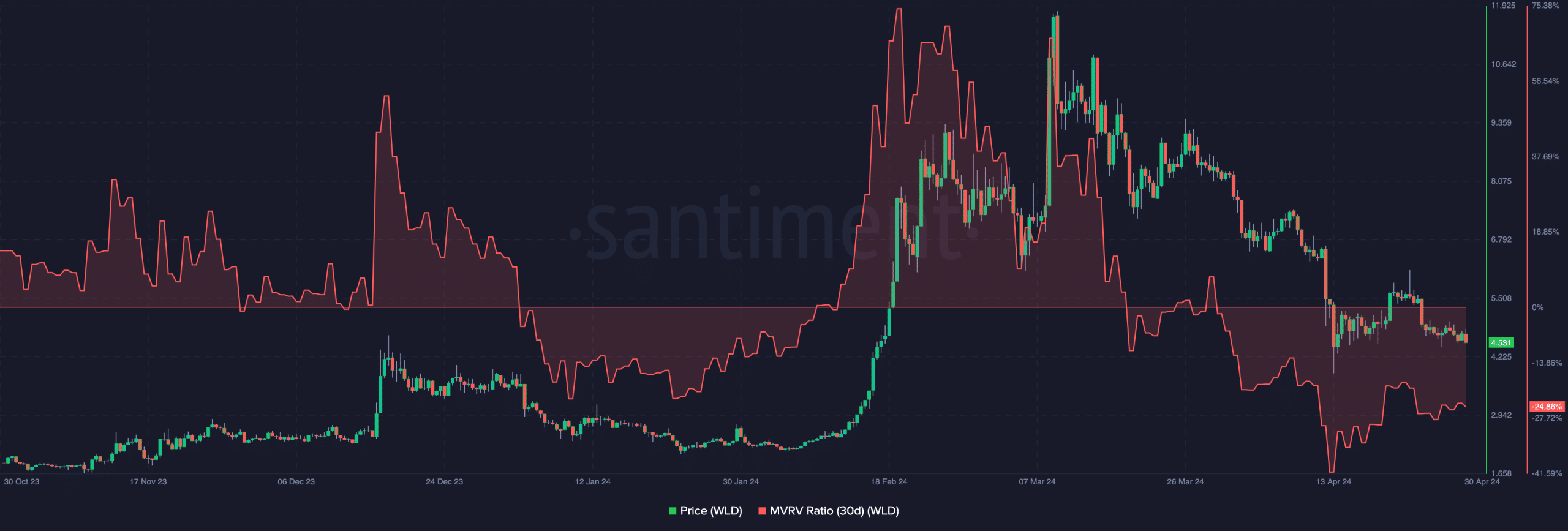

For starters, AMBCrypto evaluated the Market Value to Realized Value (MVRV) ratio. According to data obtained from Santiment, WLD’s 30-day MVRV ratio was -24.86%.

This data implied that most holders of the token were sitting on an unrealized loss. Therefore, if they all decide to sell, the average holder would have to deal with a lower investment value.

But that is unlikely to happen. For the price, the metric’s position could be a good buying opportunity before Worldcoin begins to bounce.

Returns are about to be better

This inference did not come out of the blue, and history showed that a double-digit decline in the MVRV ratio has almost always been a good level for recovery.

For instance, when the metric was at -22.25% in January, the price rallied from $2.50 to $11.88 a few weeks later. However, this does not imply that Worldcoin would produce a similar return in the short term.

However, there is a high chance that the WLD might hit $7.42 as this would leave the average return at $24.57%. Irrespective of the bullish signal, participants have to be on the lookout.

One reason for this was Worldcoin’s decision to inflate its circulating supply. According to the project, the increase was to meet the demand for its orb-verified World IDs.

However, the statement mentioned that the team would only release 0.1% to 0.4% of the extra supply weekly. If demand for the token increases as supply jumps, then WLD might be able to validate the prediction to $7.

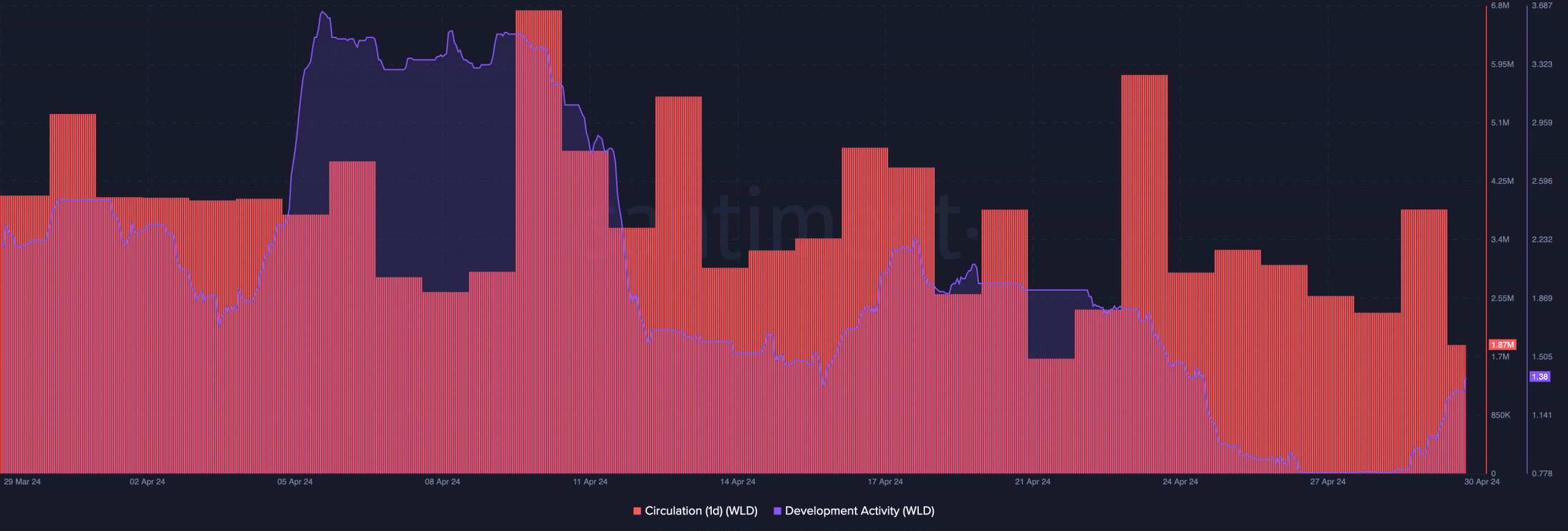

On the other hand, a bearish market condition without maximum bids for the token might stall the price rise. Meanwhile, the one-day circulation dropped to 1.87 million, according to Santiment.

This decline implied that fewer WLDs have been engaged in transactions. As such, selling pressure might be minimal. Furthermore, development activity was starting to pick up again on the Worldcoin network.

Targets begin at the upper resistance

The uptrend suggested that the project might be shipping out a new feature soon. Should this swing continue, it could be a bullish validation that could impact the token’s price.

Besides the on-chain viewpoint, it is also important to check the potential from the technical perspective. On the daily chart, WLD formed a descending channel that lasted from the 9th of March till the time of writing.

However, it seemed that the bulls had found support at $4.43, and were committed to defending the area.

Is your portfolio green? Check out the WLD Profit Calculator

Furthermore, the Relative Strength Index (RSI) was close to being oversold, indicating that a bounce could be close.

The Money Flow Index (MFI) also indicated a similar signal. Should this prediction play out, the next target for Worldcoin could be a rise to $7.46.