Ripple price prediction: What’s next after XRP jumps 7% in 12 hours?

- XRP gained 7% in the space of 12 hours, more could follow.

- Accumulation trends supported the idea of a move toward $0.7.

Ripple [XRP] noted rapid price gains in recent hours after speculation that the U.S. Securities and Exchange Commission (SEC) could appeal against the rulings of the SEC vs. Ripple case.

In a post on X, John Deaton, lawyer and candidate for United States Massachusetts, noted that an appellate court would likely not find that Judge Anastasia was in error applying the 3rd prong.

He also observed that it “makes no sense” for the SEC to appeal the court’s ruling, “which is why someone like Gary Gensler might just appeal.”

The 7th of October is the deadline by which any appeals against the rulings can be made by either party. As this deadline looms larger, XRP price volatility might go up a notch.

On-chain metrics show network-wide accumulation

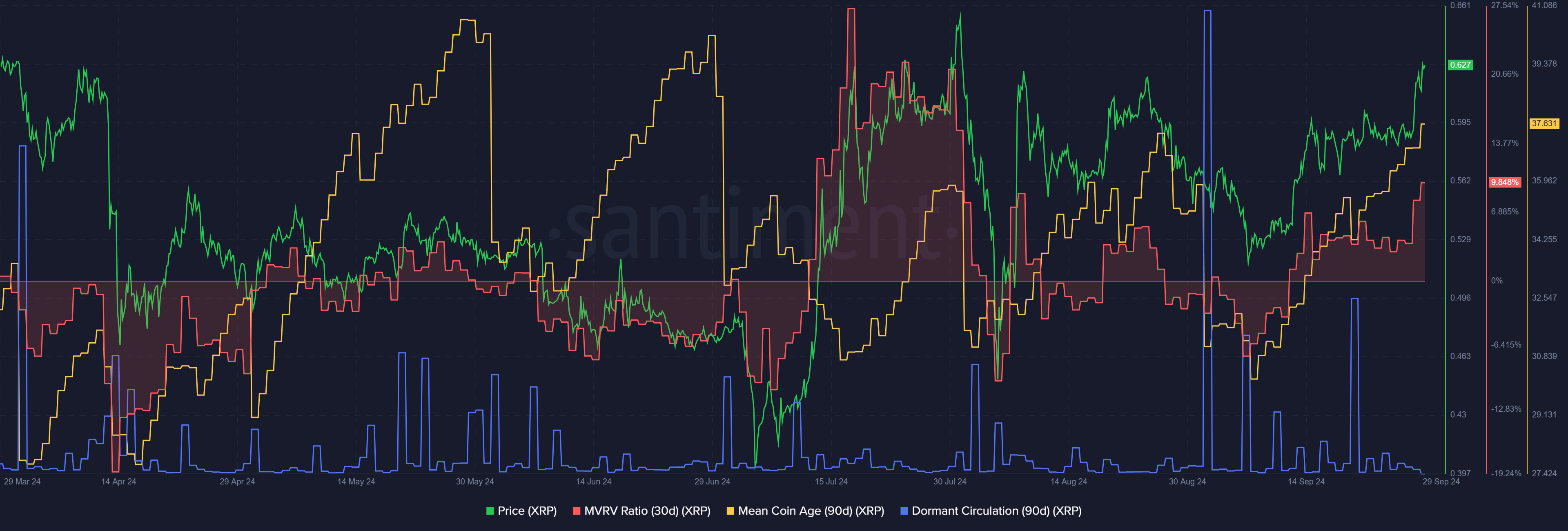

Source: Santiment

The mean coin age has been trending higher throughout September. This was a sign of accumulation, and the report of outflows from exchanges was another sign that the bulls were in control of the market.

The dormant circulation has also been silent since the 21st of September. The flurry of activity back then did not see a deep price correction.

Even before the recent price gains, the short-term holders were at a profit. The move higher took the 30-day MVRV higher once more, which could see some sell pressure from profit-taking in the coming days.

Warning signs from the spot CVD

The OBV has broken the local highs from mid-September. The CMF was also well above +0.05 to signal strong capital flow into the market. The MACD signaled firm upward momentum on the daily chart.

Realistic or not, here’s XRP’s market cap in BTC’s terms

These technical developments followed XRP’s move above the ten-week resistance at $0.62. Over the past three weeks, the token has lacked a trend compared to the rest of the market.

The strength was back in the XRP bulls’ court, but this could be short-lived if the long-term range highs at $0.71 rebuff the buyers once again.