0% of POL investors profitable – Can bulls turn the tide soon?

- A multi-year bullish pattern appeared on the token’s price chart.

- Buying pressure increased slightly, hinting at a price rise.

After Polygon’s [POL] MATIC to POL upgrade, many expected the token’s price to rise. However, that was not the case as the token continued to witness multiple setbacks over the past several weeks. Therefore, AMBCrypto investigated what’s going on.

Polygon’s dark fate

POL, after the upgrade, didn’t stir up enough bullish sentiment. This was the case as its price dropped by more than 25% in the last month. Additionally, in the last seven days alone, the token witnessed a 15% correction.

AMBCrypto’s analysis of IntoTheBlock’s data revealed that only 21 Polygon addresses were in profit. This number was negligible compared to the total number of POL addresses.

Apart from that, AMBCrypto recently reported that Polygon, despite the major update, faced a massive decline in network activity in Q3 2024. However, there might be chances of a recovery in the coming days or weeks.

Ali, a popular crypto analyst, recently posted a tweet highlighting a bullish pattern on POL’s chart. As per the tweet, a multi-year bullish pattern appeared on the token’s chart. To be precise, the pattern emerged in 2021, and since then Polygon’s price has been consolidating inside it.

If POL tests this pattern and manages a successful breakout, investors might witness a massive rally. It could allow several investors to finally enjoy profits. In fact, there were chances of POL touching $32 in 2025, which was an ambitious target.

What to expect in the short term?

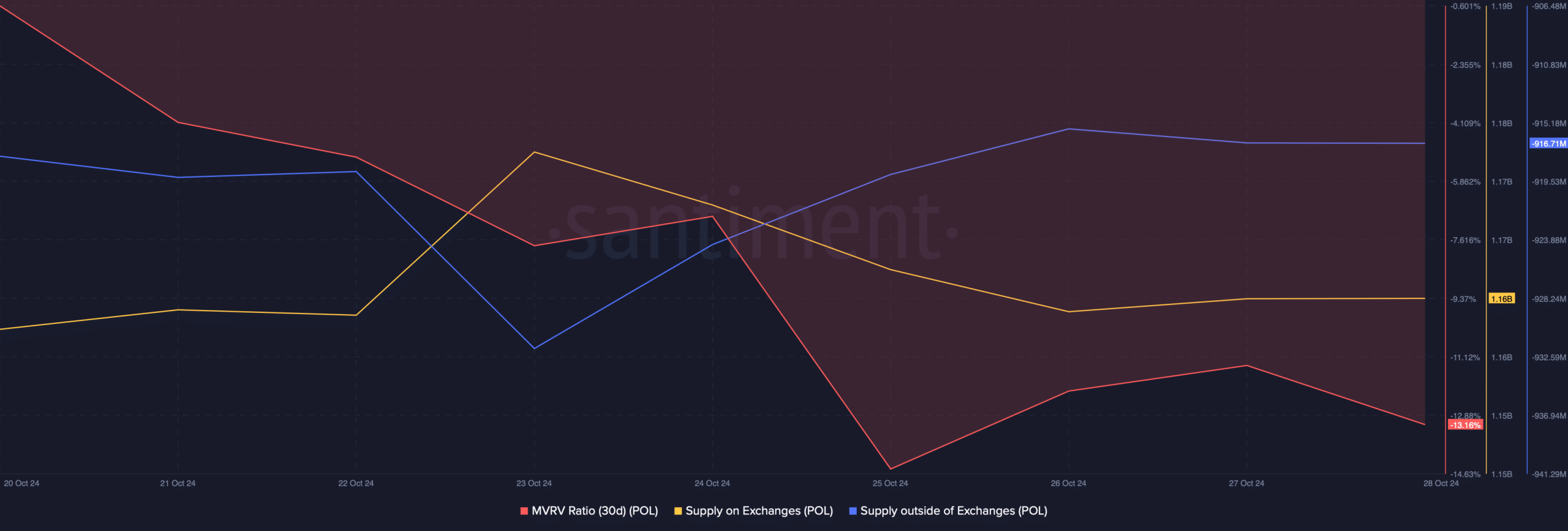

AMBCrypto then assessed Polygon’s on-chain data to find out where POL can reach or plummet to in the short term. We found that POL’s MVRV ratio dropped sharply over the last week. This can be inferred as a bearish metric.

However, buying pressure on the token increased in the past few days. Polygon’s supply on exchanges dipped while its supply outside of exchanges increased, meaning that investors were buying POL.

Generally, a rise in buying pressure is often followed by a price rise.

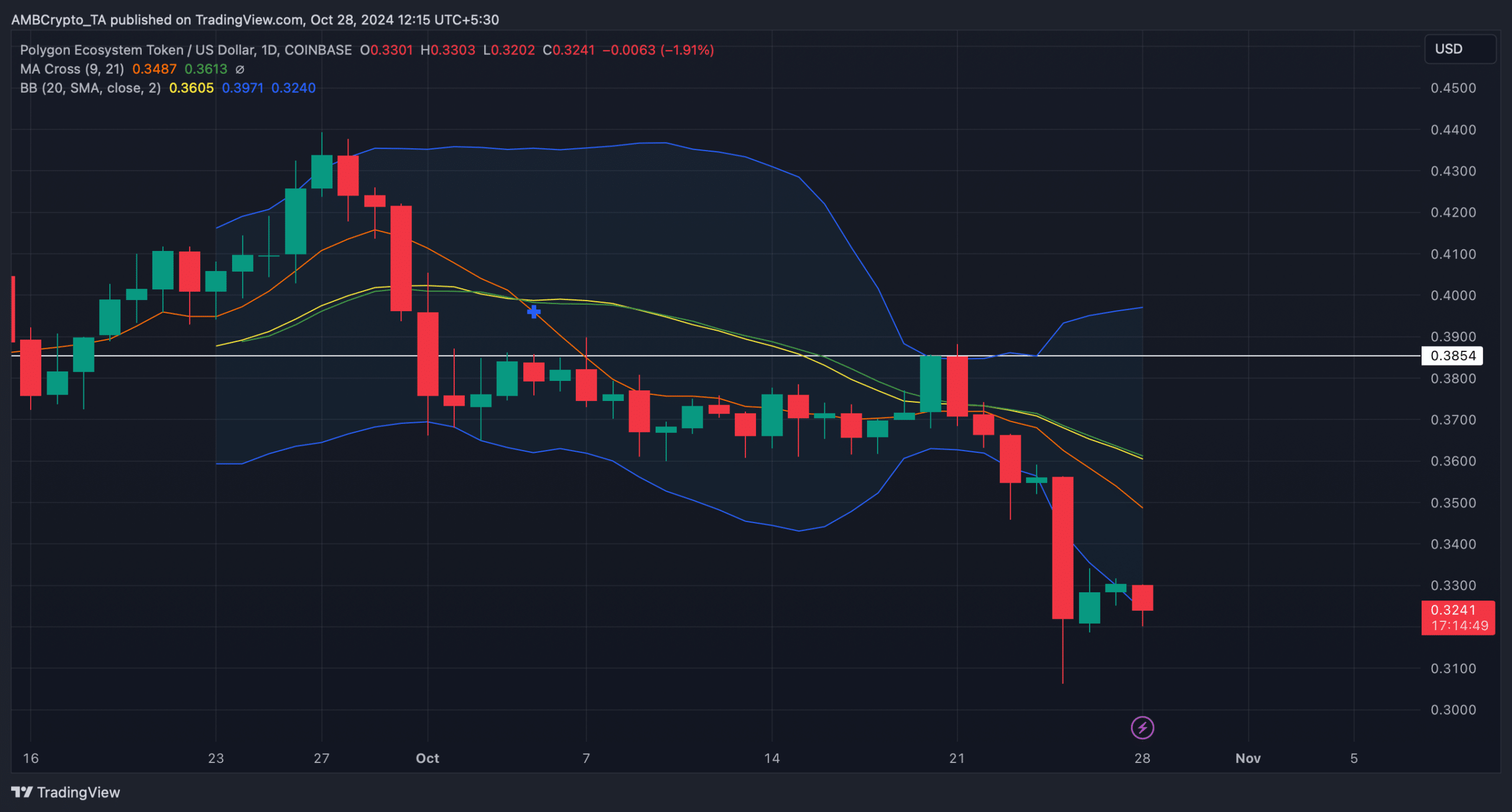

We then assessed the token’s daily chart to better understand what to expect. As per our analysis, the MA cross-technical indicator displayed a bearish advantage in the market as the 21-day MA was well above the 9-day MA.

Is your portfolio green? Check out the POL Profit Calculator

Nonetheless, POL’s price had touched the lower limit of the Bollinger Bands. Usually, when that happens, it indicates that there are chances of a price uptick in the coming days.

If that happens, then POL might first target $0.38 before it begins a full recovery.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)