$1 trillion! Crypto market cap touches new ATH after Bitcoin rallies

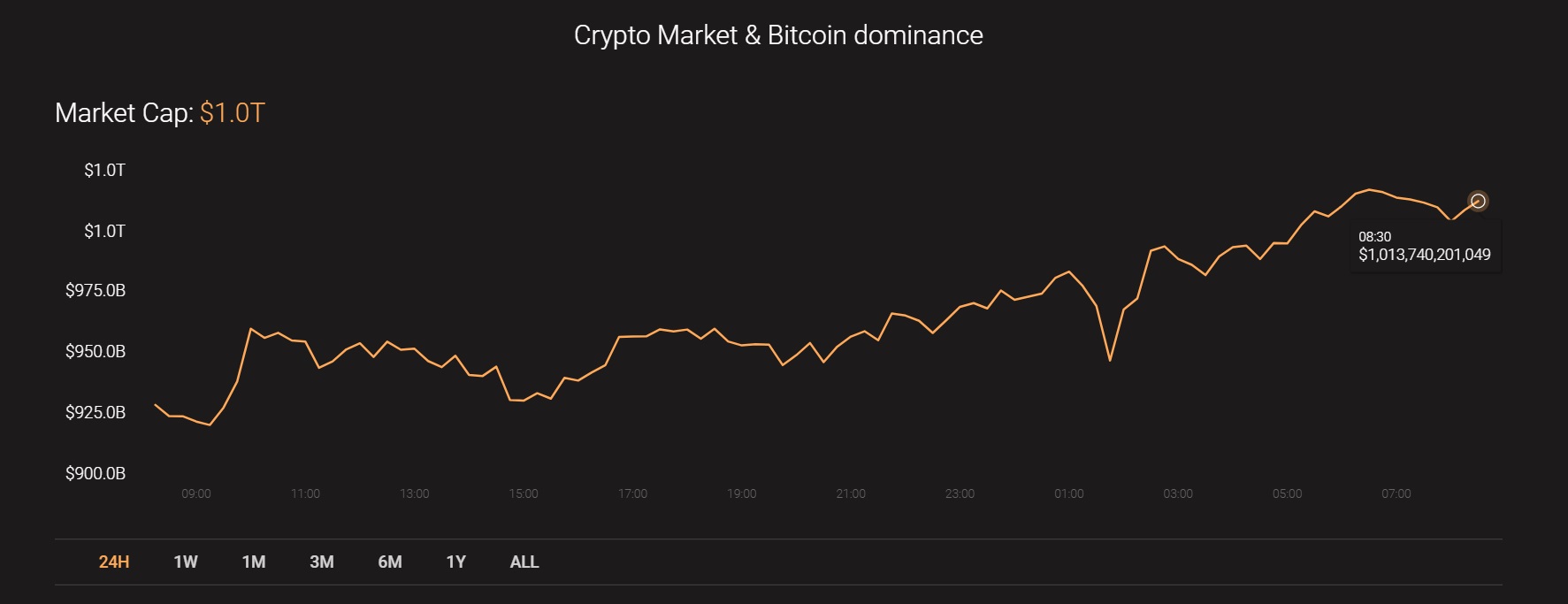

It’s been a good few weeks for the cryptocurrency market. On the back of Bitcoin climbing to one ATH after another and Ethereum going past $1000 on the price charts, the market hit yet another milestone today after the cumulative market cap of the industry hit the $1 trillion mark for the first time ever.

Source: Coinstats

Fueling the rally that contributed to the surge in market cap was Bitcoin, the world’s largest cryptocurrency, with BTC trading at $37,110 at press time, after crossing several psychological barriers earlier this week. Bitcoin also held a market dominance of 68.5%, while Ethereum, the world’s largest altcoin, noted a market share of 13.3%.

Interestingly, while most of the market has seen quite a reshuffle over the past few years, the position and dominance of the world’s top two cryptocurrencies have remained unassailable.

However, many analysts argue that BTC and ETH alone haven’t been responsible for the boom in the crypto-market. In fact, some argue that the explosive growth in DeFi and greater institutional interest in crypto can also be attributed to having contributed to the market’s growth.

XRP, the crypto-market’s fourth-largest cryptocurrency, seemed to be an exception to the general market rally, however. While it did surge on the charts briefly, late 2020 saw the SEC file charges against Ripple, following which, XRP dropped like a stone, with many traders and hodlers loosening their previously heavy XRP bags.

Ergo, while a majority of the market’s crypto-assets were recording weekly gains in excess of 50%, XRP was struggling.

The last time the market was witness to such a rally, the cumulative market cap had risen to an ATH of $829 billion. Since the market was bearish for most of the two years after, the figures never touched that level again, until recently, when BTC hiked on the charts and the market’s altcoins followed.

Since the present bull run commenced, many on-chain analysts and popular market proponents have suggested that today’s crypto market is very different from that of 2017, with the latter often accused of being a bubble driven by FOMO.

As Chief Strategy Officer at Coinshares Meltem Demirors was quick to note, “It was just a wild, frothy time and 2017 for many of us felt the same way. A lot of coins, a lot of names, a lot of capital flying around. This cycle is so different because the narrative is very focused on Bitcoin.”