1B USDT minted: What does this mean for Bitcoin?

- USDT supply jumped by 0.37%, aligning with Bitcoin’s 2% decline from the previous day.

- If confidence in a recovery fades, massive capitulation might follow.

During the recent market consolidation, stablecoins have surged. Since the 9th of September, USDT and USDC market cap increased by $1.153 billion—USDT up $410M and USDC up $743M.

This coincided with Bitcoin’s [BTC] rise to $60.5K, a 12.04% gain in a week.

Hence, this capital influx was crucial to Bitcoin’s surge. Now, with the market retracing into a bearish pullback, are investors confident in a price recovery?

Increase in USDT supply

While Bitcoin saw a 2% decline on the 16th of September from the previous day, USDT circulating supply jumped from $54.14B to $54.34B.

This increased liquidity may support potential Bitcoin price increases in the coming days, assuming there is less reliance on USDT as a safe haven.

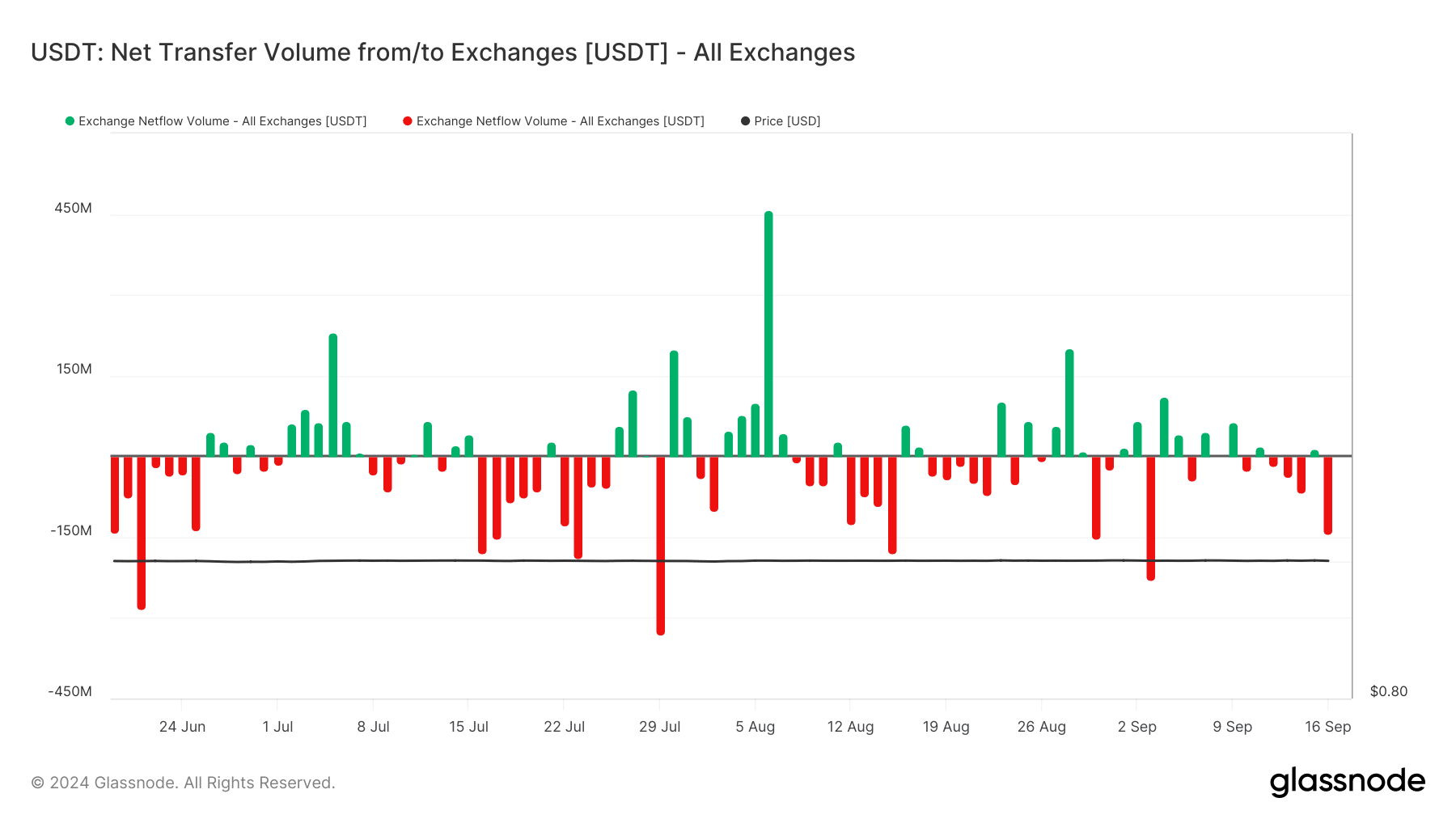

Surprisingly, the chart below presents a sharp contrast to this expectation.

The tremors have led to panicked stakeholders, shown by consecutive negative flows. Investors may have shifted capital into USDT for safety while Bitcoin’s price fell, reflecting a liquidity shift rather than a direct correlation.

Put simply, the jump in USDT supply did not correlate with increased Bitcoin demand; other factors might be at play.

On the 16th of September, the Tether treasury minted 1 billion USDT tokens, causing the sharp 0.37% rise in its supply.

While this could suggest confidence in price recovery, it may also reflect liquidity demand or market hedging, not direct optimism.

Therefore, other dynamics must be considered to gauge true confidence.

Stablecoin outflows could spark capitulation

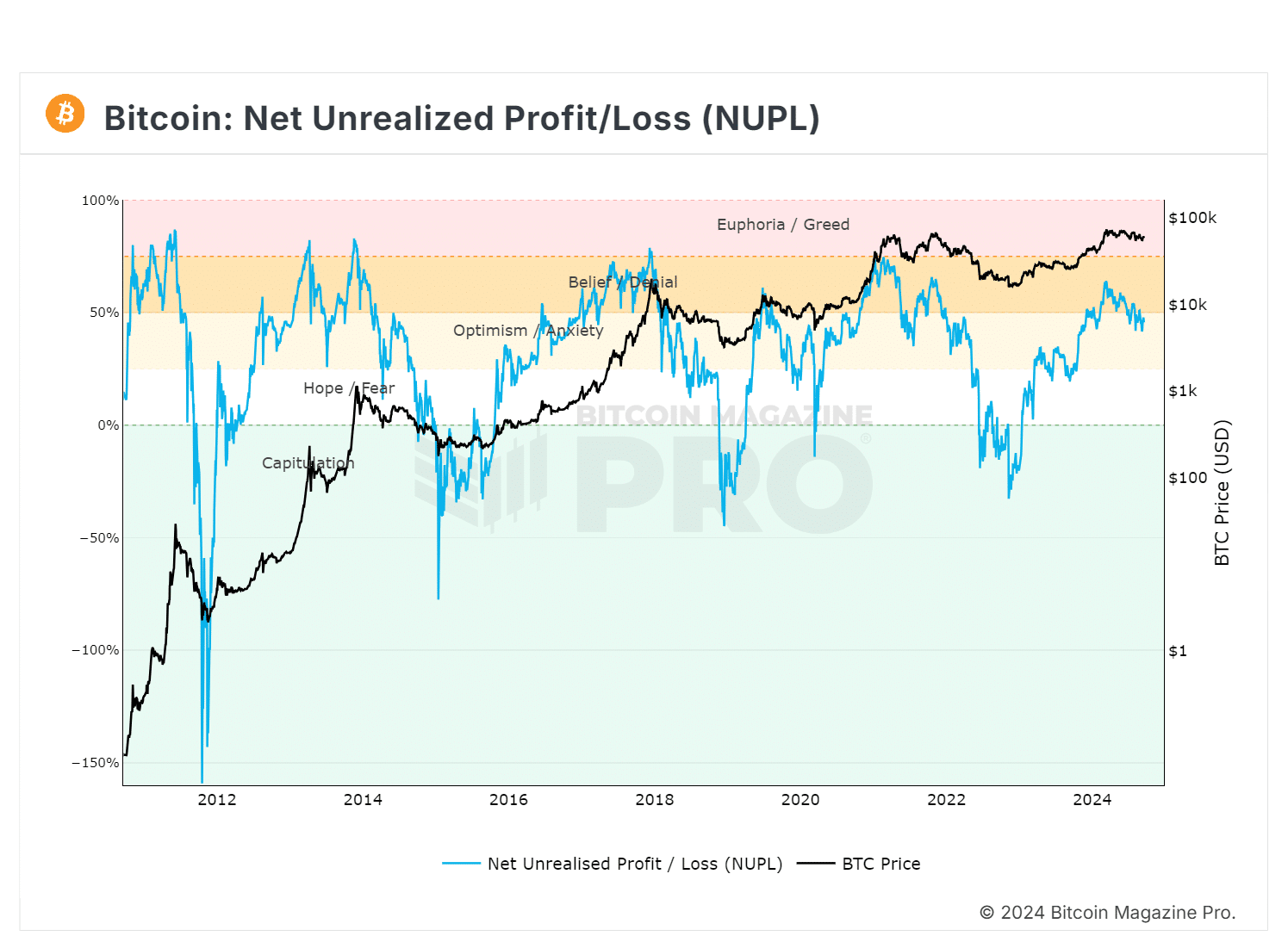

The chart shows many Bitcoin holders are in profit, which is bullish but may signal a market top as high NUPL could lead to profit-taking and potential corrections.

Conversely, rising USDT outflows could turn NUPL negative, indicating unrealized losses and possible selling to break even.

The exact position will become clearer after the FOMC meeting. If bulls act decisively, profit holders might maintain their gains.

However, nearing the $55K range could trigger increased USDT outflows, signaling potential capitulation.

Read Bitcoin (BTC) Price Prediction 2024-25

For context, on the 3rd of September, a massive $230M USDT flowed out of exchanges on the same day Bitcoin dropped nearly 3%, following a 4% rise the previous day.

This indicated that investors were likely shifting capital to safety, causing BTC to plunge below $54K in just three days. If this trend holds, BTC could retrace back to the same support level again this time.

![Solana [SOL]](https://ambcrypto.com/wp-content/uploads/2025/08/Solana-SOL-1-400x240.webp)