1Inch investors making long bets can consider this update

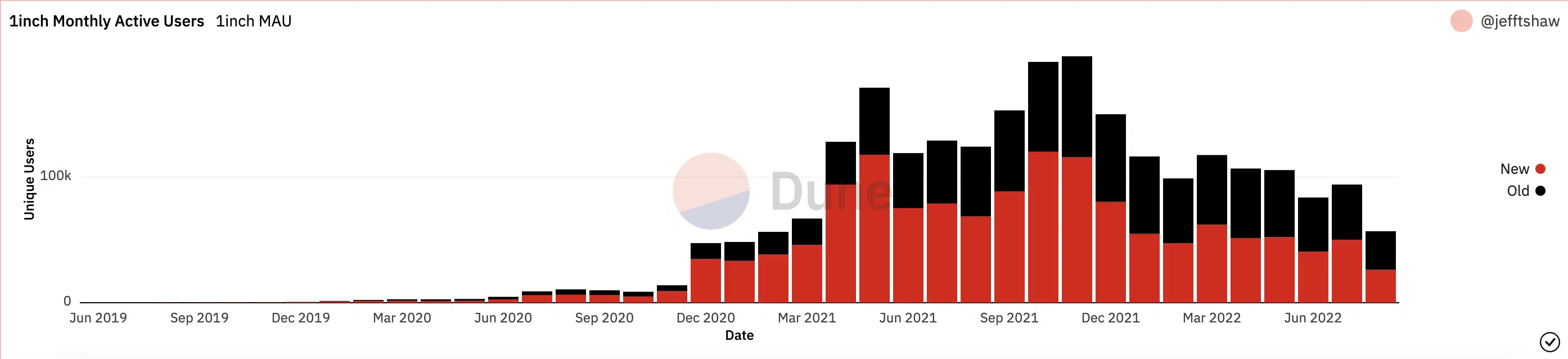

Monthly active users (MAU) on 1Inch Network have declined gradually since November 2021, data from Dune Analytics revealed. In July, the total monthly active users on the all-in-one DeFi platform stood at 94,263.

This index represented a 52% decline from the all-time high recorded nine months ago.

1Inch offers its users three product offerings: Liquidity Protocol, Aggregation Protocol, and Limit Order Protocol. It is deployed across several chains, including Ethereum, Arbitrum, Optimism, Polygon, Avalanche, BNB Chain, Gnosis, and Fantom.

Let us take a look at how this non-custodial DEX aggregator has fared in the last few months.

A few centimeters short

Since its launch in May 2019, monthly active users on 1Inch Network clinched an all-time high of 196,570 last November.

However, with the first half of 2022 marked by a downturn in the general cryptocurrency market, 1Inch was impacted as the platform’s index of users logged per month declined.

In July, the platform registered a total of 94,263 users. So far this month, 57,004 users have visited the network.

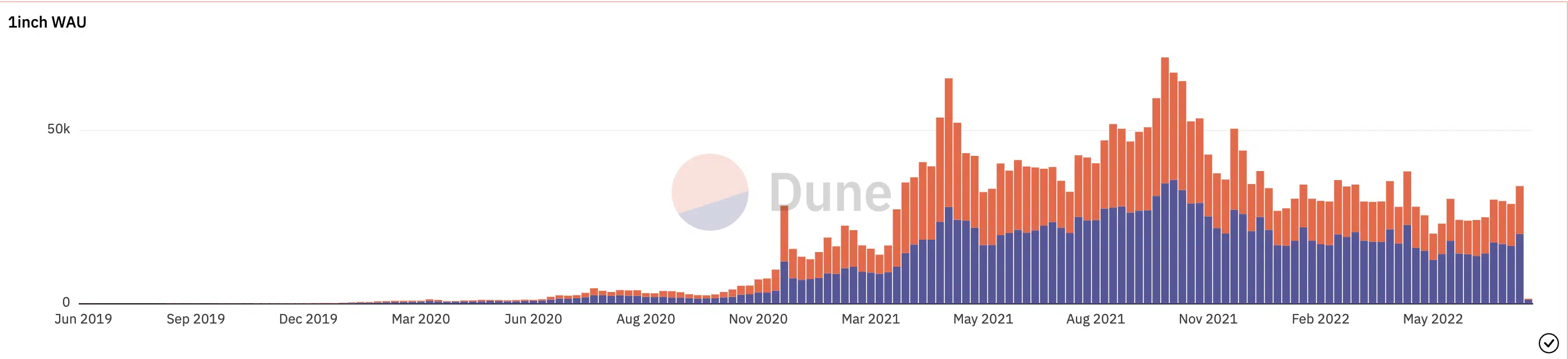

Weekly active users on the network also peaked last year. According to data from Dune Analytics, between 19-25 October, 1Inch saw 71,105 users, the most weekly users it had seen since launch.

Since then, weekly users on the network have dropped. In the past week, the count of users on 1Inch stood at 33,976.

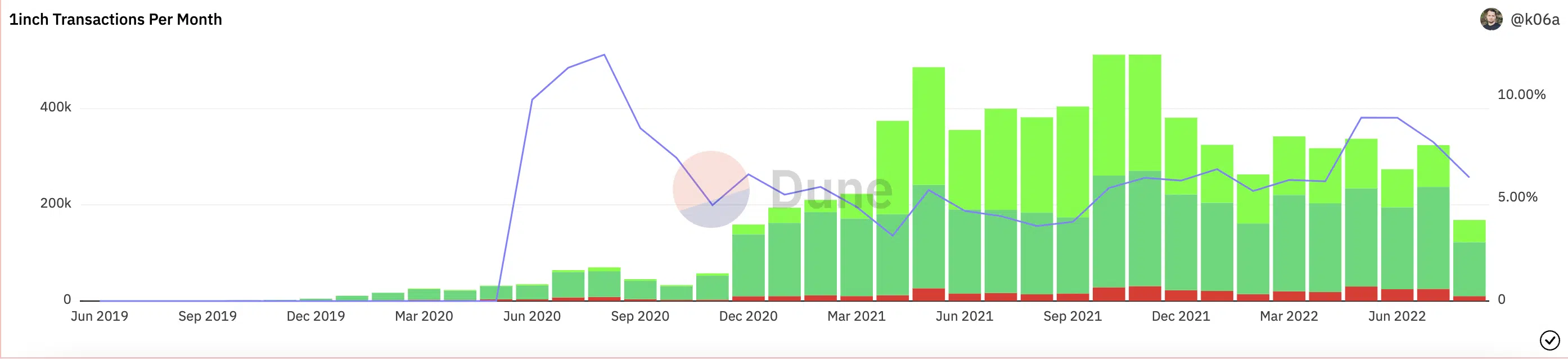

Moreover, the number of monthly transitions processed on the network had declined since last November, when it recorded an all-time high total monthly transactions of 512,315.

By July 2022, total transactions processed had fallen by 24% (385,162 transactions). So far this month, 56,647 transactions have been processed on the network.

There’s an upside

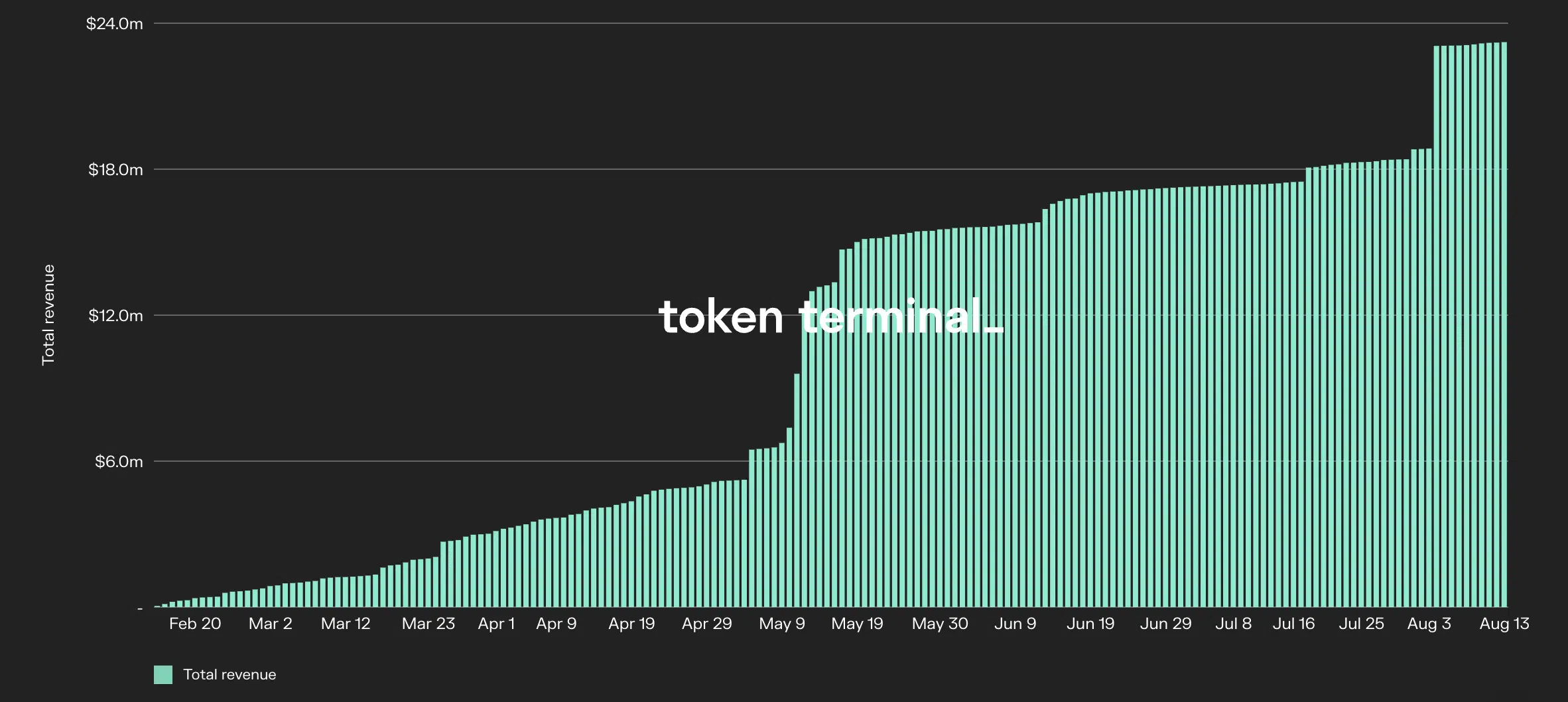

Despite the declines logged by 1Inch in the last few months, total revenue made by the network has grown steadily.

In the last month, its revenue rose by 665.2%. And, in the last 180 days, revenue was up by 26.9%.

As of 13 August, total revenue made by the network stood at $23.2 million.

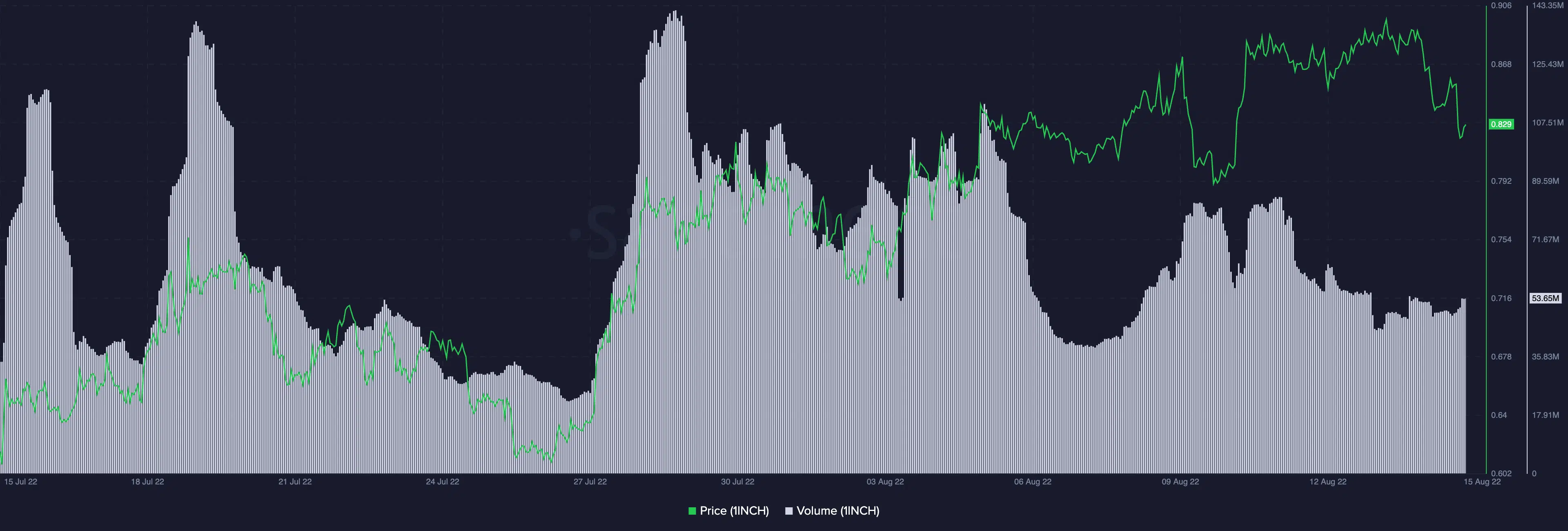

As for the network’s native token, 1INCH, its price has rallied by 27% in the last 30 days.

At press time, the token exchanged hands at $0.83. There has, however, been a price/volume divergence since 29 July, indicating buyers’ exhaustion.