1inch Network commences gas refunds, but here’s the catch

The 1inch network recently revealed some good news, particularly for members of its resolver incentive program. The network has commenced the distribution of funds that were set aside as gas refunds for December and January.

How much are 1,10,100 1INCHs worth today?

According to the announcement, the 1INCH resolver incentive program will pay out up to 10 million 1INCH. The program has already commenced and over 1.5 million 1INCH has been paid out so far.

According to the official blog regarding the matter, the allocated funds will provide stakers with an incentive to delegate Unicorn Power to resolvers.

Resolvers are market makers that pay a gas fee to support the network’s operations. Aside from the support they provide to the network, they also benefit from arbitrage trading. Still related to the matter, 1inch has confirmed that users can now migrate from its V1 staking protocol to its staking protocol V2.

1inch also announced its intention to refund the gas fees associated with staking protocol migration. The refunds will be conducted in March and they will include fees incurred within the first two months of the year.

What is the motive?

1inch’s refunds may encourage more participation from interested parties. The incentives might also be enough to encourage more investors to jump on board, hence encouraging a long-term perspective for 1INCH.

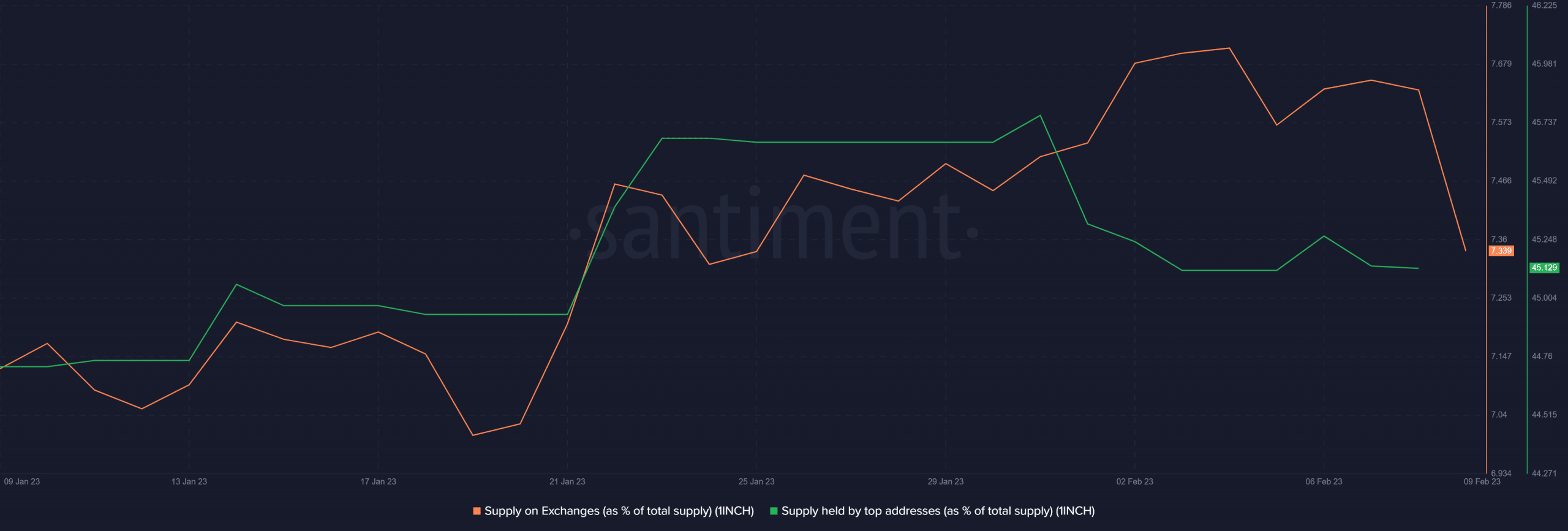

This aligns with exchange outflows as observed in the last few days. The supply of 1INCH on exchanges dipped substantially in the last few days, confirming that there was significant buy pressure.

The retail segment is likely responsible for the drop in supply on exchanges. This is because the supply held by top addresses also dropped by a noteworthy margin in the last five days.

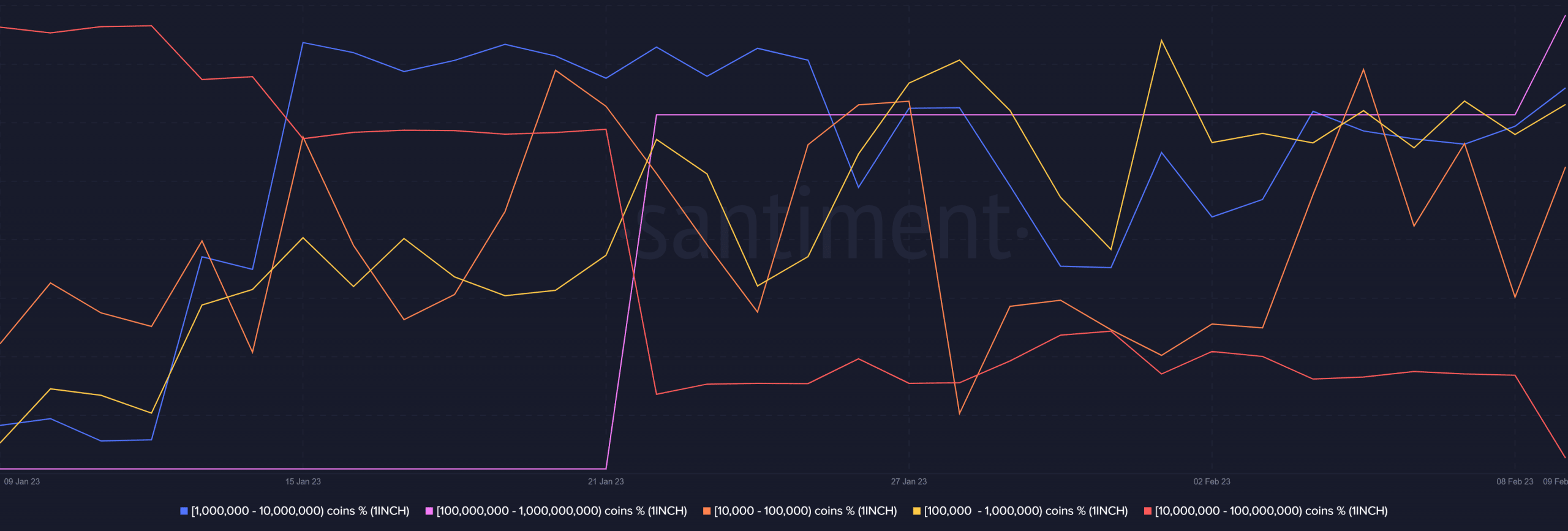

A look at the supply distribution reveals that addresses holding between 10 million and 100 million hold the largest amount of 1INCH token.

The same category has been selling for the last two days, thus having a bearish impact on the market.

Is your portfolio green? Check out the 1INCH Profit Calculator

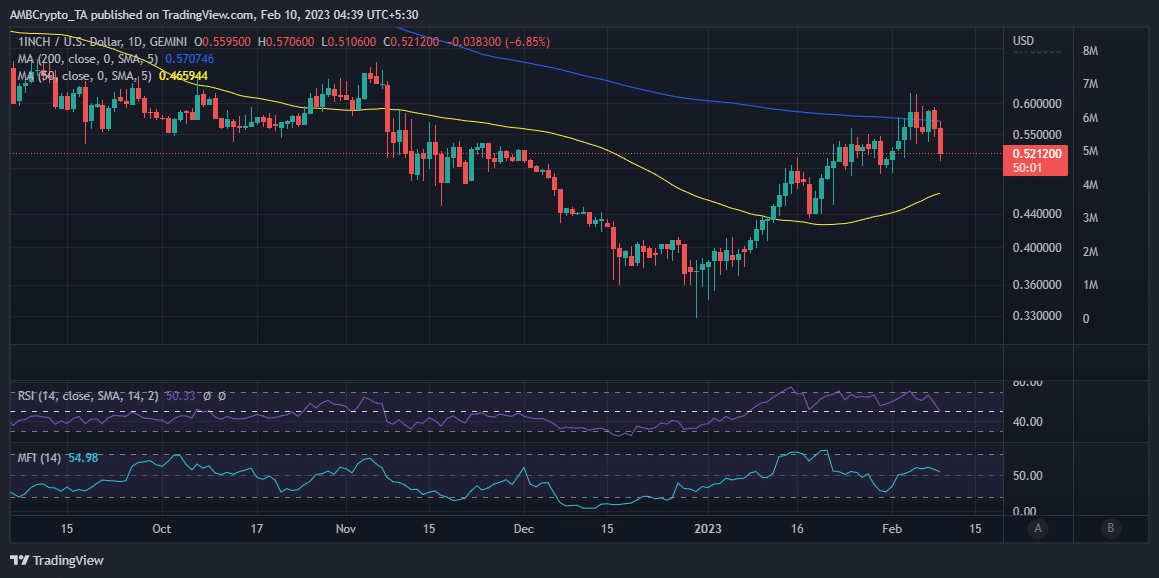

Most of the other whale categories have been accumulating. However, the strength in numbers has the clear upper hand because 1INCH and the rest of the market have tanked in the last two days. 1NCH traded at $0.52 at the press time, courtesy of an 11.6% pullback.

The bearish outcome is largely associated with a wave of FUD triggered by the SEC’s assault on crypto staking on exchanges.

The market may continue to fall if there will be enough selling pressure. However, 1INCH’s RSI is now at the 50% RSI level where it might bounce back. Short traders looking to capitalize should consider this before executing.

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)