Analyst – 2 reasons why Ethereum’s downtrend is nearing its end

- Ethereum demonstrated signs of recovery, though it remained below previous highs amid cautious market sentiment.

- Rising Ethereum exchange outflows indicated investor confidence, possibly pointing to a bullish trend ahead.

Ethereum [ETH], the second-largest cryptocurrency by market capitalization, has recently experienced a modest recovery in its price, trading at $2,661 at the time of writing.

This marked a 1.6% increase over the past day.

Prior to this, Ethereum had been on a downward trajectory, reaching a low of $2,545 last week.

Despite the recent uptick, Ethereum’s price remained significantly below its March high of $4,070 and was still down by approximately 45% from its all-time high of $4,878, recorded three years ago.

The current market conditions raise questions about whether Ethereum is on the verge of a more sustained recovery, or if the recent price movements are merely a temporary correction.

Inasmuch, CryptoQuant analyst Burak Kesmeci suggested that Ethereum may be in the late stages of its correction, citing on-chain metrics that indicate a potential shift in market sentiment.

Market sentiment

In his recent analysis, Burak Kesmeci highlighted two key datasets, which indicated that Ethereum was nearing the end of its correction phase.

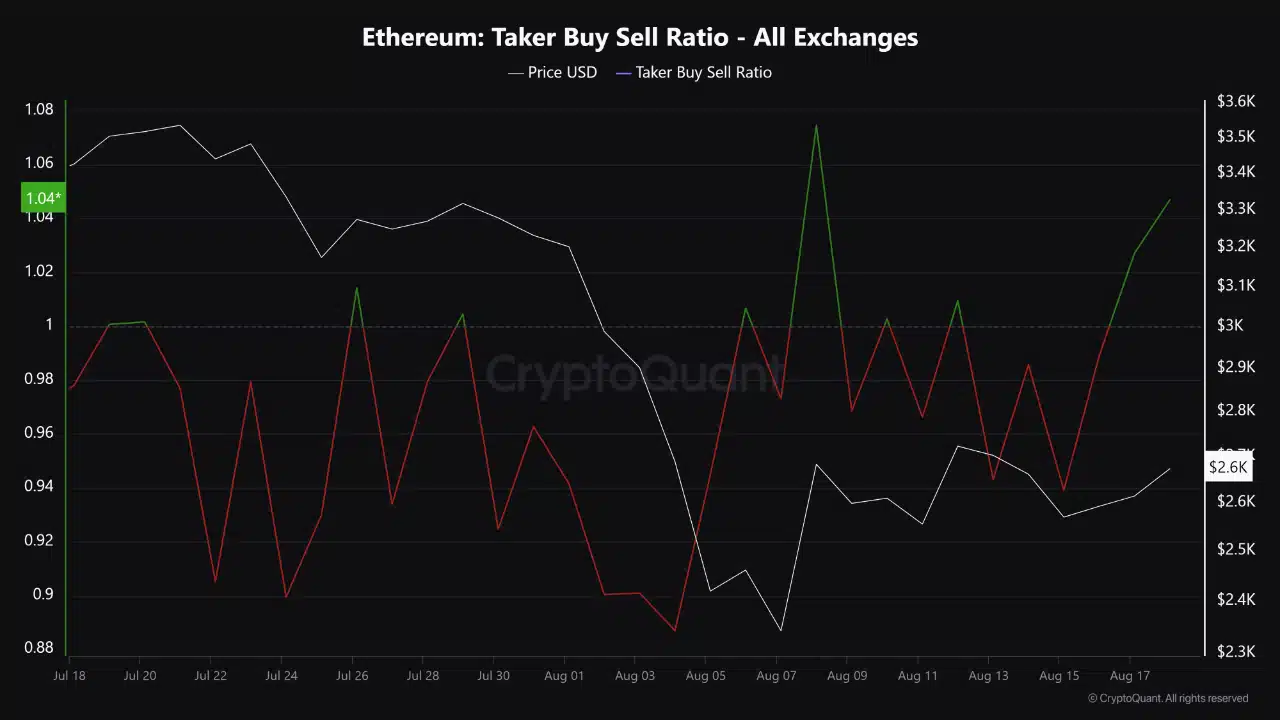

The first is the Taker Buy Sell Ratio, which measures the ratio of buyers to sellers across all exchanges.

According to Kesmeci, this ratio has turned positive, indicating that buyers are beginning to regain strength.

This shift in the buyer-seller dynamic could be an early sign of a potential rally, especially if the trend continues into the following week.

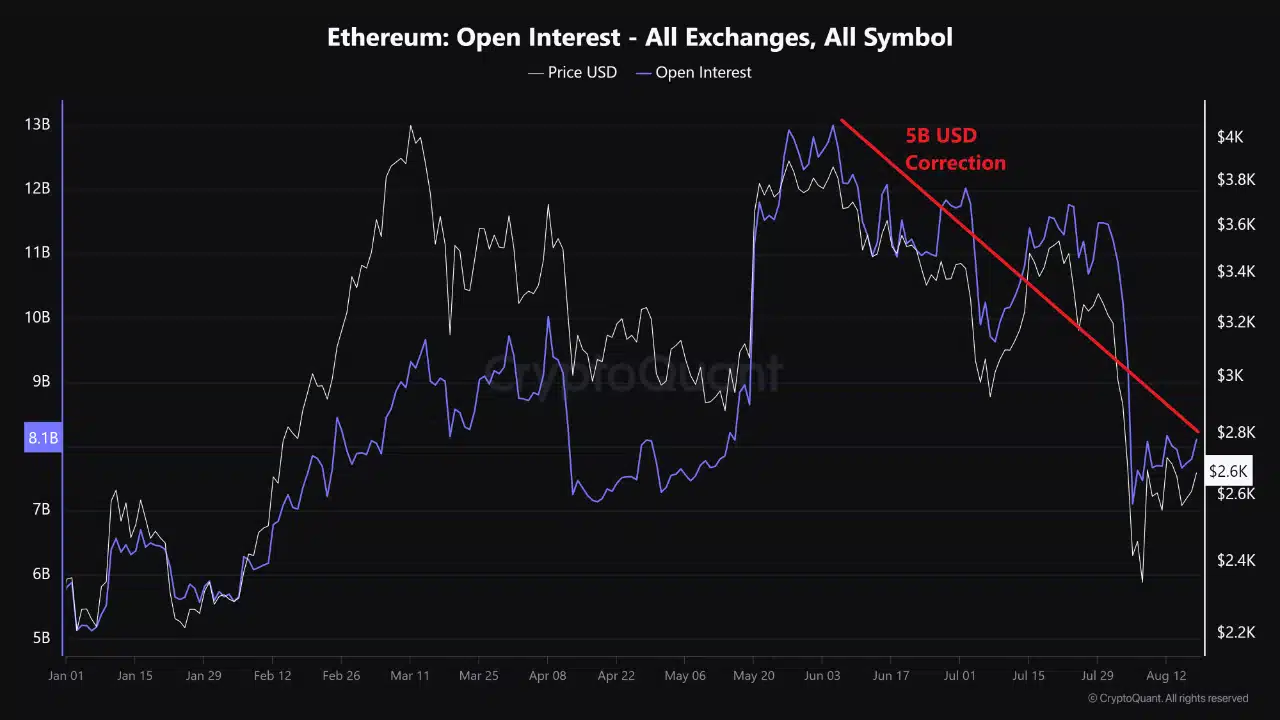

The second metric is Open Interest (OI), which represents the total number of open long and short positions in the market.

As Kesmeci pointed out, in June 2024, when Ethereum’s price reached $3,800, OI hit a record high of over $13 billion, suggesting that a market correction was imminent.

This correction materialized on the 5th of August 2024, when a macroeconomic event caused OI to plummet to $7 billion.

Kesmeci noted that for Ethereum’s price to experience a significant upward movement, leveraged players would need to re-enter the market, potentially driving a new wave of buying activity.

Is Ethereum ready for a rally?

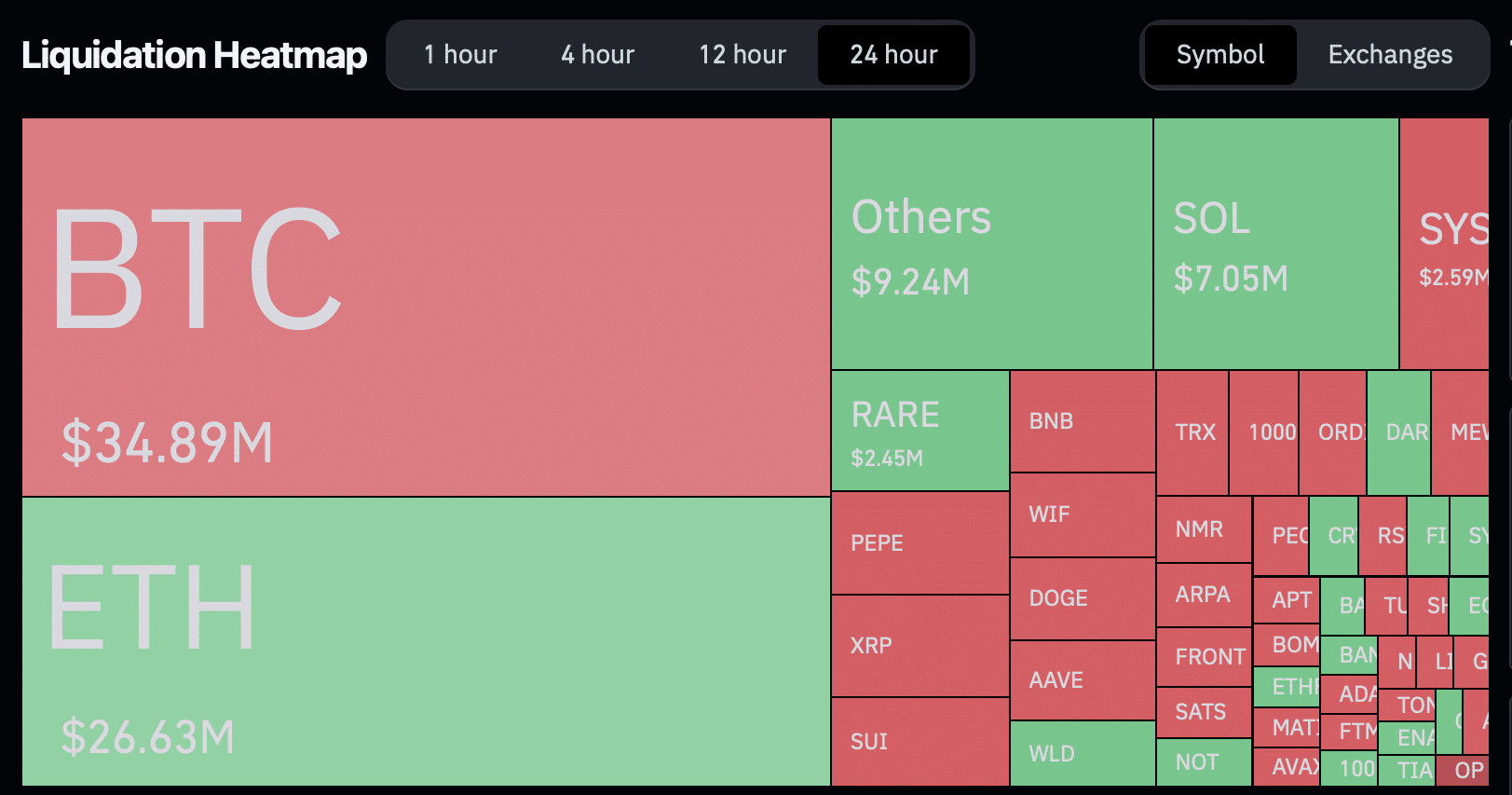

While these metrics highlighted by Kesmeci offer a promising outlook, the broader market has borne the brunt of ETH’s 24-hour recovery.

Over this period, a total of 43,521 traders were liquidated, with liquidations amounting to $111.52 million. Ethereum accounted for $26.63 million of these liquidations, with the majority being long positions.

This suggests that while there is optimism among some traders, the market remains volatile, and leveraged positions continue to carry significant risk.

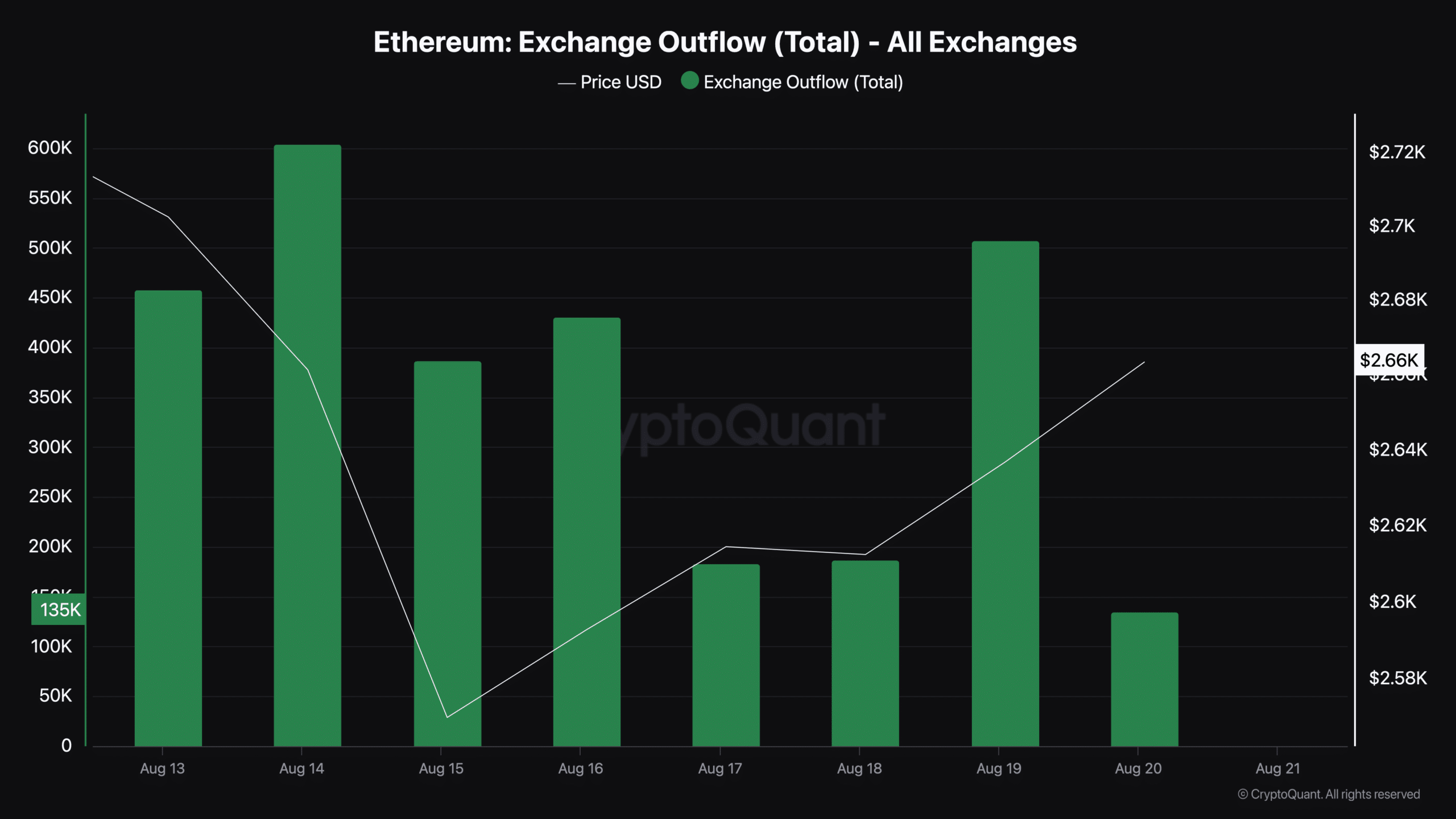

Beyond the on-chain metrics, another critical factor to consider is the movement of Ethereum out of exchanges.

Data from CryptoQuant indicated a consistent increase in Ethereum exchange outflows over the past week.

On the 14th of August, more than 600,000 ETH left exchanges, followed by approximately 507,000 ETH on August 19. As of today, nearly 200,000 ETH has already been withdrawn from exchanges.

This increase in exchange outflows typically signals that investors are moving their Ethereum holdings into long-term storage, reducing the supply available for trading on exchanges.

Such behavior often suggests a bullish outlook among investors, as they anticipate higher prices in the future.

Reduced exchange supply, coupled with sustained demand, can create upward pressure on Ethereum’s price.

Read Ethereum’s [ETH] Price Prediction 2024-2025

However, it remains to be seen whether this trend will lead to a significant rally or if the current market conditions will continue to challenge Ethereum’s recovery.

Kesmeci concluded the post by saying,

“Current data shows that buyers in Ether are gradually regaining strength. However, time will tell whether this is a temporary rebound or the start of a strong rally led by the bulls.”