2 reasons why Solana traders should watch out for the SOL/BTC trading pair!

- Analysts forecast a potential downturn for Solana, as the SOL/BTC pair continues to lag behind ETH/BTC

- If this anticipated drop materializes, it could echo across other SOL pairings

SOL/USD has recently faced challenges similar to other cryptocurrency pairs amid the broader market’s instability, dropping by 4.52% in the last 24 hours.In fact, at the time of writing, it was trading at $147.09, despite hitting a peak of $162 when the week began.

Additionally, the SOL/BTC pair registered a decline from the week’s opening high of $0.0025359 to $0.0024544. This trend suggests vulnerability across various SOL pairs, which could suffer additional losses if analysts’ predictions prove accurate.

Bearish outlook for SOL?

Crypto analyst Benjamin Cowen recently highlighted in a tweet that SOL/BTC is mirroring the movements of ETH/BTC, raising concerns about the implications of this trend.

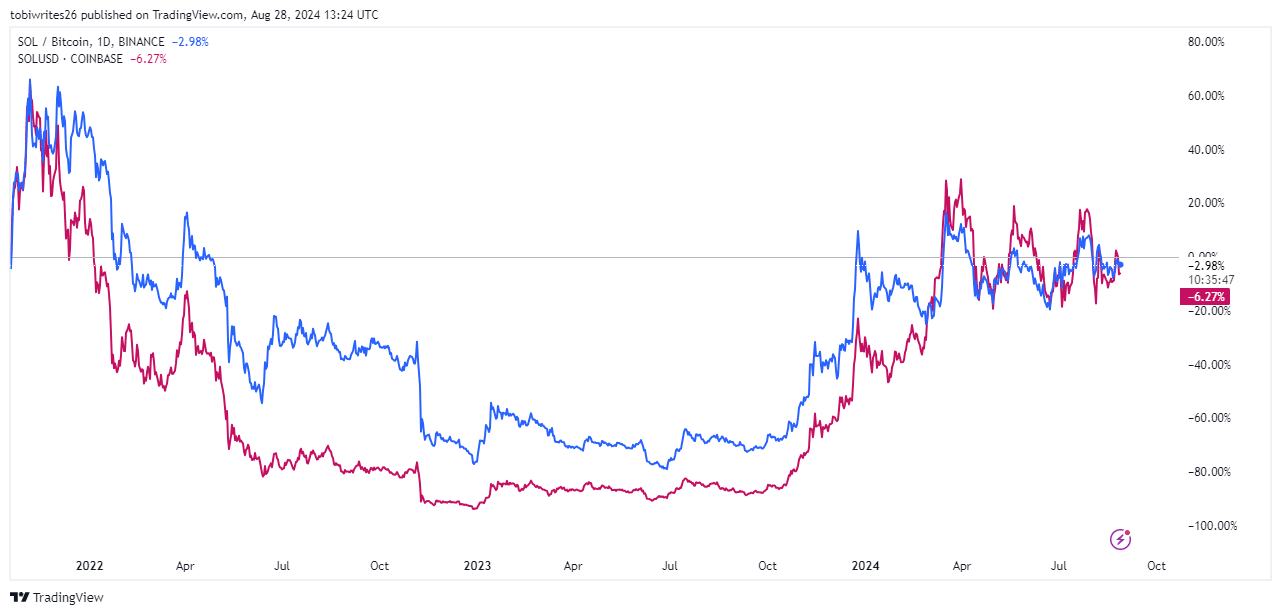

Cowen’s analysis was based on a shared chart that noted historical similarities for both pairs. ETH/BTC, after its peak in 2017, plummeted by 90%, only to surge by 500%. It is presently in another downward phase.

Similarly, SOL/BTC replicated this trajectory, suffering a 90% drop after achieving a new all-time high in 2021, followed by a 500% hike. If this historical pattern persists, SOL/BTC may face a major downturn which ETH/BTC is trading within by year’s end.

However, despite this gloomy outlook, Cowen is optimistic about the pair’s long-term recovery after this corrective phase.

According to him,

“[SOL will] bounce into 2025, before dropping again in 2026.”

AMBCrypto confirmed that such a correction would affect not only SOL/BTC, but also other SOL pairs like SOL/USDT and SOL/USD. These are more widely traded and thus, more vulnerable to similar declines.

SOL/BTC correction will affect other SOL pairs

A comparison of SOL/BTC (blue line) and SOL/USD (purple line) demonstrates that these assets have closely mirrored each other’s trajectories—Matching highs and lows despite occasional discrepancies.

The chart below illustrates this alignment in their price movements, showcasing a very similar overall trend. Entering a corrective phase, SOL/BTC could erase gains for both long-term traders and investors.

However, If SOL/BTC manages to defy the prevailing trends seen in ETH/BTC by climbing to higher levels, then expect to see a corresponding hike across other related pairs as well.

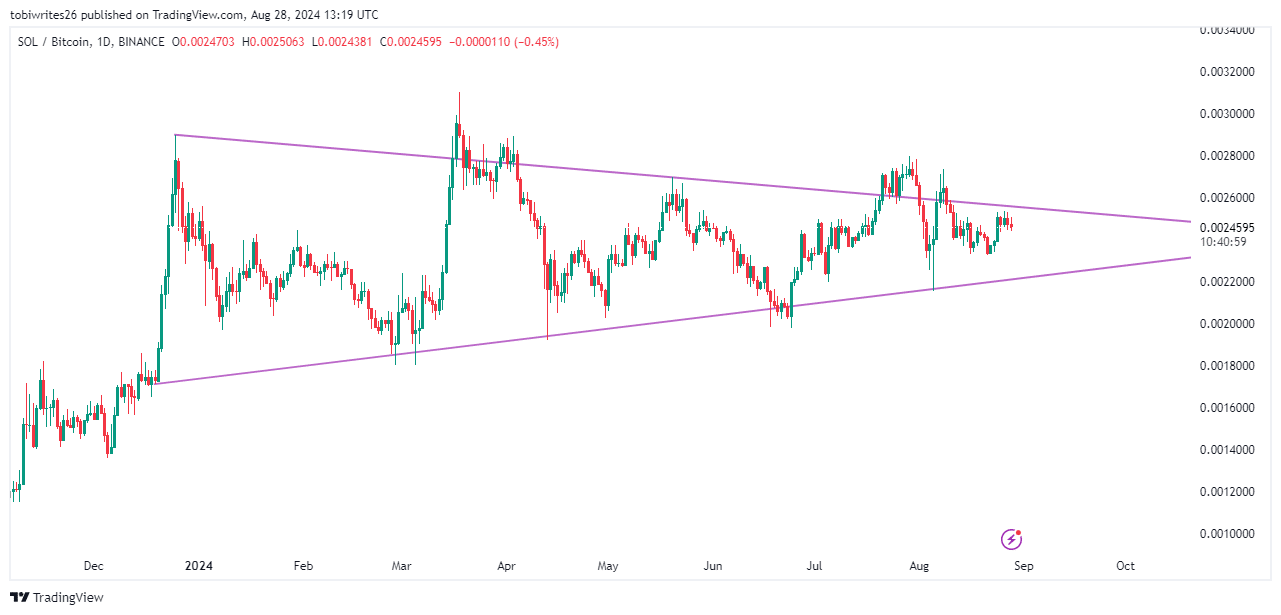

Ascending triangle could shift the SOL/BTC narrative

At the time of writing, SOL/BTC was trading within a bullish ascending triangle pattern on the daily timeframe.

This formation typically requires the price to remain within the pattern for an extended period, before potentially surging to higher levels.

AMBCrypto noted that this pattern is pivotal – A similar formation in 2021 was a precursor to SOL/BTC hitting a new all-time high (ATH) of $0.0046700.

Should this pattern persist, it could signify a break from SOL/BTC’s long-established correlation with ETH/BTC, potentially propelling it to new heights.