210,000 Bitcoin on the move: Decoding what it means for BTC’s next move

- Massive movement of BTC into long-term storage.

- Open interest and technical indicators are bullish on Bitcoin.

Bitcoin’s [BTC] upward trajectory continues, with the price recently hitting $64K before a slight retracement to $63.7K. This pullback is temporary, as BTC is poised for further gains once the retracement concludes.

A significant factor driving Bitcoin’s price higher is the withdrawal of 210,000 BTC from exchanges since the start of the year.

This trend indicates that BTC hodlers are increasingly moving their assets off exchanges for long-term storage, reducing market selling pressure and setting the stage for higher prices, likely in Q4 of 2024.

History of Bitcoin’s falling wedge pattern

Bitcoin’s historical price patterns also support the bullish outlook. Since its inception in 2009, Bitcoin has repeatedly formed a falling wedge pattern, which typically precedes a strong upward movement.

This Bitcoin [BTC] pattern developed between 2021 and 2023 leading to a sharp bullish wave after a period of consolidation.

Source: TradingView

Currently, Bitcoin is in a descending broadening wedge, and a breakout above the $70,000 level could send BTC soaring toward $100,000 in the coming months, especially if the Federal Reserve cuts rates in September.

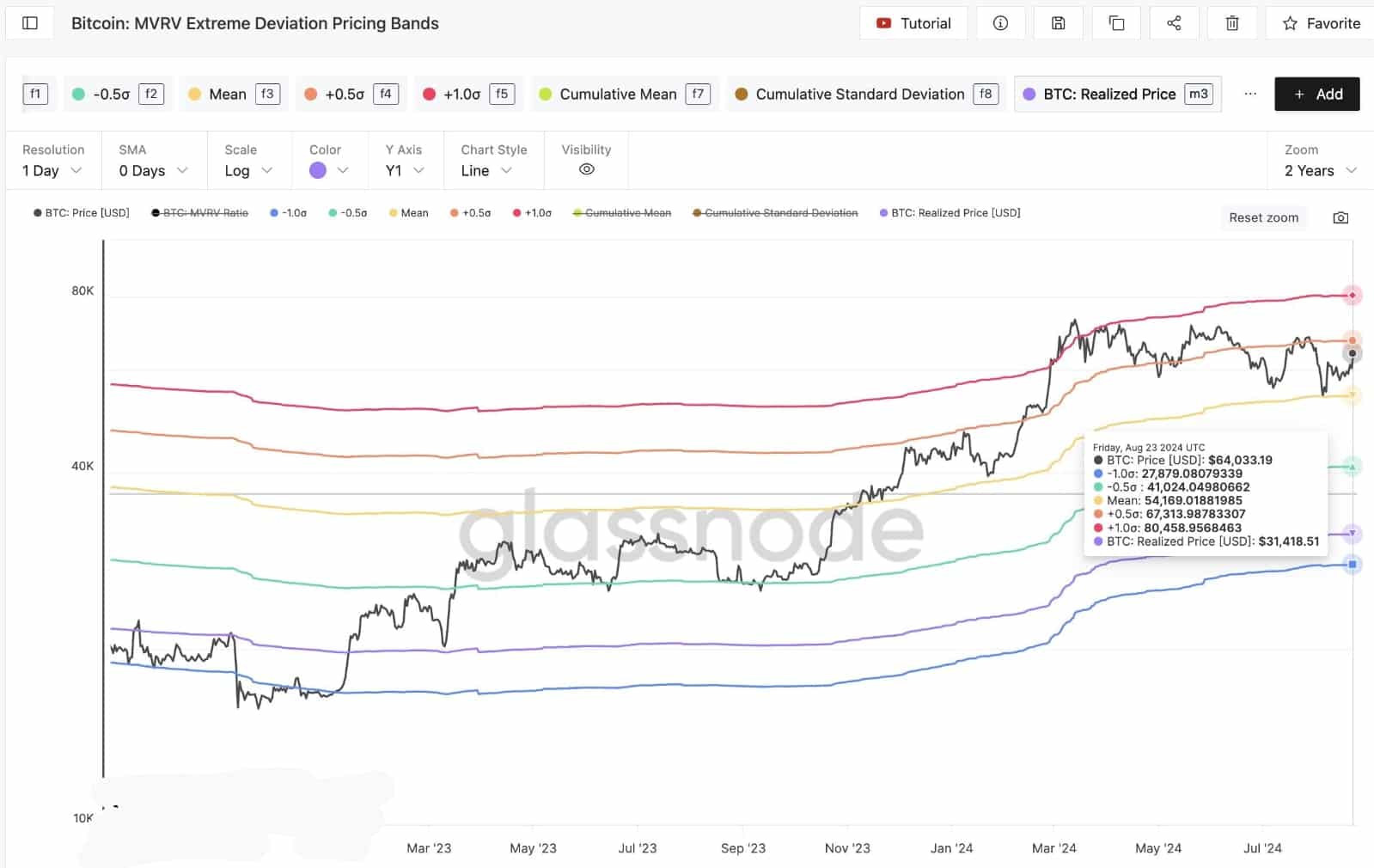

Bitcoin MVRV extreme deviation pricing bands

Another key factor influencing Bitcoin’s potential to climb higher is the MVRV (Market Value to Realized Value) pricing bands.

A significant resistance level at $67,300 is crucial for Bitcoin to clear. Breaking past this level could pave the way for BTC to reach $80,500.

Source: Glassnode

With the recent price movements and the reduction in market selling pressure due to the long-term storage of 210,000 Bitcoins, breaking this resistance seems increasingly likely, setting the stage for higher prices.

Bitcoin classic slow movement closes the CME gap

Additionally, Bitcoin’s performance around the CME close price over the weekend played a critical role in maintaining market stability.

The lack of a gap at the CME close has kept the market steady, providing a solid foundation for the bullish momentum that began last Friday. If Bitcoin continues this trend, it could trigger fresh buying and push the price even higher.

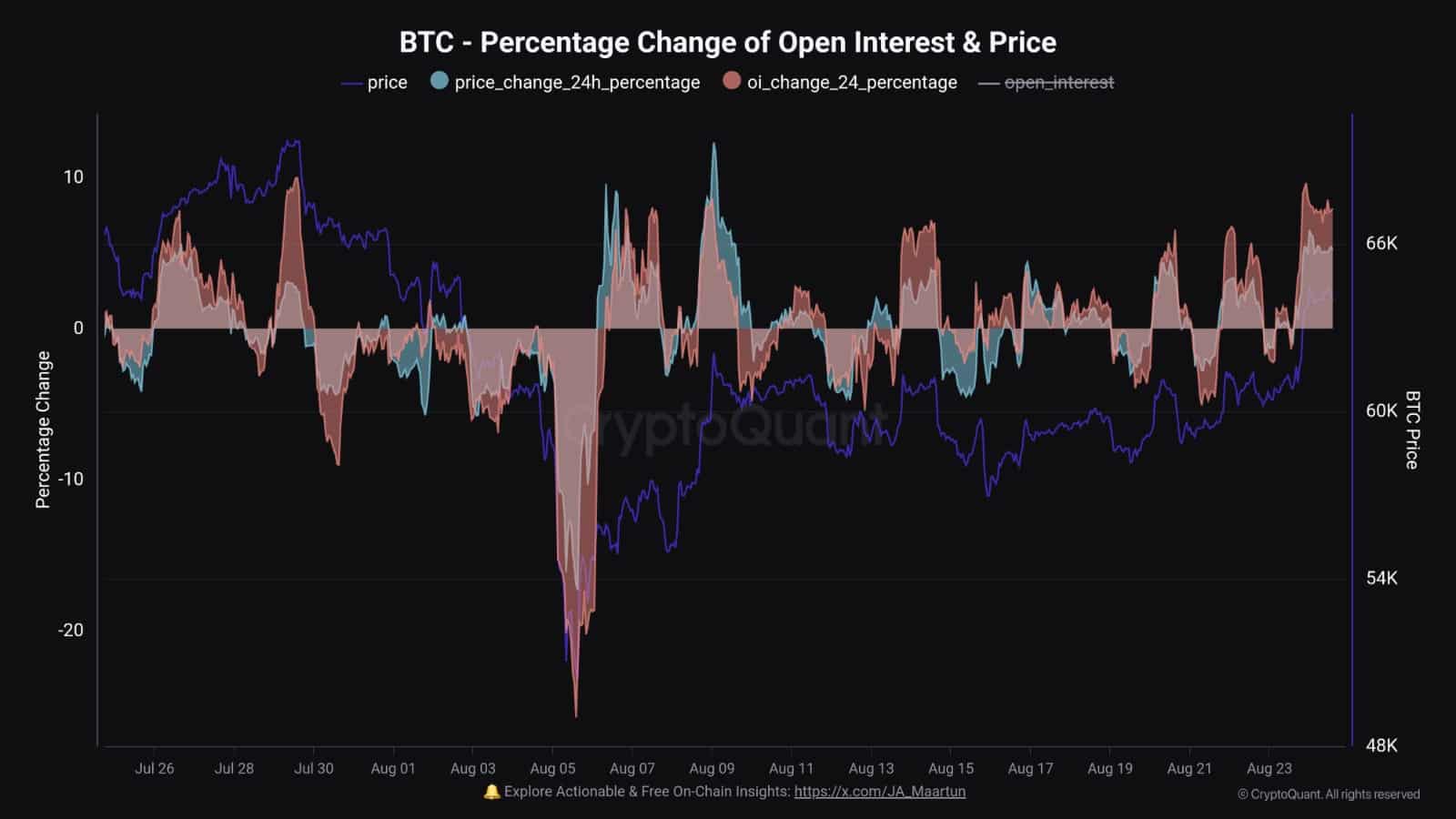

Bitcoin Open Interest rises

Lastly, Bitcoin’s open interest has surged, outpacing the recent price decline. This phenomenon, seen twice before, has historically led to quick price recoveries and new highs.

Read Bitcoin’s [BTC] Price Prediction 2024-25

With this increase in open interest, the expectation is that Bitcoin will continue its upward trend, driving the price higher as the year progresses.

Bitcoin is well-positioned for a strong performance, with multiple factors aligning to push BTC prices higher in the coming months.