23 days to a Bitcoin rally? BTC halving cycle has the answer!

- Bitcoin could start October on a bullish note, supported by a hidden pattern.

- The probability leans strongly in favor of this scenario.

Bitcoin [BTC] had a bullish weekend, briefly testing the $60K mark before pulling back. At press time, it traded at $58,272, reflecting a momentary retreat after the surge.

With prices retracing, hope hinges on the impending Fed rate cut—but it’s not the only factor. As BTC enters its 148th day post-halving, a hidden pattern suggests the breakout may be closer than expected.

History suggests rebound possibility

The chart highlights a recurring trend in the Bitcoin cycle emerging after each halving season. For context, Bitcoin halving is a deflationary model occurring every four years, reducing the Bitcoin supply by half.

From an economic standpoint, a reduced supply increases the value of each coin. Consequently, each cycle typically sees an upward trend begin after an average of 170 days.

For instance, following the halving on 11th May, four years ago, BTC first tested the $40K ceiling on the daily price chart approximately 170 days later. A more significant peak pushed BTC above $50K roughly 480 days after, around early August.

A similar pattern has been observed after each halving period. If this trend holds, BTC might reach $70K in the first week of October before facing resistance. Additionally, the upcoming FOMC meeting could further influence this hypothesis.

Although the historical trend looks promising, reality must be factored in—so, is a potential rebound just 23 days away?

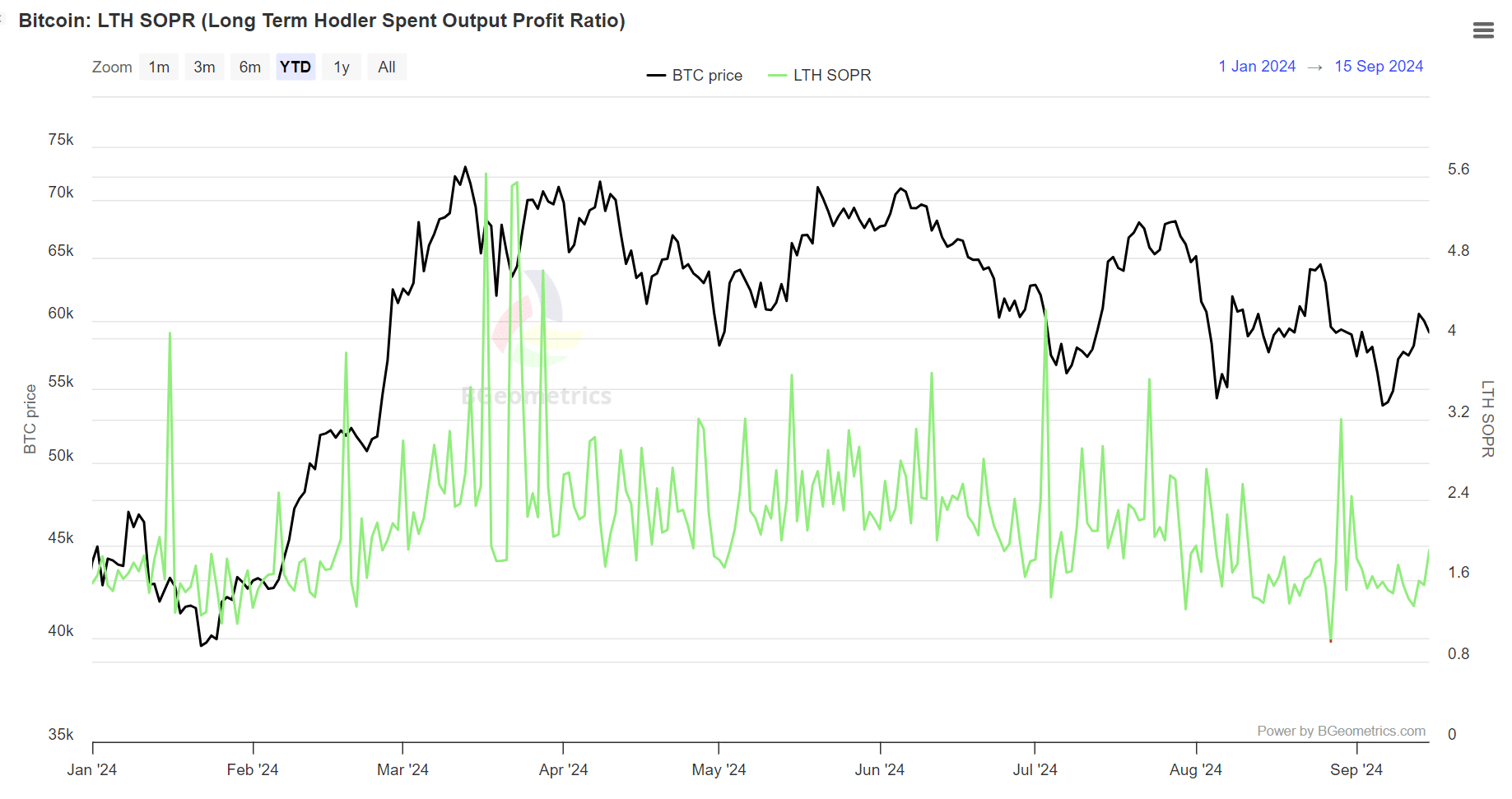

LTH reinforced their support for Bitcoin

Seasoned investors are confident in a potential price correction. Historically, a rising LTH SOPR supports each bull rally, indicating long-term holders are realizing profits.

While the uptick is a sign of optimism, if the price does not match the rise, it could undermine the expected correction. This may prompt long-term holders to sell at a profit rather than risk losses.

Put simply, long-term holders realizing profits signals strength in Bitcoin’s current market value. If this trend persists, a reversal could be imminent. However, a price retrace below $57K might signal concern.

The LTHs represent a significant portion of investors, but they alone do not fully capture market confidence in an October upward trend.

That said, analyzing futures traders can provide better insights.

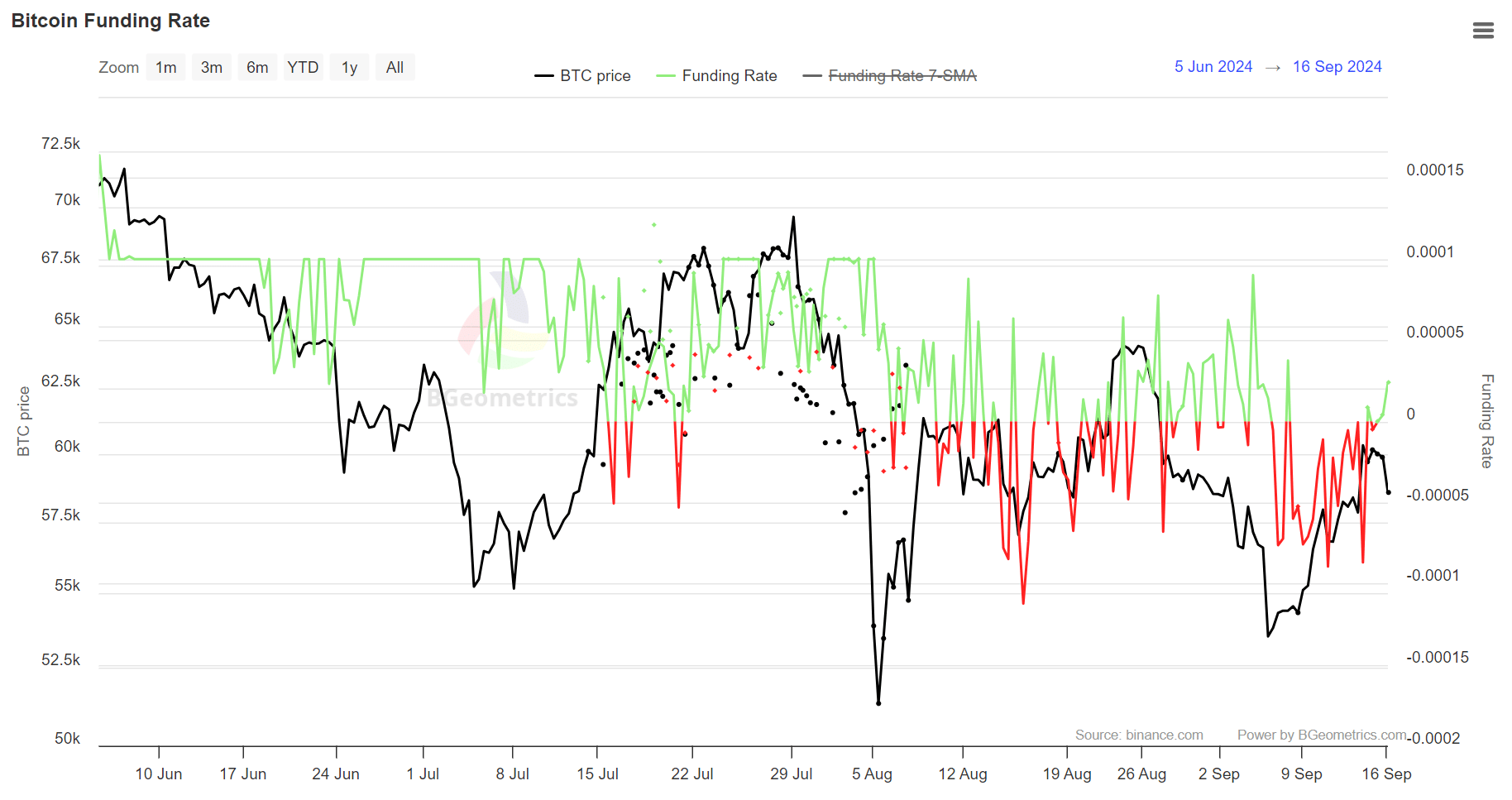

Renewed confidence among Bitcoin future traders

While shorts have dominated derivatives for a while, longs have recently increased their presence, as shown by the positive funding rate. Historically, a positive funding rate indicates confidence among futures traders, suggesting they expect BTC prices to rise.

Moreover, this aligns with AMBCrypto’s earlier projections, which noted that a positive sentiment often precedes BTC testing crucial price ranges.

Though appreciated, a more consistently positive funding rate could improve the chances of a Bitcoin rebound in the next two weeks.

Surprisingly, despite renewed dominance, BTC fell below $60K, suggesting potential third-party involvement.

While this indicates a slight divergence, other factors may neutralize its long-term impact. The question remains: Will the downtrend hold?

What now?

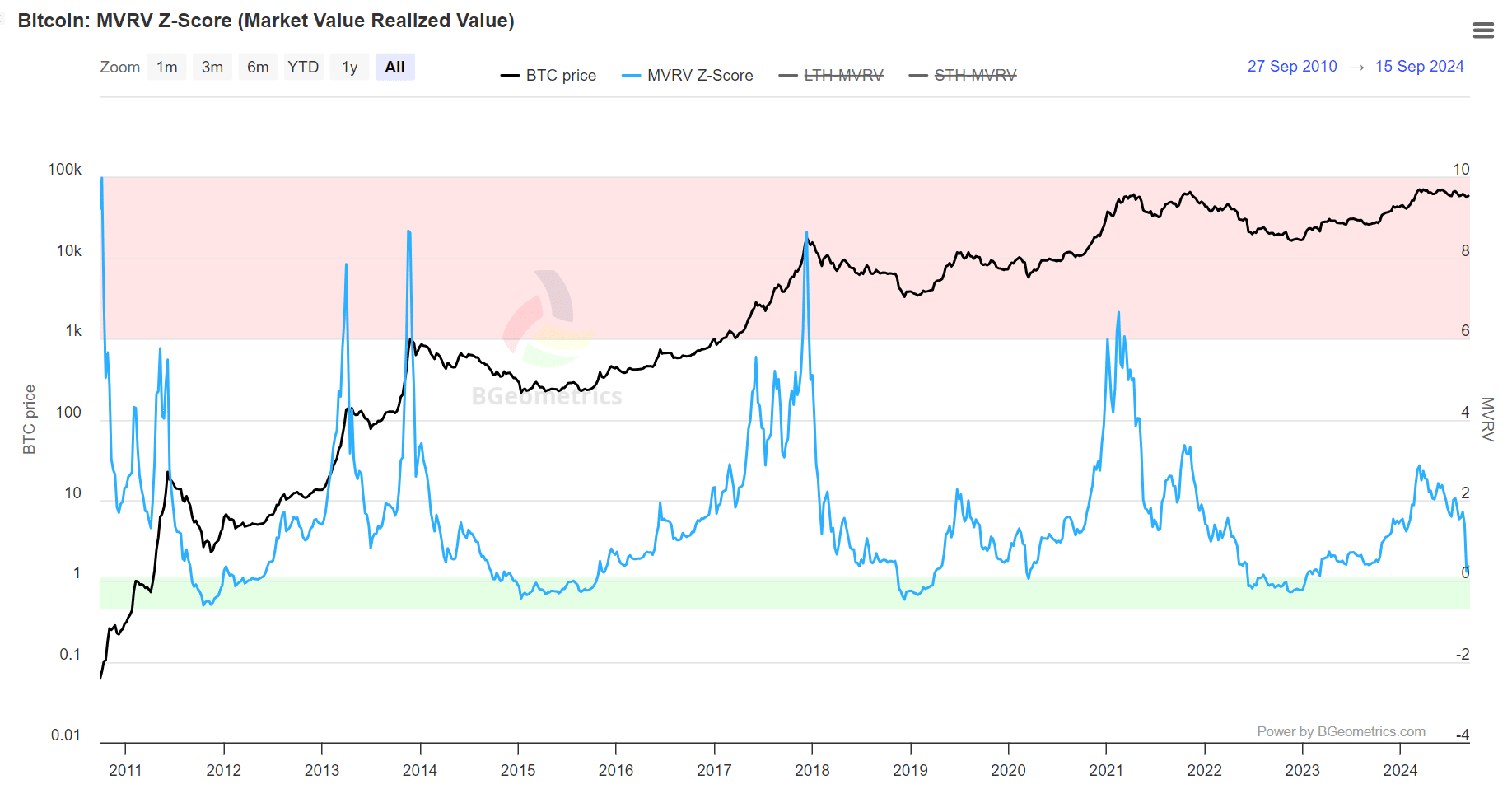

The chart below shows the MVRV-Z score approaching the green box, a zone that historically signals undervaluation. Buying Bitcoin during these periods has typically resulted in outsized returns, with BTC prices rallying afterward.

However, if the halving trend holds true, the current MVRV mirrors the mid-September value from four years ago—just before the Z-score entered the pink box, which signals the market cycle top. The above mentioned charts support this scenario.

Read Bitcoin (BTC) Price Prediction 2024-25

According to AMBCrypto, October could start with Bitcoin testing the market top around $70K, provided recent profit-takers refrain from selling, LTH continues to hold, and longs maintain dominance in the perpetual market.

If this plays out, the halving effect hypothesis would be confirmed as “true.”