‘3 in a row’ for Bitcoin fees, but what will dictate BTC’s short-term price action?

- Bitcoin fees hit a yearly low for the third consecutive week as market volume increased

- Repetition of 2019 divergence of BTC and SPX might spur bullish sentiments

Bitcoin [BTC] fees have hit a yearly low for the third week running, following the market’s recent stabilization, according to IntoTheBlock’s observation on X.

Following this fall in the cost of transacting Bitcoin, NPS, the third-largest public pension fund globally, invested $34 million in MicroStrategy’s stock for Bitcoin exposure.

The move highlights a growing trend among institutions to diversify into Bitcoin through companies with substantial Bitcoin holdings at this time of low fees. This is also a sign of the mainstream increasingly accepting this asset class as viable.

BTC and SPX 2019 divergence repeats itself

The divergence between Bitcoin and the SPX signaled a reversal, similar to 2019 when Bitcoin’s price surged after a rate cut by the Fed. This pattern is repeating in 2024 with the Fed expected to cut rates again.

Bitcoin’s recent decline and subsequent divergence from the SPX mirrors the 2019 trend, which led to a significant price hike. Despite skepticism, this scenario would follow a familiar cycle, reflecting a recurring market pattern.

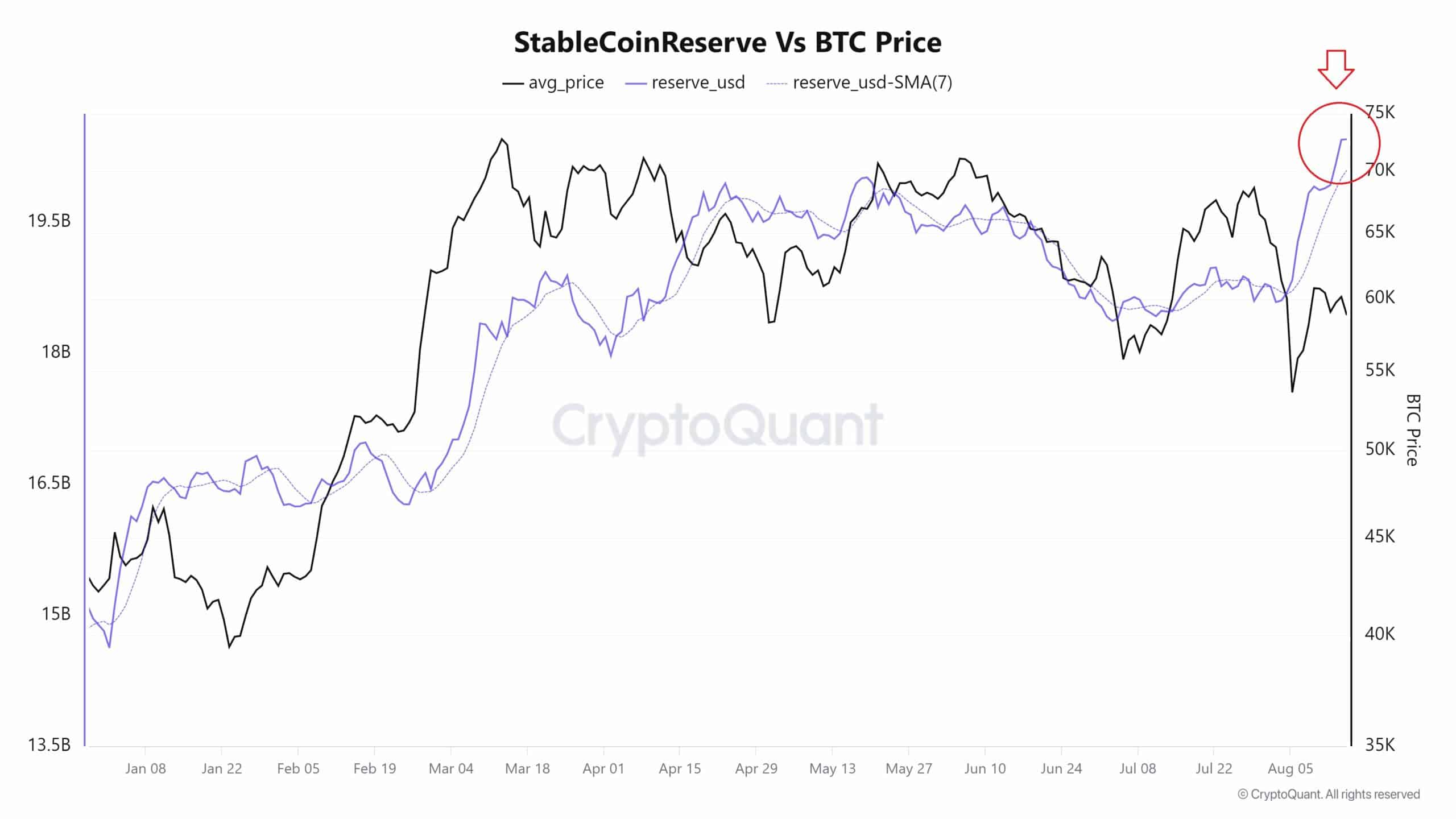

Stablecoins reserves’ influence on BTC price

Stablecoin reserves on exchanges are at record high right now, boosting Bitcoin’s buying power significantly.

This surge is driving major institutions to rapidly accumulate Bitcoin, as can be deduced from the broadening wedge pattern on the 4-hour BTC/USDT chart.

In the first quarter of 2024, 874 institutions held Bitcoin ETFs, with the same increasing to 1,008 by the second quarter.

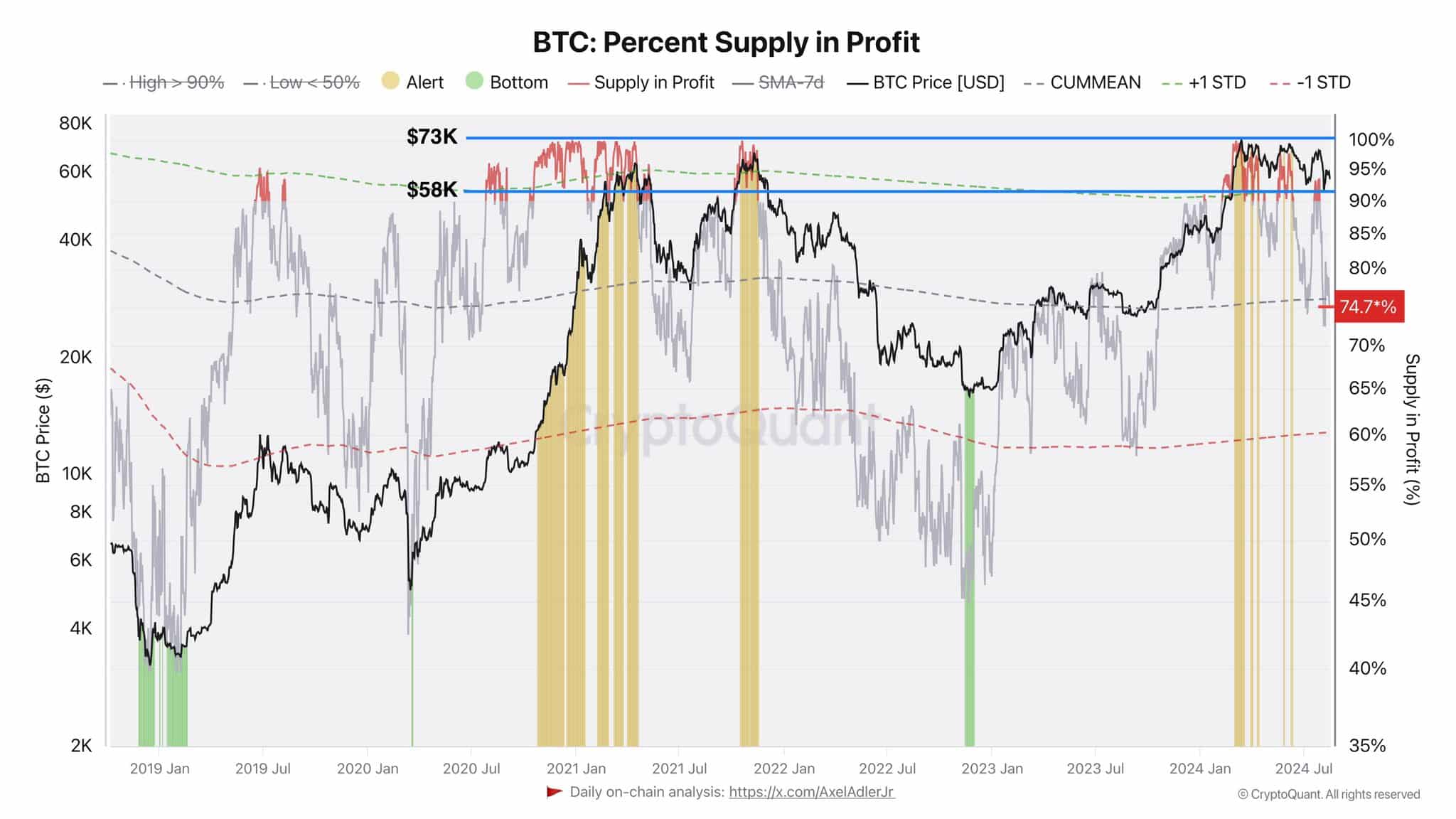

In fact, a quarter of Bitcoin’s total supply was bought at $58K-73K, equal to about $300 billion. Investors who bought in this range are likely holding for future gains, suggesting that they expect Bitcoin’s price to rise further.

Despite Bitcoin’s slow price action and low retail interest, institutional buying is accelerating though – Another sign of the crypto’s long-term growth.

Combined with recent developments in Bitcoin’s market, a positive long-term price trend can be traced.

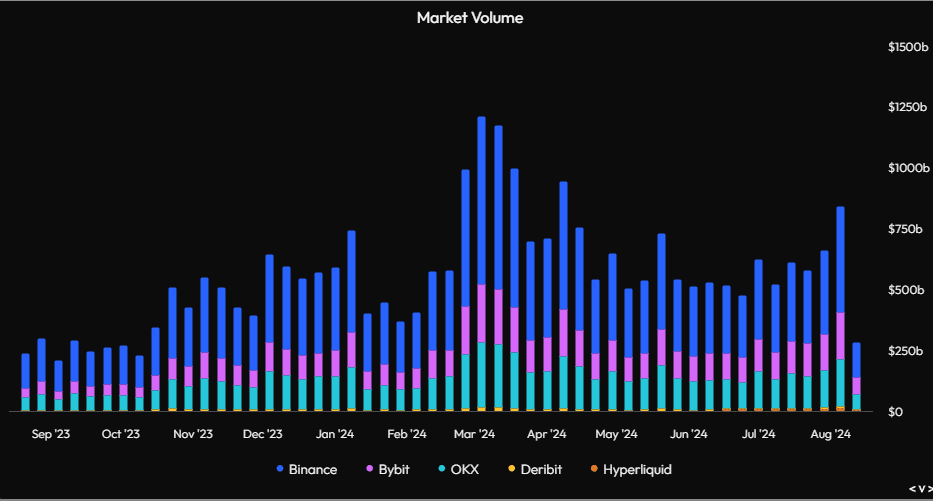

Market volume increases in the midst of low funding rates

Since peaking in March, market volumes have been declining for a prolonged consolidation phase too.

Just last week, despite global market turmoil from the Japanese stock market crash, the crypto markets saw a significant volume hike on the charts.

This has led to heightened volatility in Bitcoin and other cryptocurrencies.

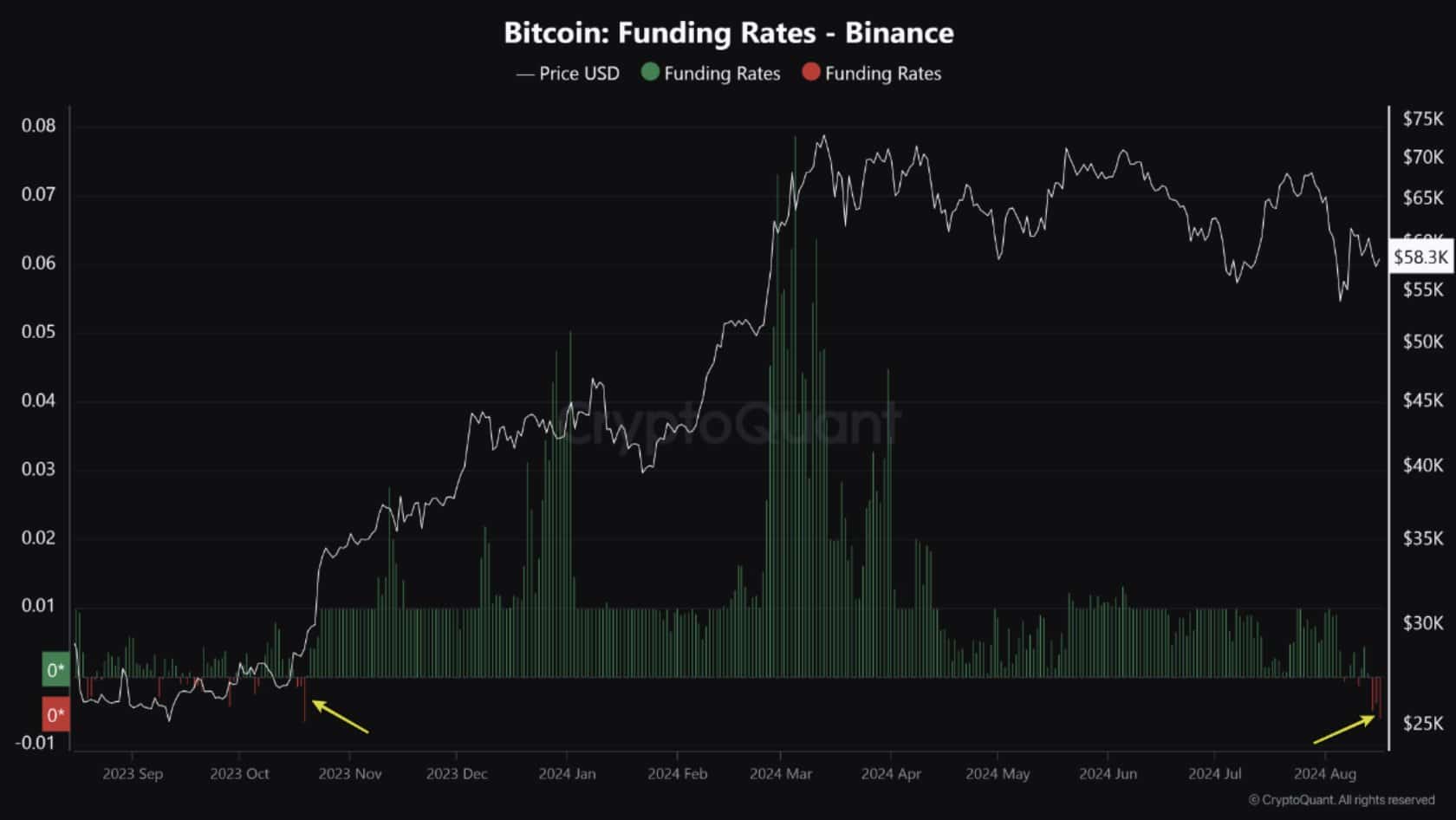

Finally, Bitcoin funding rates on Binance have hit their lowest point of the year too. The more shorts are loaded, the higher BTC will go.

With Binance holding the largest share of Open Interest, some short-term bearish sentiment may be evident too. However, this would present a potential buying opportunity for long-term investors and traders to accumulate more Bitcoin.