3 things you need to know about the Cardano vs Ethereum race

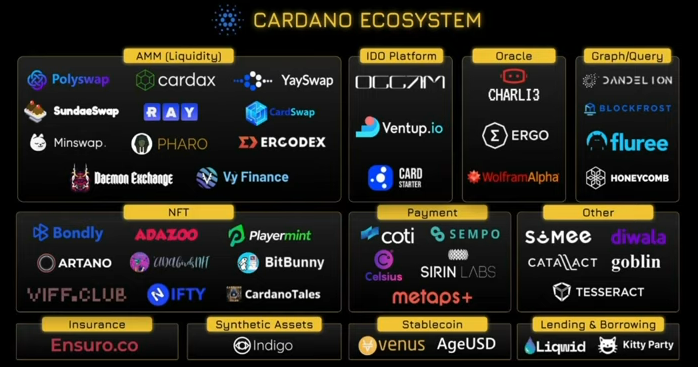

The fast-growing Cardano ecosystem is rewarding for users since it is possible to use rewards and incentives earned on Cardano to buy other assets within the ecosystem. From AMM, liquidity, IDO to lending and borrowing, there are several assets for traders to hold their assets in.

Source: Twitter

1.Hodler pattern

While most altcoins attempted to make a recovery, Cardano’s price was up over 15% since the past week and this is one of the fastest recoveries this week. The launch of its testnet had a further bullish impact on the altcoin’s price. The altcoin’s market capitalization was up to $71 Billion and the concentration of large HODLers was 24%.

Of this, 69% HODLers were profitable at the current price level. The network supported over $69.7 Billion worth of large transactions over the past week and the inflow of investment was up 3%. These signs support the bullish narrative.

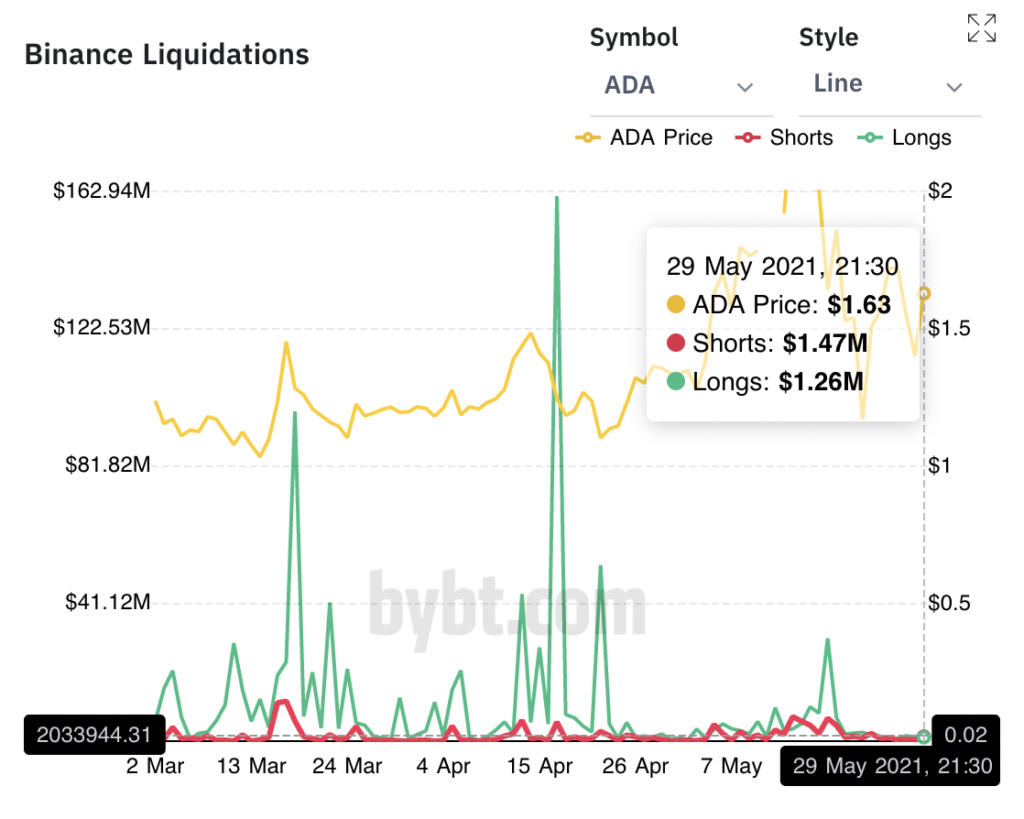

Source: Bybt

2. Liquidations

Based on the above chart, since the beginning of May 2021, there were shorter peaks of liquidation, unlike earlier in 2021. On May 29, 2021, more longs were liquidated than shorts. With the recovering open interest, it is likely that Cardano’s rally will continue for long. In the case of Ethereum, the current narrative is the bullish one, with the price up 10% in the past week.

3. On-Chain sentiment

When ETH exchange volume exceeded BTC several times this week, the narrative shifted to long-term bullish. However, unlike ETH L2 scaling solutions, Cardano is competing with Ethereum, with increasing demand and bullish on-chain sentiment. Cardano has emerged as competition for Ethereum with its collection of projects and assets for traders to invest in and though ETH exchange volume has exceeded.

The current altcoin season is led by rallies of altcoins, however as ETH and BTC are recovering, in terms of volatility and price, projects like Cardano and Polkadot are more likely to outperform ETH. Cardano is racing to the top, unlike most of the other altcoins, and against Ethereum. Back in 2o18, during the previous bull run, it would have been a challenge to see Cardano and its ecosystem as competition against Ethereum, however, in the current bull run Cardano has an ROI of 30% in 90 days.