Ethereum

300K Ethereum withdrawn in a week – What it means for ETH prices

Ethereum’s exchange reserves have seen a sharp decline, hinting at growing investor confidence in holding ETH long-term.

- Over 300,000 ETH were withdrawn from exchanges in the past week alone.

- The ETH price has continued its slight uptrend.

Ethereum’s [ETH] recent price movement around the $2,500 mark comes as exchange reserves significantly drop. The drop highlights potential changes in investor sentiment.

A decline in reserves often signals that investors are moving their holdings off exchanges. The move typically indicates a long-term holding strategy rather than an intent to sell. This shift could be essential in stabilizing ETH’s price and shaping its future performance.

Over $4 billion in Ethereum withdrawn from exchanges

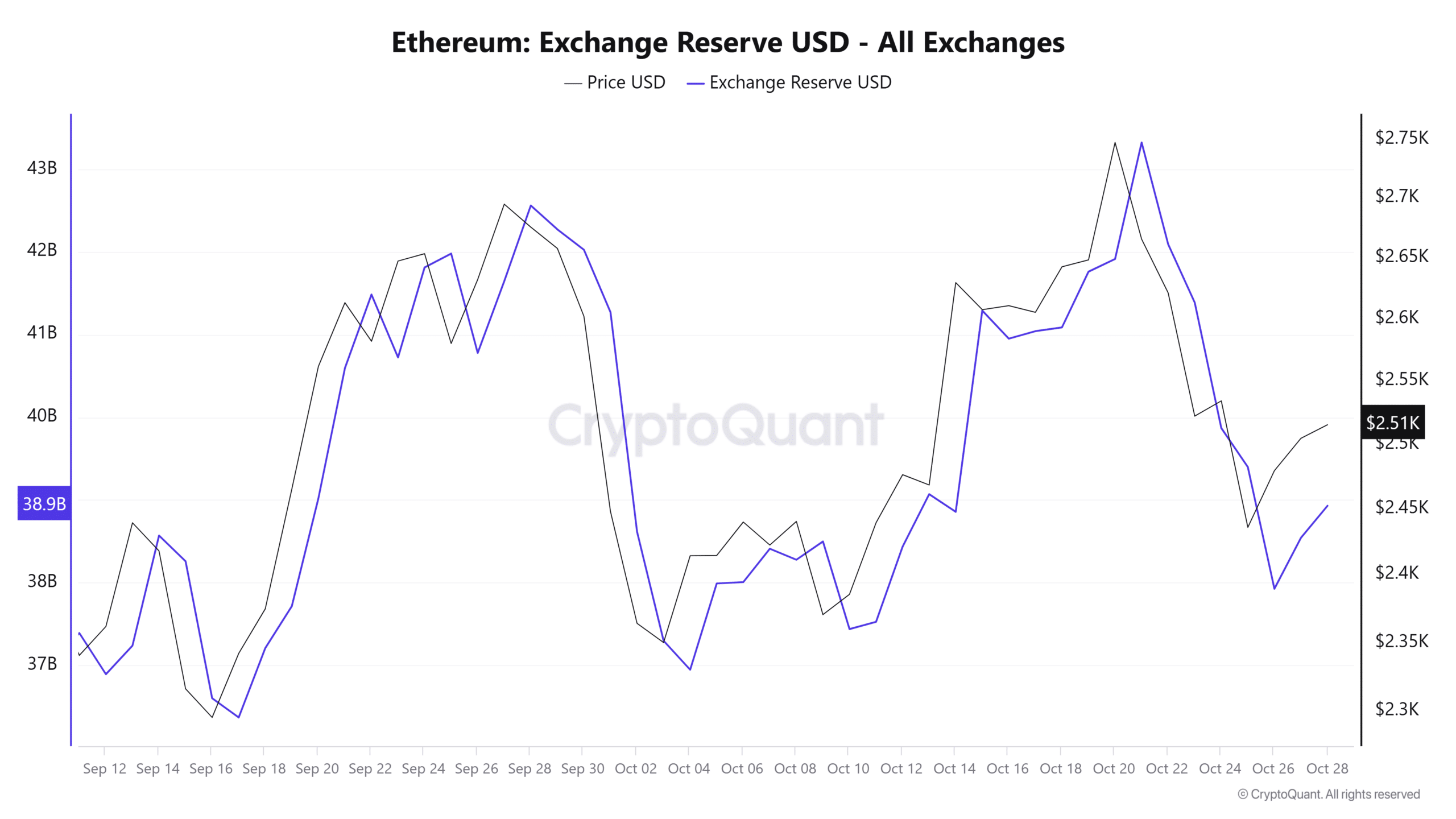

According to CryptoQuant data, Ethereum’s exchange reserves have fallen sharply. Data showed a drop from over $42 billion to approximately $38.9 billion within a few weeks. This represents more than $4 billion worth of ETH being moved off exchanges.

The move hints at many investors shifting their strategy toward holding rather than trading in the near term. This trend emerges at a time when Ethereum’s price fluctuates between $2,400 and $2,700.

Ethereum withdrawal coincides with price consolidation

This trend of withdrawals aligns with Ethereum’s recent struggle to surpass resistance levels at around $2,600. By moving holdings off exchanges, investors could be signaling confidence in its long-term value.

This behavior may reduce selling pressure, particularly if exchange reserves continue to decline in the coming days, allowing its price to consolidate and stabilize. The price could stabilize with fewer tokens available for immediate trade, especially if demand holds steady.

How declining Ethereum reserves could impact price stability

Reduced exchange reserves often result in lower available liquidity. This can contribute to price stability or upward movement if demand remains consistent. When fewer tokens are readily available on exchanges, any surge in buying interest can drive more significant price effects.

As Ethereum aims to regain traction after recent dips, these exchange outflows suggest a shift in sentiment. It shows that holders are more inclined to hold, reducing the risk of large-scale sell-offs.

However, a stable demand level will be crucial. If demand weakens, ETH may continue to struggle with resistance levels, potentially leading to a more prolonged consolidation period.

Short-term outlook for Ethereum

The current decline in exchange reserves suggests a period of price consolidation, with the possibility of upward momentum. Holding the $2,500 support level and a steady decline in reserves could help set a foundation for sustainable recovery.

Read Ethereum (ETH) Price Prediction 2024-25

Should market conditions favor increased demand, Ethereum could see strengthened buying interest, making further price gains possible.

Nonetheless, if market conditions shift and demand decreases, ETH may still face pressure at resistance levels. The latest data indicates cautious optimism, with long-term holders showing resilience through the ongoing market fluctuations.