318M USDT flow into Ethereum: Good news for ETH’s price?

- Massive amounts of USDT flowed from Tether to Ethereum exchanges.

- Activity on the network remained stable as the price of ETH declined.

Ethereum [ETH] has witnessed massive price volatility over the last few days. However, Tether’s [USDT] recent behavior could help improve sentiment around ETH.

USDT gets into the mix

According to Lookonchain’s data, over the past 18 hours, a significant amount of USDT, specifically 318 million dollars worth, has moved from Tether’s treasury wallet to exchanges on the Ethereum network.

This outflow has significantly reduced Tether’s holdings on Ethereum. Their treasury held only 124 million USDT at press time.

To meet potential demand, it’s expected that Tether will soon mint another 1 billion USDT on Ethereum.

Tether has a history of minting large amounts of USDT, often corresponding with periods of increased cryptocurrency activity. This doesn’t necessarily guarantee a surge in Ethereum usage.

While Ethereum is the dominant platform for USDT, other blockchains like Tron could also be used for the same purposes.

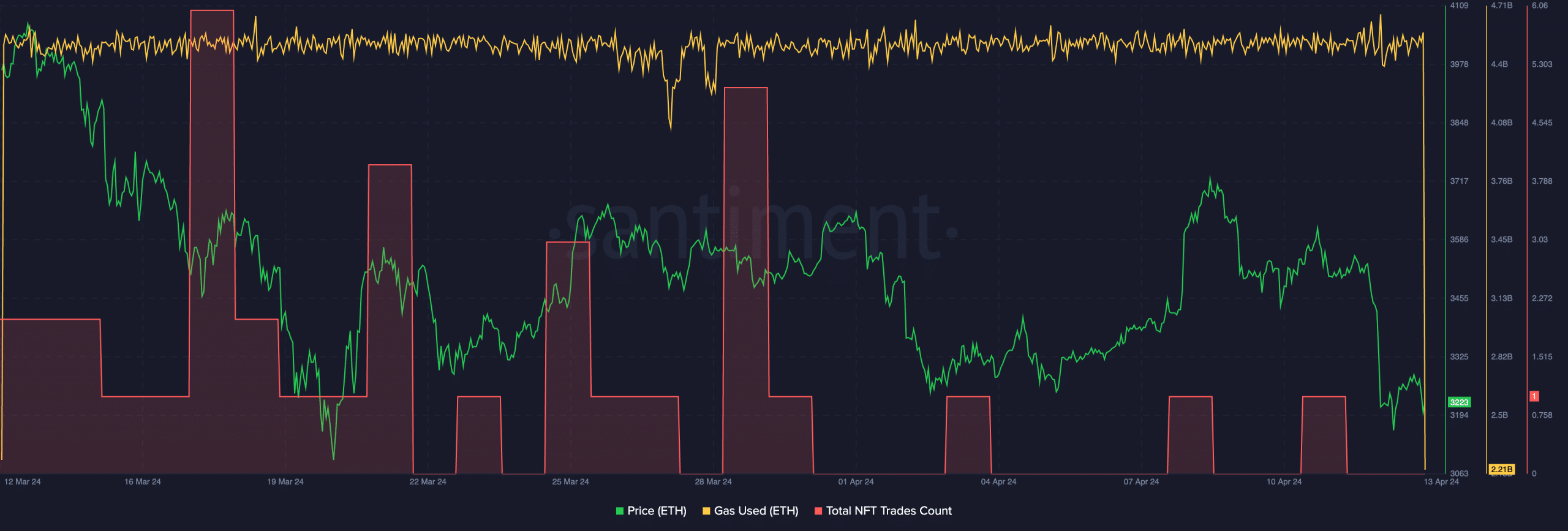

At press time, the gas usage on the Ethereum network had remained the same over the last few days. However, the NFT trades occurring on the network had declined significantly.

This suggests other types of activity are picking up the slack. DeFi transactions, stablecoin swaps, or general token activity could be contributing to the steady gas usage.

On the NFT side, a market correction or declining public interest may be playing a role.

How are holders doing?

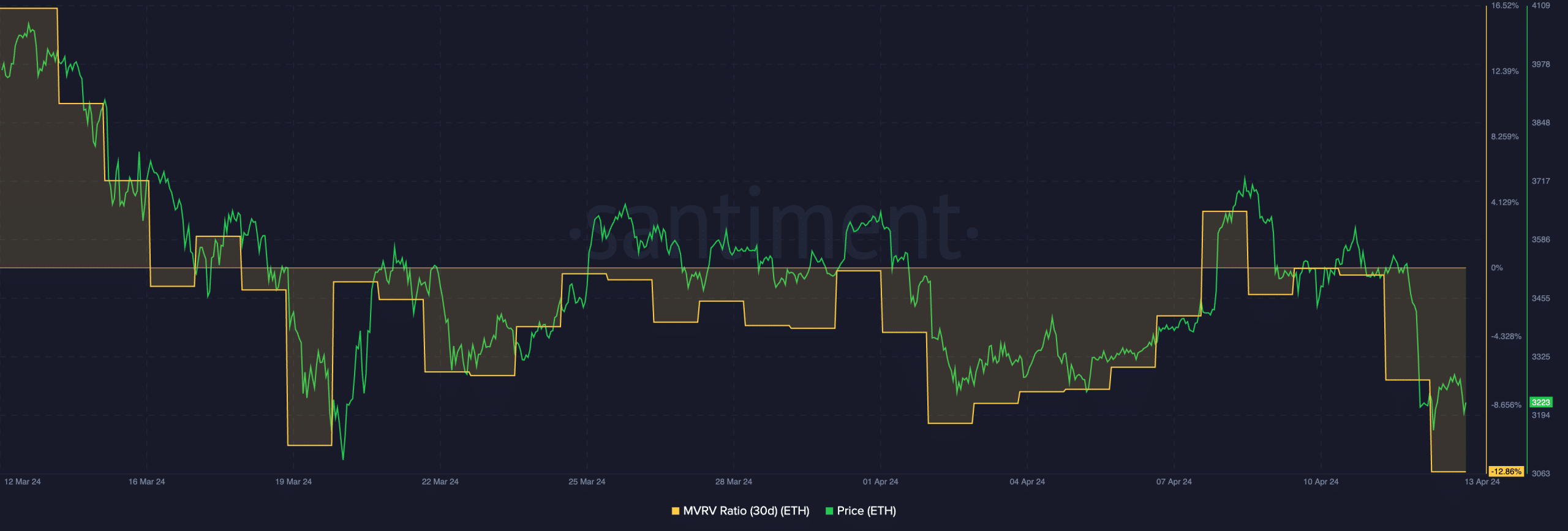

Even though activity on Ethereum was consistent, the price movement of ETH wasn’t showing signs of green. At press time, ETH was trading at $3,000.70 and its price had declined by 2.74% in the last 24 hours.

If the price continues to decline further, it may cross the $3,000 level for good, which could further cause panic in the markets.

Read Ethereum’s [ETH] Price Prediction 2024-25

Due to this massive decline in the price of ETH over the last few days, the MVRV ratio for ETH fell considerably. This indicated that the most holders not profitable at the time of writing.

However, the volume at which ETH was trading at had grown by 11.79% as well during this period.