5 key metrics hint at Ethereum’s next big bull run – Here’s what to watch

- Ethereum whales are accumulating while reduced selling pressure hints at a potential supply squeeze.

- Growing daily transactions and short-term holder interest suggest ETH’s next bullish phase is near.

Ethereum [ETH] is positioned as the next crypto to attract substantial capital inflows, according to analysis from blockchain intelligence platform IntoTheBlock.

While Bitcoin [BTC] recently reached a record-breaking all-time high of $99,261.30, Ethereum’s price sits at $3,365.66, with a 24-hour trading volume of over $55 billion.

Despite underperforming Bitcoin’s recent gains, Ethereum may be poised for a bullish breakout, with key metrics offering insights into its next trajectory.

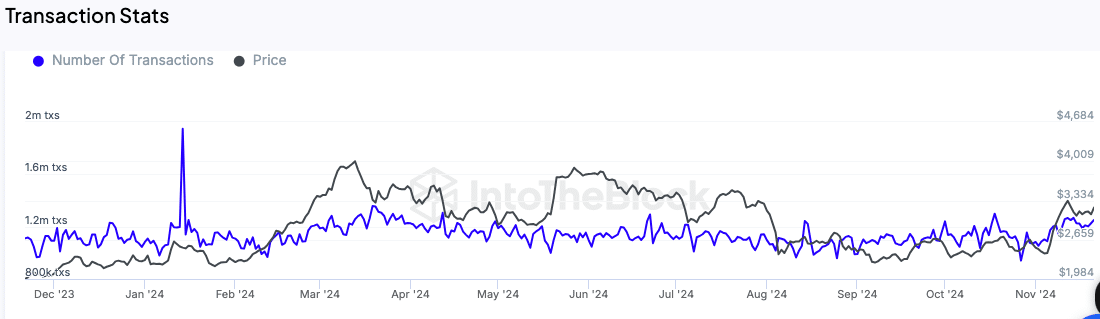

Daily transactions showing steady growth

The number of transactions on the Ethereum network has increased notably in recent months. IntoTheBlock’s data reveals that daily transactions have grown from 1.1 million to 1.22 million in the last three months.

This steady rise indicates increased usage of the Ethereum network, which could be a precursor to greater price activity.

An uptick in daily transaction volume is often seen as an early signal of heightened interest among users and investors, which could fuel further momentum in Ethereum’s price.

Large holders display confidence

Whale activity is another crucial indicator being monitored. According to IntoTheBlock, holders of at least 0.1% of Ethereum’s circulating supply are showing a positive net flow, signaling their confidence in the asset.

This pattern suggests accumulation by larger investors, which has historically aligned with upward price movements.

The reduced selling pressure from these large holders indicates that they may be anticipating further gains. Such behavior typically signifies optimism among institutional and high-net-worth investors, who often drive substantial market trends.

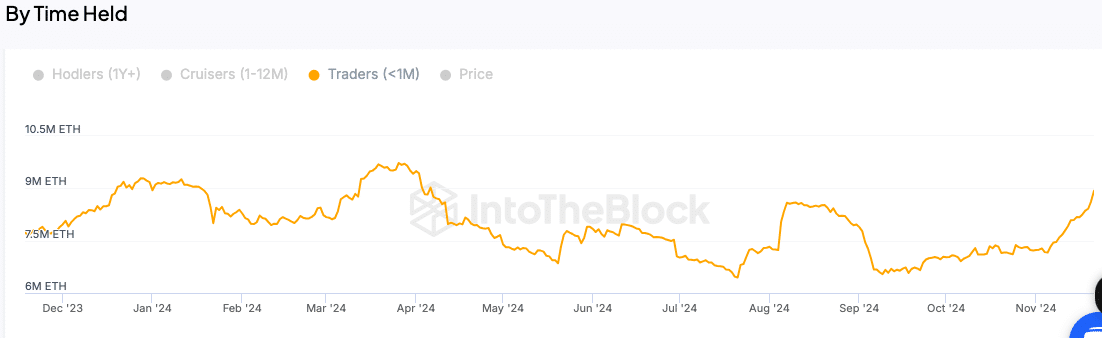

Increasing interest among short-term holders

Short-term Ethereum holders—those who have held the asset for less than a month—are also being closely watched. An increase in the number of these holders suggests renewed interest from retail investors.

This metric is particularly important because short-term holders often react to market trends and play a pivotal role in driving trading volumes.

A rise in their activity could contribute to a bullish phase for Ethereum, especially if paired with the ongoing confidence shown by larger holders.

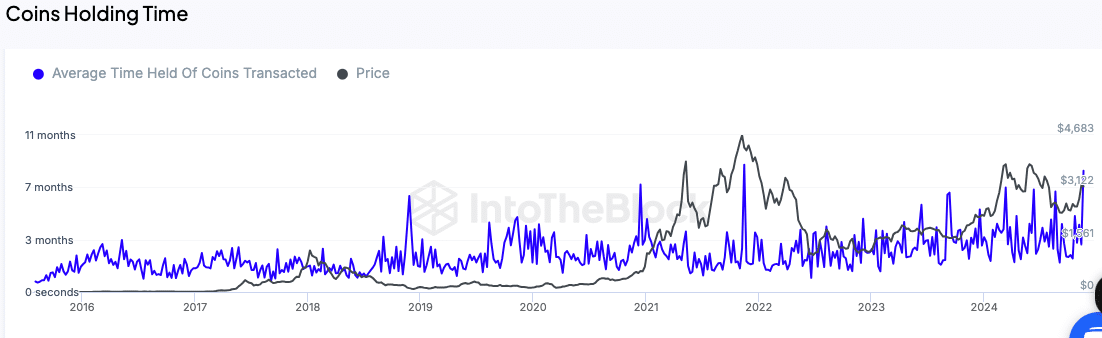

Longer holding times indicate reduced selling pressure

Another key metric is the average holding time of transacted coins. According to the analysis, the holding time has increased to 11 months, reflecting reduced selling activity among Ethereum users.

This trend points to a supply squeeze, as fewer tokens are being circulated in the market.

A reduced willingness to sell often supports price stability and can create conditions for an upward price trajectory. Combined with the growing network activity, this is a factor that investors are monitoring closely.

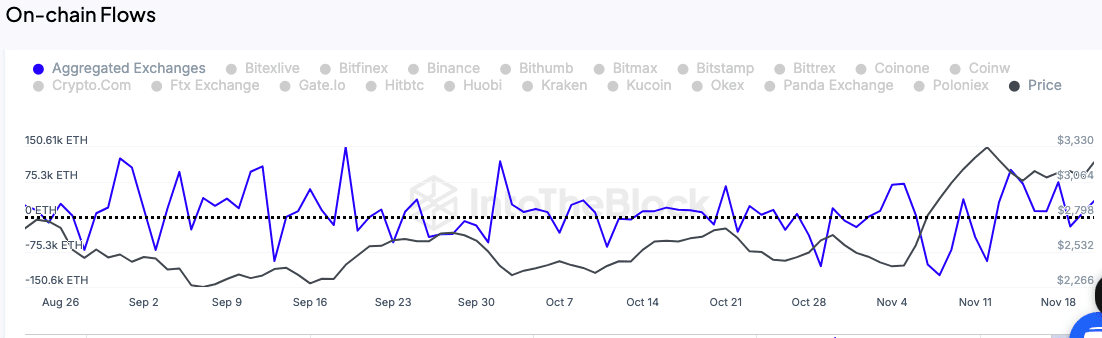

Exchange flows reflect accumulation trends

The movement of Ethereum tokens to and from exchanges is also being tracked as a potential signal of upcoming price action.

A decrease in exchange inflows typically indicates accumulation, as investors move their holdings to private wallets rather than keeping them on exchanges for potential selling.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Ethereum’s exchange inflows remain low, signaling that holders are opting to hold rather than sell.

Meanwhile, this accumulation behavior aligns with expectations of a price increase in the near term, as demand may outpace supply.

![Bonk Coin [BONK]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-400x240.webp)