50% of Cardano, 28% of SHIB holders at a loss: Time to hold or fold?

- The holders at a loss could dampen bullish fervor, especially for Cardano.

- If the assets breach the key resistances highlighted, the going might get easier.

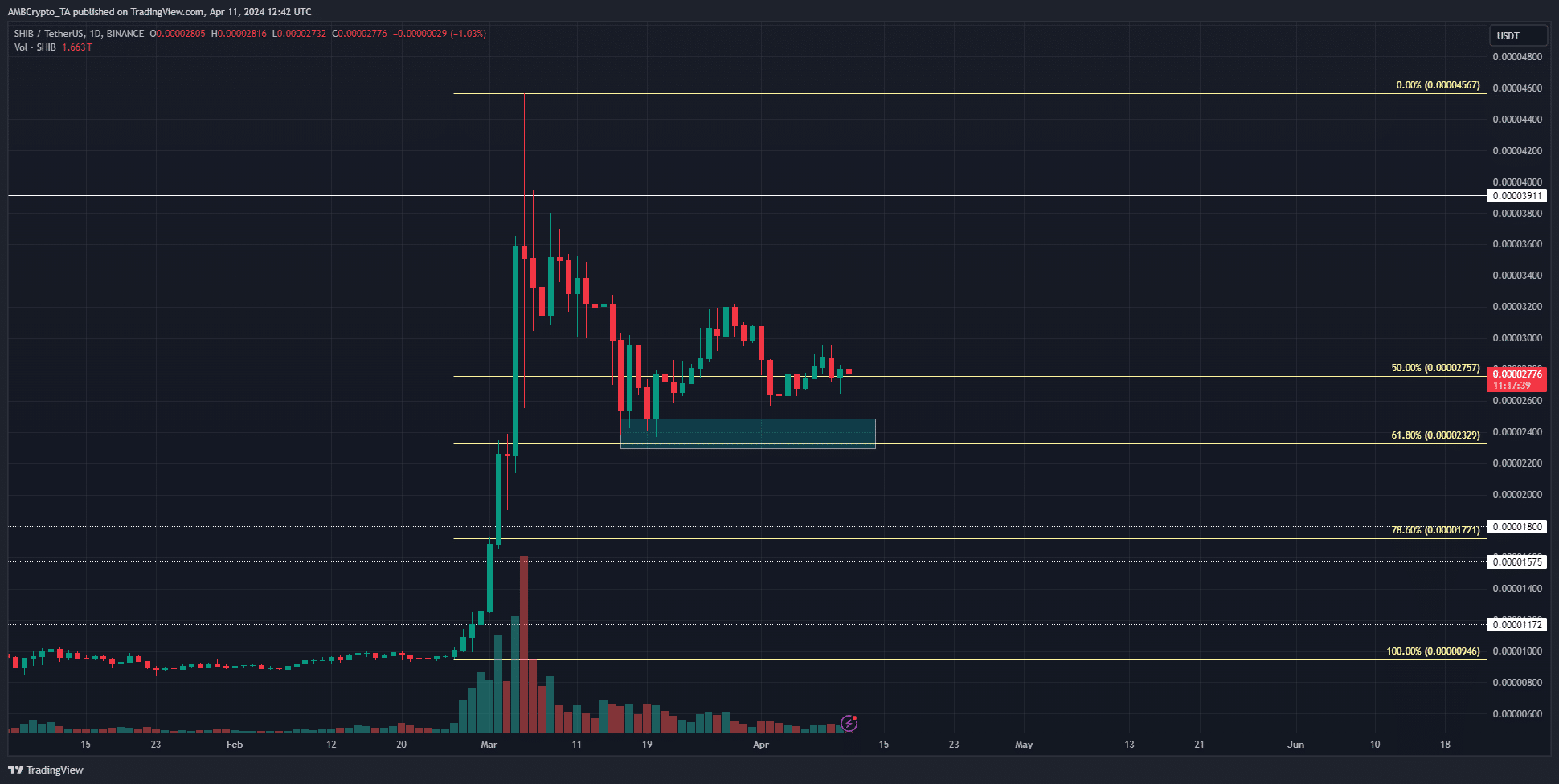

Cardano [ADA] and Shiba Inu [SHIB] saw muted price action in recent weeks and short-term bearish pressure. ADA was hanging on to the $0.568 support but its position looked precarious. Shiba Inu also appeared set on a course toward a demand zone 13% south.

A post on X from a crypto analyst noted that Cardano and Shiba Inu, among other altcoins, had a large percentage of holders out-of-the-money. What are the implications of this news?

Cardano and Shiba Inu bulls have an uphill battle ahead

Out-of-the-money has a different meaning in the options market. When referring to crypto holders, it simply means that they are at a loss. At current market prices, 50% of ADA holders were at a loss, and 28% of Shiba Inu holders were in the red, according to IntoTheBlock data.

Simply put, if the average cost of the investor’s assets is more than the current market price, the investor is at a loss.

This represented a sizeable chunk of the total share of holders. It implied that a rise in prices would likely see a great amount of selling pressure in the form of profit-taking.

Therefore, among the two coins, ADA would face greater selling pressure since a greater portion of its holders would face losses if they sold right now. Technical analysis of the two tokens could give a better idea of where this selling pressure would be high.

Cardano and Shiba Inu were in undergoing retracements

The price action of ADA in March saw the asset set a new swing high at $0.81 before receding to the $0.568 support level. The trading volume has also dropped off in the past week. This was a strong sign of consolidation.

At press time, the rally was not yet in the discussion. Instead, given the repeated retests of the support level, another dip toward the 78.6% retracement level at $0.525 appeared likely.

Above the $0.8 level, the selling pressure might begin to rise enormously again. The higher timeframe charts showed that the $0.8-$0.84 and the $1-$1.05 region were two stiff resistances that could halt bullish progress.

Shiba Inu also showed similar signs of consolidation as Cardano. The trading volume has reduced dramatically and the bulls were unable to push above the $0.000032 level, which had acted as support during the first half of March.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

The 1-week timeframe chart showed that the $0.000031-$0.000032 area, as well as the $0.000039-$0.00004 area were the two bearish zones to watch out for.

The selling pressure could get even more intense if underwater holders seek to get out at break-even or a minor profit.