$50K if Harris wins, $90K for Trump – Analysts predict post-election Bitcoin moves

- Bernstein projected a BTC target of $50K for a Harris win and $90K if Trump wins.

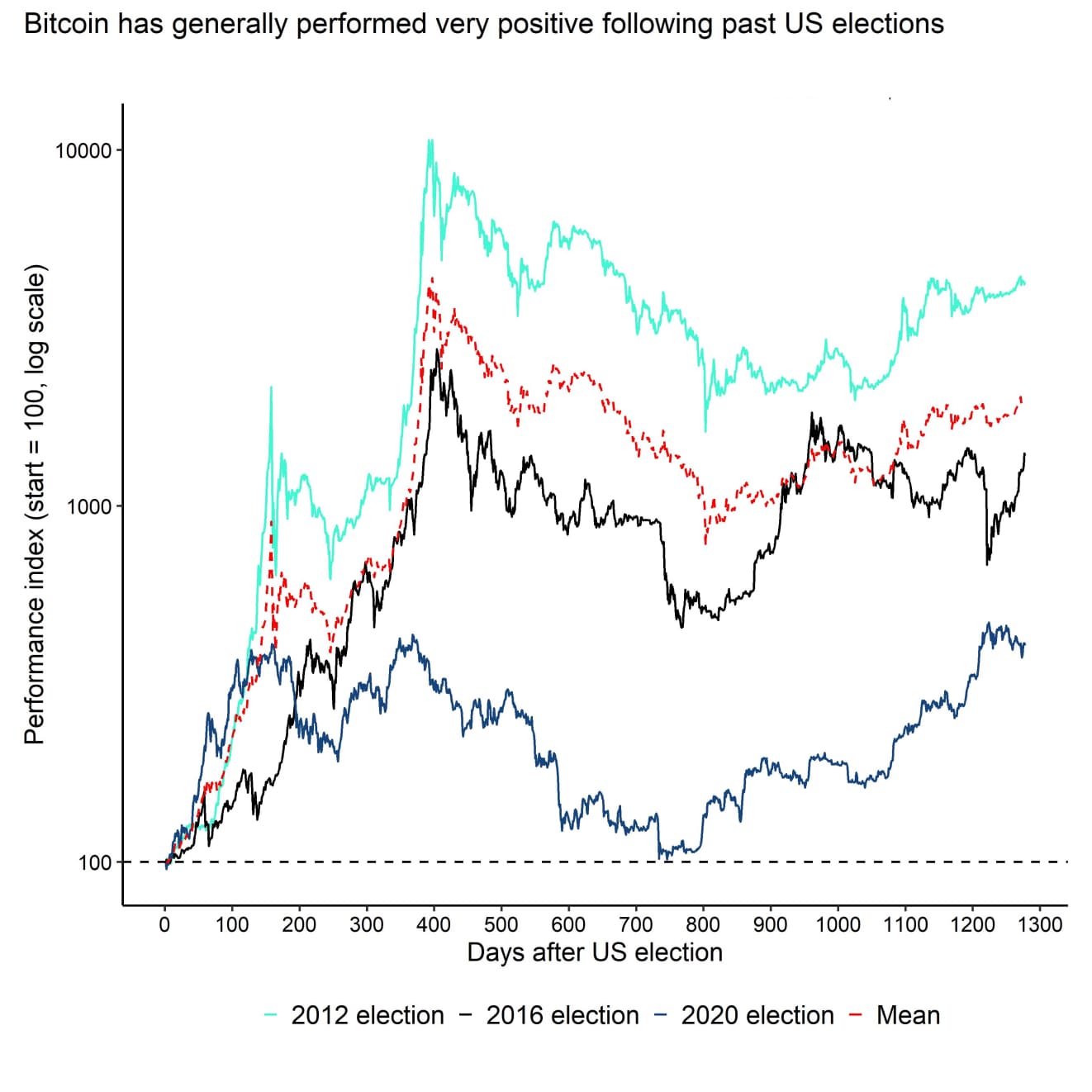

- Beyond short-term noise, BTC has always seen positive growth in past elections.

Bitcoin could see ‘$90K or $50K’ based on U.S. election outcome, analysis says…

The D-Day for U.S. elections is here, and the short-term impact of the outcome on Bitcoin [BTC] could be big.

According to the latest Bernstein outlook, a Harris win could drag BTC to $50K, while Trump’s victory could rally it to a range between $80K-$90K.

The research and brokerage firm cited Harris’s relatively hawkish stance as the reason for BTC’s $50K target.

But if Trump emerges as the winner, the analysts projected that BTC could hit a new ATH, citing the former president’s pro-crypto stance.

BTC’s election price targets

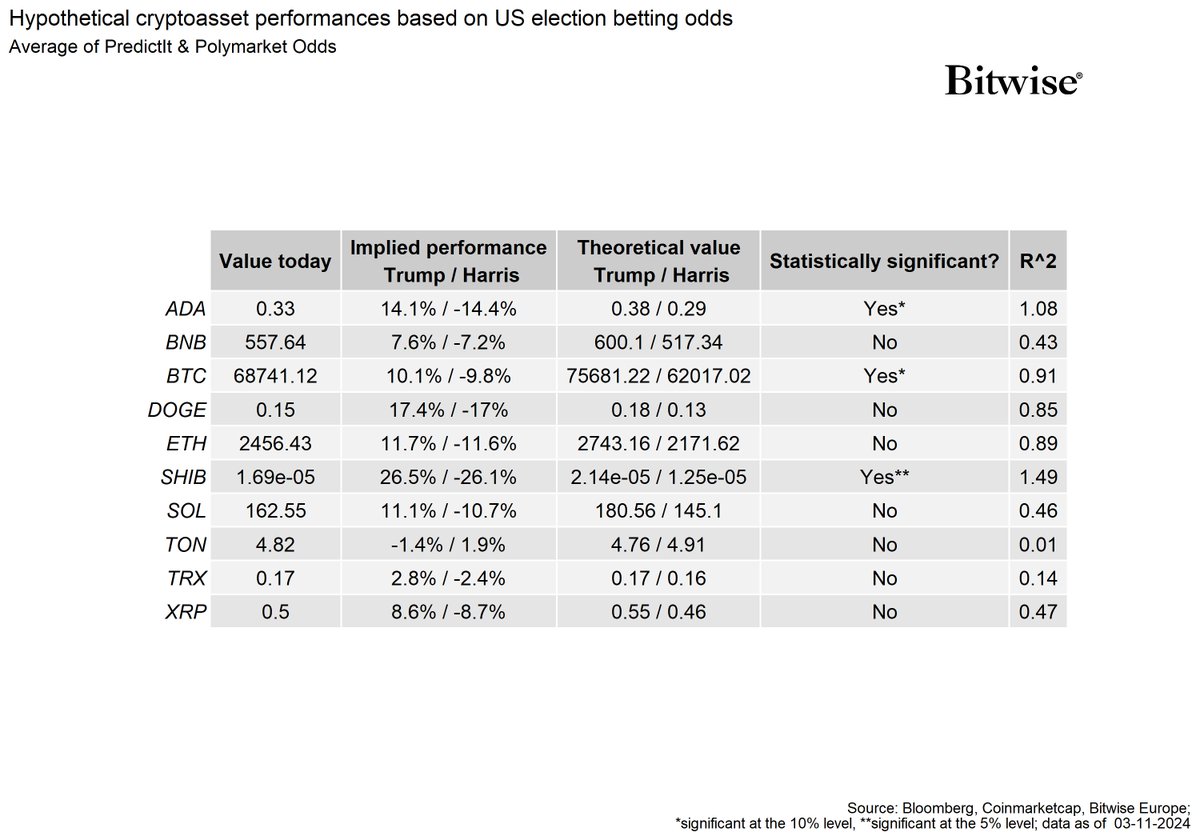

Amberdata, a blockchain insights firm, and asset manager Bitwise, echoed the same projection, although with slightly different targets.

According to Amberdata analysts, there could be a $6K-$8K price swing depending on who wins the U.S. elections.

Part of its report read,

“Therefore, major price levels are $60k (A Kamala win dip) or a $75k/$77k a Trump win that brings spot right back to the ATHs then THROUGH them, as election enthusiasm breaks the high seen last week.”

This was consistent with recent action by hedge funds for potential bullish outcomes while covering for likely wild BTC price swings.

Based on BTC’s sensitivity to Trump’s odds on Polymarket, Bitwise analysts found BTC could surge 10% if Trump wins. Conversely, BTC could drop by nearly 10% if Harris wins.

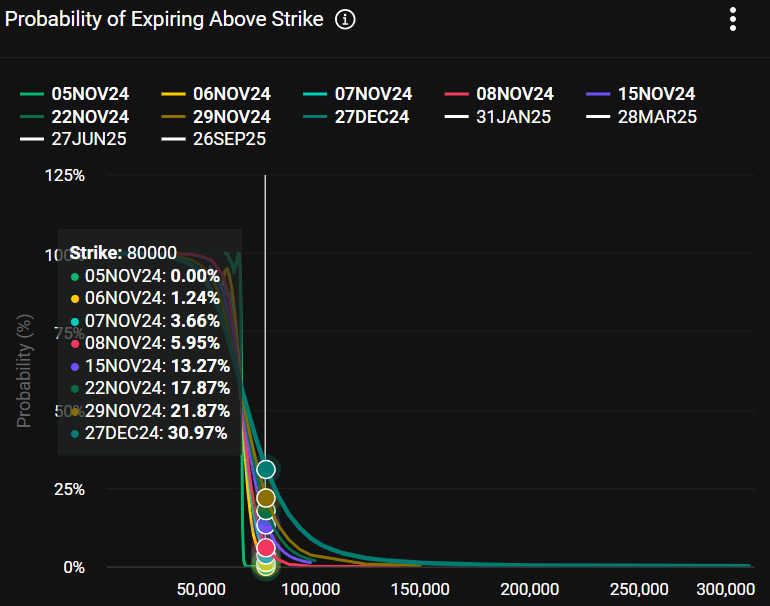

That said, at press time, Deribit data showed options traders were pricing a 21% chance of BTC hitting $80K by the end of November.

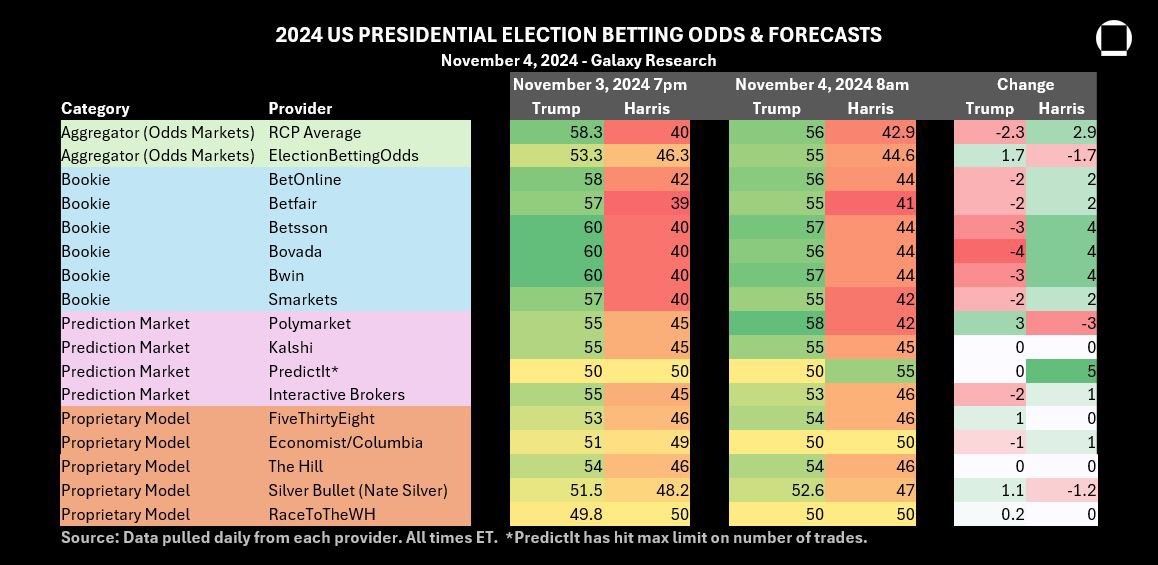

That wasn’t far-fetched given that as of the 4th of November, Trump was still leading amongst most election models and prediction sites per the latest data from Galaxy Digital.

When zooming out from the short-term U.S. election noise, BTC’s long-term impact has always been positive in the past three election cycles, with Bernstein projecting $200K by 2025.

Sharing her thoughts on the same, Maria Carola, CEO of crypto exchange StealthEX, told AMBCrypto that a likely positive scenario could play out after the elections. She said,

“The statistics show an interesting pattern – after each election, there was impressive growth. After the 2016 elections, the price soared to $1,110, and in 2020, Bitcoin set a historical record, exceeding $40,000.”

However, she cautioned that the short-term volatility could spike if the results are contested.

“BTC is unlikely to see a rise in volatility ahead of the election, but volatility could increase after the U.S. presidential election, especially if the results are controversial.”