Bitcoin

55K Bitcoin worth $5.34B pulled from exchanges in 72 hours – Why?

Bitcoin’s $5.34 billion withdrawal and “extreme greed” sentiment fuel speculation on a potential rally or correction.

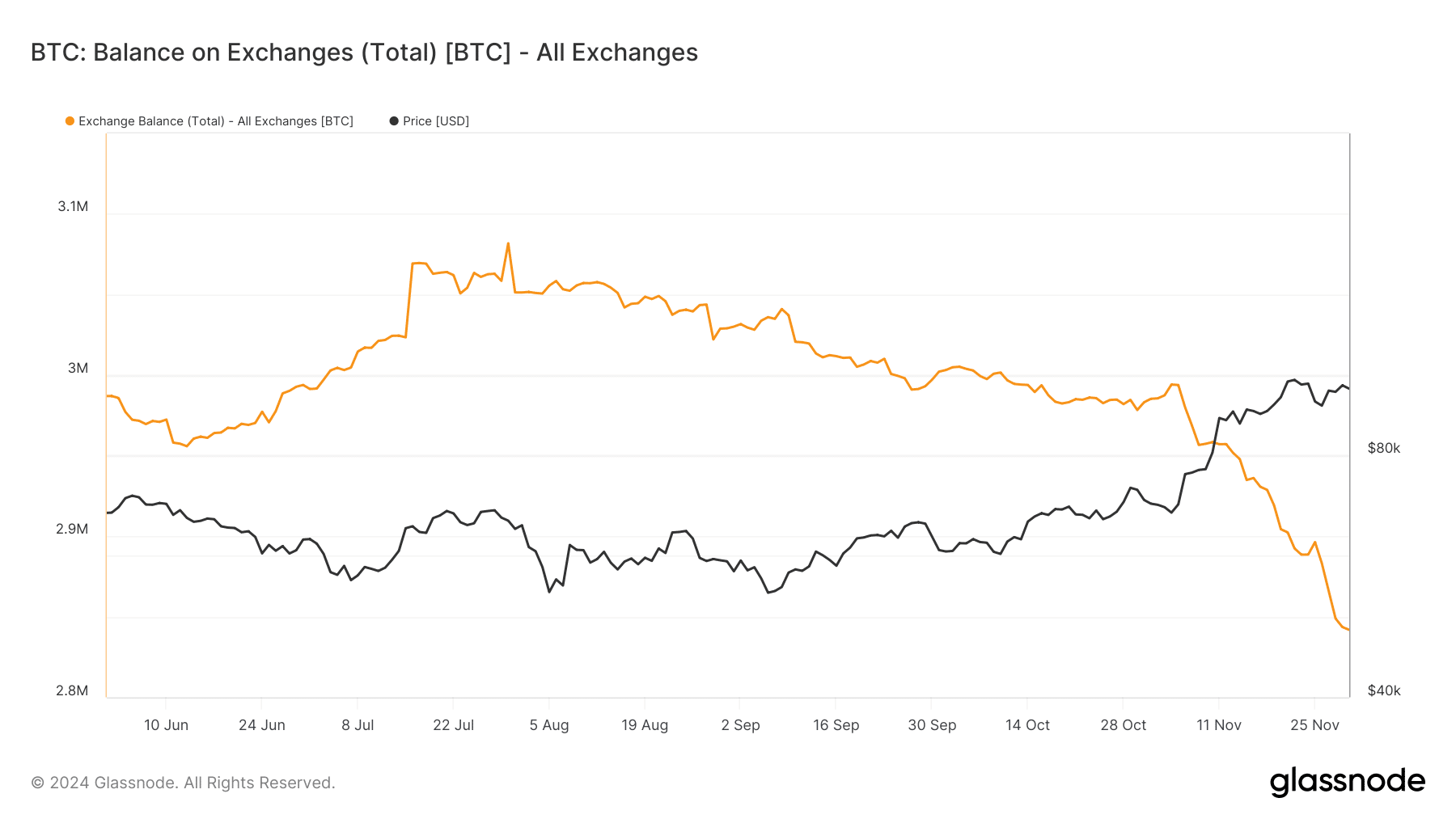

- Over 55,000 BTC were withdrawn from exchanges in 72 hours, highlighting strong accumulation and demand.

- Bitcoin’s “extreme greed” signals caution, as history shows high risk of market corrections

Bitcoin [BTC] has once again captured the market’s attention with a colossal withdrawal of over 55,000 BTC from exchanges in just 72 hours — a move valued at $5.34 billion.

This exodus, combined with the Fear & Greed Index now registering “extreme greed,” has ignited speculation about its next major move.

The sentiment mirrors conditions seen during Bitcoin’s historic bull run, when euphoric optimism propelled the price from $15,000 to $57,000 between 2020-21.

As the market grapples with this unprecedented activity, investors are left to wonder: Are we on the brink of another explosive rally, or is a sharp correction looming?

The Bitcoin exodus

The sharp drop in Bitcoin’s exchange balance, now under 2.8M BTC for the first time since 2018, reflects strategic moves by investors.

This 55,000 BTC exodus aligns with heightened on-chain activity, suggesting significant accumulation. The movement coincides with increased demand for self-custody as confidence in centralized platforms wanes.

Additionally, the rising price trend highlights a potential supply squeeze. Historically, such withdrawals have preceded bull runs, reducing immediate sell pressure on exchanges while signaling a long-term holding strategy.

Riding the wave of “Extreme Greed”

The Bitcoin Fear & Greed Index has surged into “extreme greed” territory, reflecting heightened optimism among investors.

Sitting above 80 at press time, a level not seen since the 2021 bull run, this sentiment suggests a potential rally but also signals caution.

Historically, extreme greed has driven parabolic price movements, such as the climb from $15,000 to $57,000 in 2020-21.

However, these periods often precede volatility, as exuberant sentiment increases the risk of overleveraged positions and abrupt corrections.

With Bitcoin breaking past $99,000 in November, the market is entering uncharted territory. Exchange reserves have plunged to multi-year lows, signaling a supply squeeze as long-term holders dominate.

However, the combination of extreme sentiment and overheated conditions warns of potential retracements — like the most recent price correction in the last week.

Bitcoin’s milestone reflects strong bullish momentum but underscores the fragile balance between euphoria and caution as investors weigh profits against further upside potential.

Catalysts, sustainability, and risks

Bitcoin’s recent rally is a result of a trio of factors: a tightening supply as exchange reserves fall below 2.8M BTC, increased institutional participation, and macroeconomic uncertainty driving demand for digital assets.

The ongoing supply squeeze, coupled with the surge in long-term holder activity, provides a strong foundation for sustained upward momentum.

However, risks loom large. The “extreme greed” sentiment heightens the probability of leveraged liquidations, which could trigger sharp corrections.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Additionally, Bitcoin’s unprecedented growth amplifies speculative activity, making it susceptible to profit-taking.

Sustaining the rally depends on continued institutional inflows, stable macro conditions, and the ability to navigate volatile sentiment shifts without destabilizing the market.