6 days of Bitcoin ETF outflows – Where do BlackRock, Fidelity stand?

- Bitcoin ETFs faced outflows, but BlackRock’s IBTC remained stable and increased holdings

- Analyst Thomas believes Bitcoin’s current dip is a precursor to a significant bull run.

As the crypto-community gears up for the launch of spot Ethereum [ETH] ETFs, interest in spot Bitcoin [BTC] ETFs appears to be waning.

Bitcoin ETF flow analysis

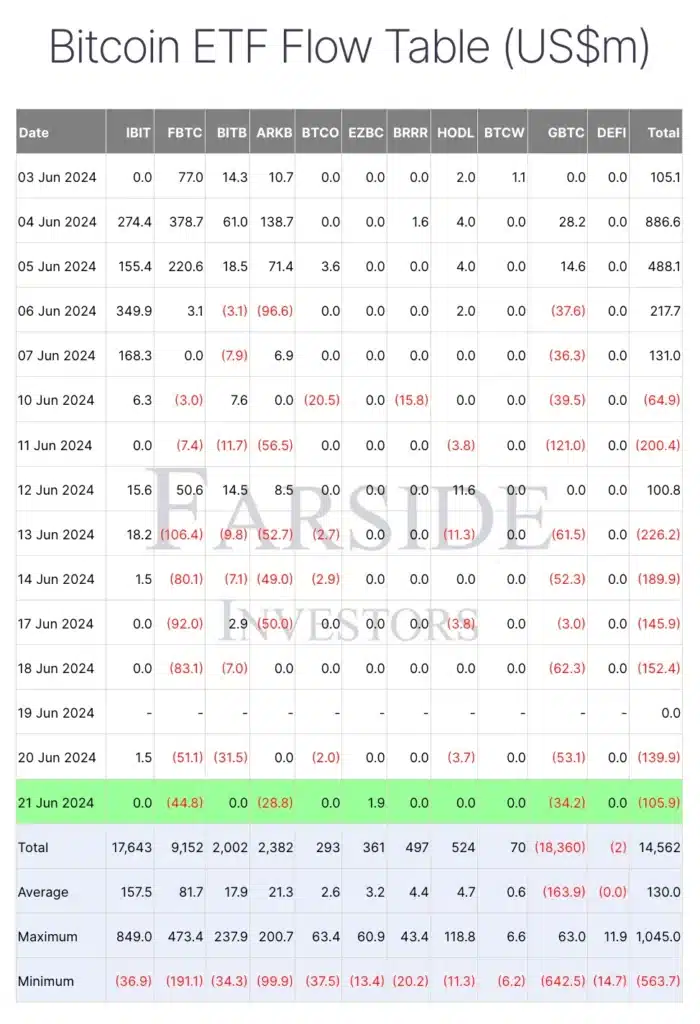

Data from Farside Investors revealed that Bitcoin ETFs recorded six consecutive days of outflows from 13 to 21 June (excluding 19 June).

As of 21 June, Fidelity Wise Origin Bitcoin Fund (FBTC) was hit the hardest with outflows totaling $44.8 million, followed by Grayscale Bitcoin Trust (GBTC) which saw outflows of $34.2 million in a single day.

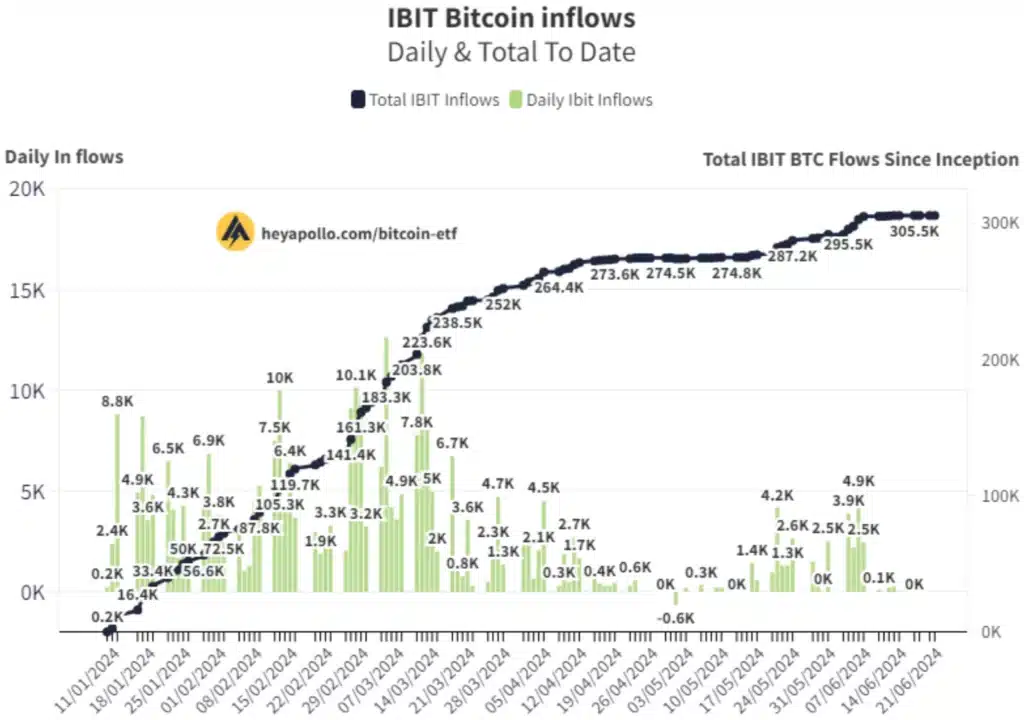

However, not all Bitcoin ETFs registered significant outflows. BlackRock’s IBTC remained stable, with zero days of outflows during this period and even prior to it.

Remarking on the same, Thomas, co-founder of ApolloSats took to X (formerly Twitter) and noted,

“Blackrock Continues to HODL. Zero outflows today. +23 Bitcoin this week while every other major ETF has a bloodbath. Larry you’ve done it again.”

This divergence in investor interest underscores the shifting dynamics within the cryptocurrency market.

BlackRock stands strong

While some Bitcoin ETFs faced significant outflows, the stability of BlackRock’s IBTC is a sign of selective confidence among investors.

Additionally, BlackRock’s recent surge in Bitcoin holdings highlights institutional confidence in Bitcoin’s role as an inflation hedge and investment.

On 5 June, BlackRock purchased 3,894 Bitcoins, worth approximately $276.19 million, increasing its total holdings to 295,457 Bitcoins valued at about $20.95 billion.

This move is seen as a positive signal to the market, likely influencing other investors and driving up demand for Bitcoin.

Additionally, execs believe that BlackRock’s accumulation may contribute to a supply shortage, further lifting Bitcoin prices amid evolving economic and regulatory conditions.

Impact on Bitcoin’s price

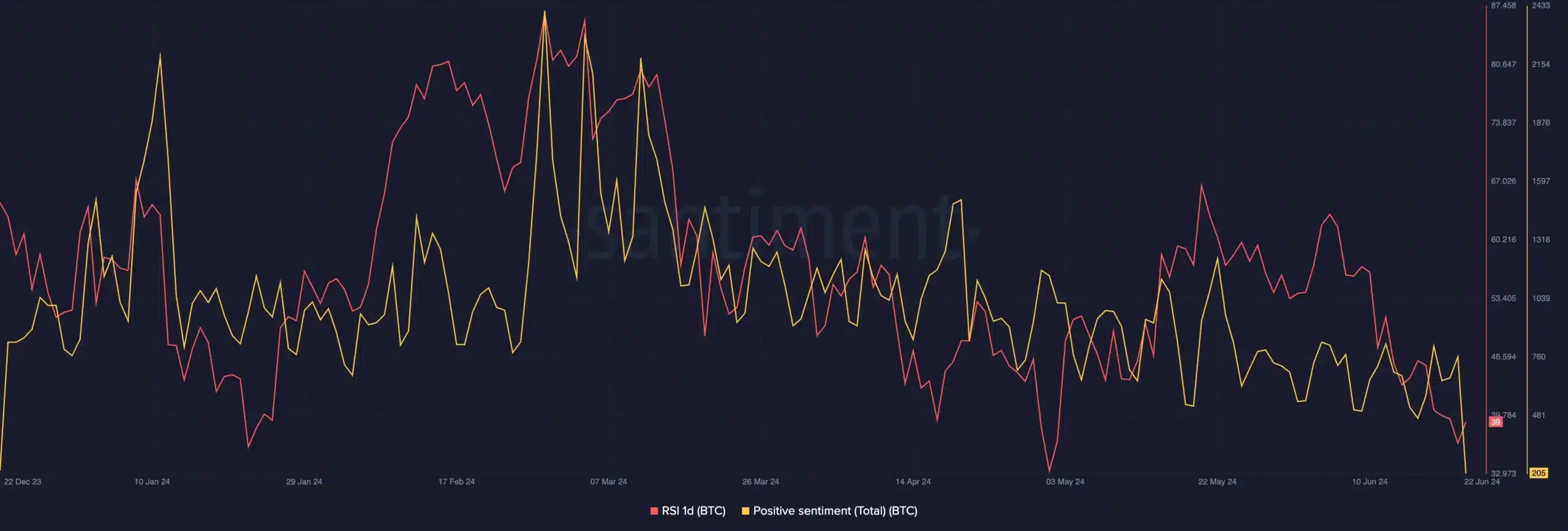

Meanwhile, it’s worth pointing out that BTC, while stable, hasn’t been able to register a consistent uptrend on the charts. In fact, at press time, it was well below the $70,000-mark.

Thomas, in a separate analysis, drew parallels to previous Bitcoin halving cycles. According to him, the current downturn mirrors past patterns, with the analyst also stating that he is anticipating a bull run in the days ahead.

However, according to AMBCrypto’s analysis of Santiment data, positive sentiment has fallen drastically. Even so, the one-day Relative Strength Index (RSI) seemed to be recovering from its lows – A sign of a possible turnaround.