Bitcoin

63% Bitcoin traders bet on long positions: Will this take BTC beyond $60K?

Despite a tumultuous market, Bitcoin traders keep their gaze fixed on a recovery above the $60,000 mark.

- Bitcoin has seen more long positions in the last few weeks.

- BTC has maintained the $60,000 price level in the last two days.

Bitcoin [BTC] has experienced significant volatility in recent weeks, fluctuating but ultimately reclaiming the $60,000 level.

Despite this turbulence, the majority of traders have maintained a bullish outlook, favoring long positions. However, recent data reveals that these long positions have faced some setbacks during this period.

Bitcoin traders stay long

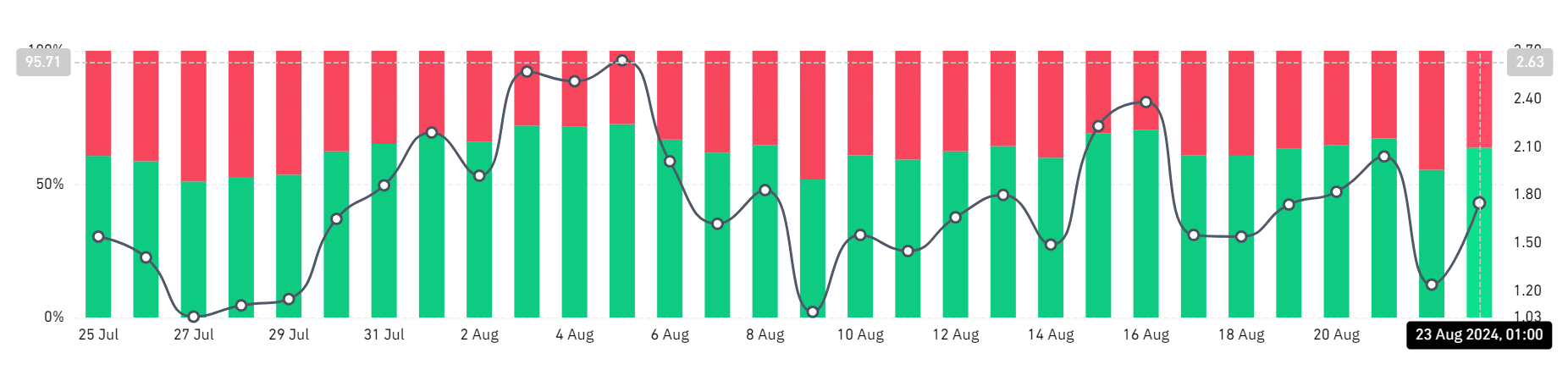

Recent data analysis from Coinglass has shed light on the ratio of long to short Bitcoin positions on Binance, the world’s largest cryptocurrency exchange.

The findings reveal that, over the past few weeks, the majority of accounts have maintained long positions, consistently surpassing 60%. As of the latest data, the percentage of long positions has risen to over 63%.

Since July, this trend has persisted, with long positions consistently outnumbering short positions, even as Bitcoin’s price dipped below the critical $60,000 mark.

This suggested that traders remained confident in Bitcoin’s upward trajectory, regardless of its price fluctuations.

Liquidation volume shows the extent of volatility

AMBCrypto’s analysis of Bitcoin’s liquidation trend added an intriguing dimension to the dominance of long positions.

Despite the majority of accounts maintaining long positions, recent weeks have seen a notable increase in long liquidations.

In August, long liquidation volume reached its highest level in over a year, exceeding $245 million.

When combined with short liquidations, this trend becomes even more significant, highlighting the volatility and risk present in the current market despite the overall bullish sentiment among traders.

Bitcoin maintains its $60,000 price level

AMBCrypto’s look at Bitcoin’s price trend revealed that it has been struggling to consistently reclaim the $60,000 level, despite briefly doing so in recent days.

In the previous trading session, it closed with a slight decline of over 1% yet managed to stay within the $60,000 range.

As of press time, BTC was trading at approximately $60,900, reflecting an almost 1% increase. The king coin Bitcoin remained just below its short-term moving average (yellow line), though it is approaching it closely.

A break above this moving average, which aligned with the resistance level of around $61,000, would signal a potential upward trend.

Long positions to remain dominant

Bitcoin’s price trend, along with the Top Trader Long Short Ratio, indicated that long positions were likely to remain dominant regardless of price fluctuations.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The charts revealed that even when Bitcoin’s price dropped to around $54,000 earlier in August, the percentage of long positions held steady at approximately 60%.

This suggested that traders continued to favor long positions, maintaining a bullish outlook despite price declines.