Ripple

76% XRP traders choose to go long: Good news for the altcoin?

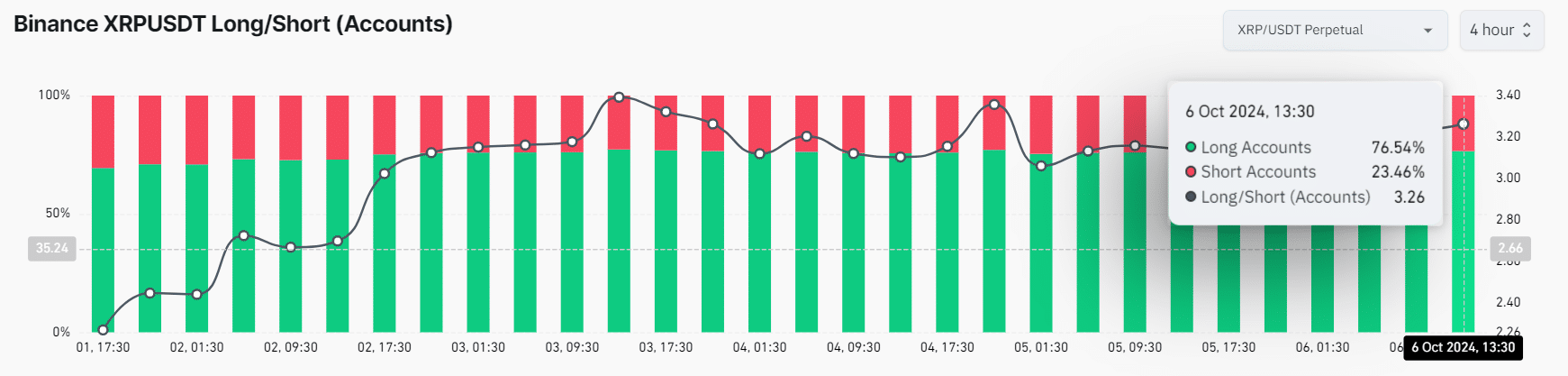

76.54% of Binance traders go long on the XRPUSDT pair, while 23.46% go for short positions.

- XRP’s Futures Open Interest has shown positive growth of 2.3% in the past four hours.

- XRP’s OI-Weighted Funding Rate indicated that traders were bullish, as long positions were paying short positions.

In the ongoing sideways cryptocurrency market, XRP traders on Binance appeared bullish as they significantly increased their long positions over the past four hours until press time.

According to the on-chain analytics firm Coinglass, 76.54% of Binance traders went long on the XRPUSDT pair, while 23.46% preferred short positions.

Binance traders go long on XRP

This significant long position on Binance suggested that traders were optimistic about XRP’s price increasing in the coming days.

However, this bet on the notable long position occurred when XRP was struggling to gain momentum near the strong support level of $0.52.

At press time, XRP was trading near $0.529 and has experienced a price decline of 0.65% over the past 24 hours.

Meanwhile, traders and investors remained hesitant to participate, as its trading volume has dropped by 50% compared to the previous day.

XRP’s bullish on-chain metrics

Despite the fear in the market, XRP’s Futures Open Interest has shown positive growth of 2.3% in the past four hours. This indicated that traders’ bets are increasing, which could be a bullish signal for XRP holders.

As of now, the major liquidation levels were $0.519 on the lower side and $0.541 on the upper side, with traders being over-leveraged at these levels, according to Coinglass data.

If the market sentiment shifts to negative and the price of XRP falls below the $0.519 level, nearly $10.21 million worth of long positions will be liquidated.

Conversely, if sentiment improves and the price soars to the $0.541 level, approximately $8 million worth of short positions will be liquidated.

However, another on-chain metrics supporting this bullish outlook was XRP’s Open Interest (OI)-Weighted Funding Rate, which was at +0.0097% at press time.

A positive Funding Rate indicated that traders were bullish, as long positions are paying short positions.

Combining the data from the Long/Short Ratio, Futures Open Interest, liquidation levels, and Funding Rate, it appeared that bulls were currently dominating the asset, with expectations that prices will rise.

XRP technical analysis and key levels

According to AMBCrypto’s technical analysis, XRP has been consolidating within a tight range between $0.518 and $0.545 for the past three days, near the crucial support level of $0.52.

However, a breakout from this consolidation zone will determine the next movement in XRP’s price.

Read XRP’s Price Prediction 2024–2025

Based on the historical price momentum, if XRP breaches the zone and closes a daily candle above the $0.545 level, there is a strong possibility that it could soar by 17% to reach the $0.65 level.

Conversely, if XRP breaches the lower boundary of the consolidation zone and closes a daily candle below $0.515, it could decline by 12% to $0.455 in the coming days.