80% Bitcoin holders remain in the red as BTC hovers at $60K – Why?

- BTC crossed over to the $60,000 price level at press time.

- Short holders have suffered more losses with the price volatility.

Bitcoin [BTC] has faced significant challenges in maintaining its position above the $60,000 price level, frequently dipping below this key threshold in recent weeks.

This volatility has particularly impacted short-term Bitcoin holders, many of whom are now holding their assets at a loss due to the fluctuating price.

Short Bitcoin holders at a loss

A recent report has revealed that over 80% of short-term Bitcoin holders were holding their BTC at a loss at press time. This meant that their Bitcoin investments were worth less than what they initially paid.

This situation arose as Bitcoin continues to struggle around the $60,000 price level.

The analysis drew parallels between the current scenario and similar market conditions in 2018, 2019, and mid-2021.

In those periods, a large proportion of short-term holders were also held at a loss, which led to increased panic selling. This behavior contributed to prolonged bearish trends as investors rushed to cut their losses.

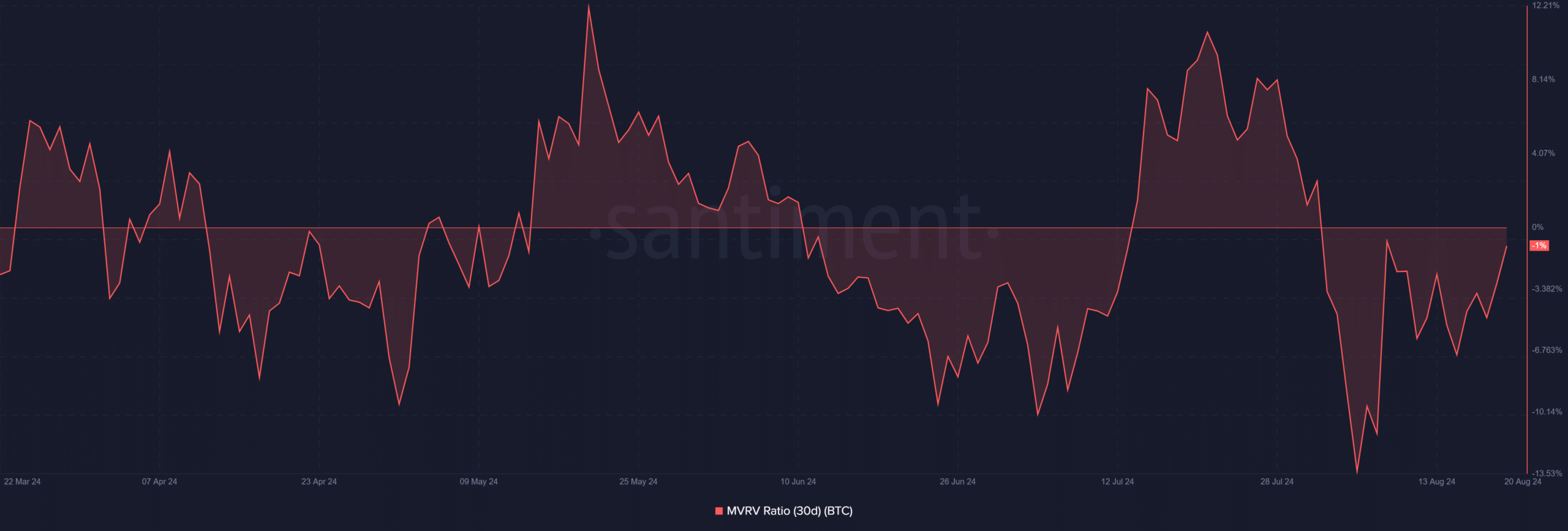

AMBCrypto’s analysis of the 30-day Market Value to Realized Value (MVRV) on Santiment confirmed the challenges faced by short-term Bitcoin holders.

The metric indicated that these holders have been in a loss position for several weeks. The MVRV has been below zero since the beginning of the month, reflecting that most short-term holders were underwater.

The MVRV has remained below zero for an extended period, signaling that short-term holders have generally been holding at a loss.

On the 5th of August, the MVRV dropped to around -13%, highlighting the extent of the losses.

As of the 18th of August, the MVRV had improved to approximately -5%, still in negative territory but showing some recovery.

In the last 48 hours, the situation improved further, with the MVRV rising to around 1% as of this writing. This positive shift is largely due to the recent price gains, which alleviated some pressure on short-term holders.

More Bitcoin holders remain profitable overall

Shifting the focus from short-term holders to the overall Bitcoin holder base reveals a more positive outlook.

According to data from IntoTheBlock, a substantial majority of Bitcoin holders were still in profit despite recent price fluctuations.

Specifically, over 80% of all Bitcoin addresses, equivalent to approximately 45.45 million addresses, were “in the money,” meaning they held BTC at a price higher than their purchase price.

Furthermore, about 6.9 million addresses, or around 12.9% of the total, were “out of the money,” meaning these holders were at a loss, based on press time prices. 2% of the addresses were at breakeven.

While short-term holders have been more affected by the recent price declines, the overall market is still largely in profit.

This means that reactions from short-term holders, who are more likely to sell at a loss, are unlikely to have a significant impact on the broader BTC price trend.

Bitcoin price in the last 48 hours

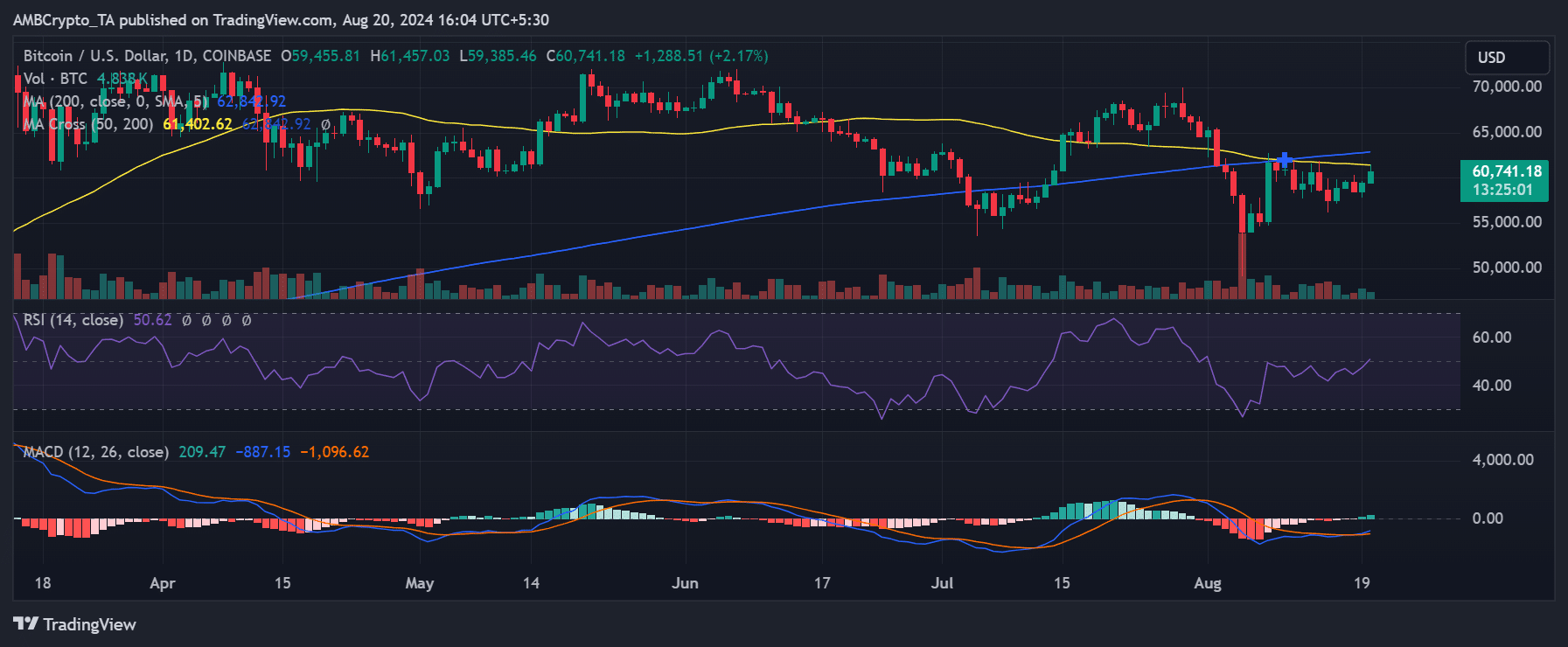

As of this writing, Bitcoin has seen a price increase of over 2%, pushing it to approximately $60,800. This follows an almost 1% rise in the previous trading session, which brought its price to around $59,452.

The recent gains have brought Bitcoin closer to a critical resistance level marked by its short-term moving average (yellow line) around the $60,000 mark.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Suppose Bitcoin can break through the $60,000 resistance provided by the short-term moving average.

In that case, the next major resistance level lies at around $63,000, marked by the long-term moving average (blue line). This level will be the next critical target for Bitcoin to reach as it continues its upward trend.