$81 mln Solana token unlock incoming: Impact on SOL?

- Despite substantial token unlocks, Solana’s TVL has increased by 2.75%.

- SOL’s Long/Short Ratio was 1.019, indicating bullish market sentiment among traders.

Solana’s [SOL] upcoming token unlock has garnered significant attention from crypto enthusiasts due to fears of a potential price decline.

Solana’s token unlock

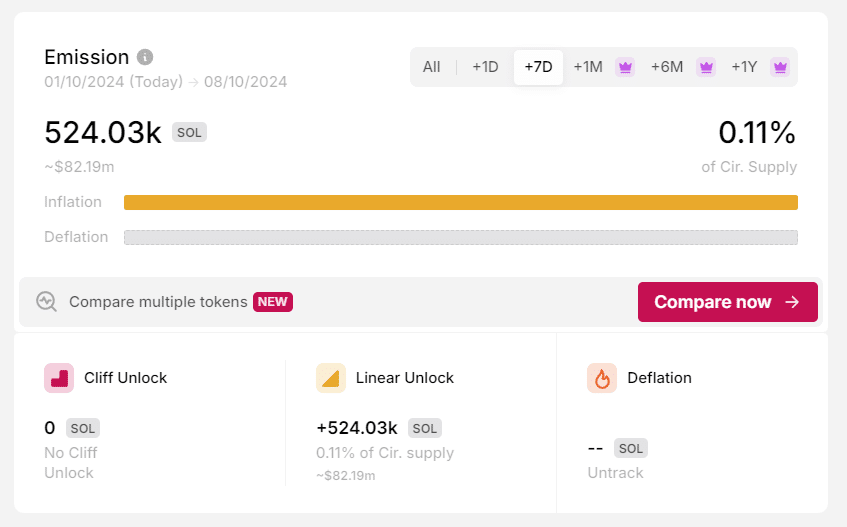

Recently, the token unlocks dashboard shared data showing that 524,030 SOL, worth $81.56 million, are set to be unlocked and released into the circulating supply between the 1st and the 7th of October.

However, this unlock represents just 0.11% of Solana’s total circulating supply.

Following this report, there is a strong possibility that SOL could experience a selling pressure and price decline in the coming days.

In general, a token unlock is often considered a bearish sign, as the increase in available supply in the market can lead to selling pressure.

Current market sentiment

Solana’s Total Value Locked (TVL) has increased by 2.75% over the last 24 hours, indicating a positive sentiment among traders. According to data from DeFiLlama, Solana’s TVL was $5.506 billion at press time.

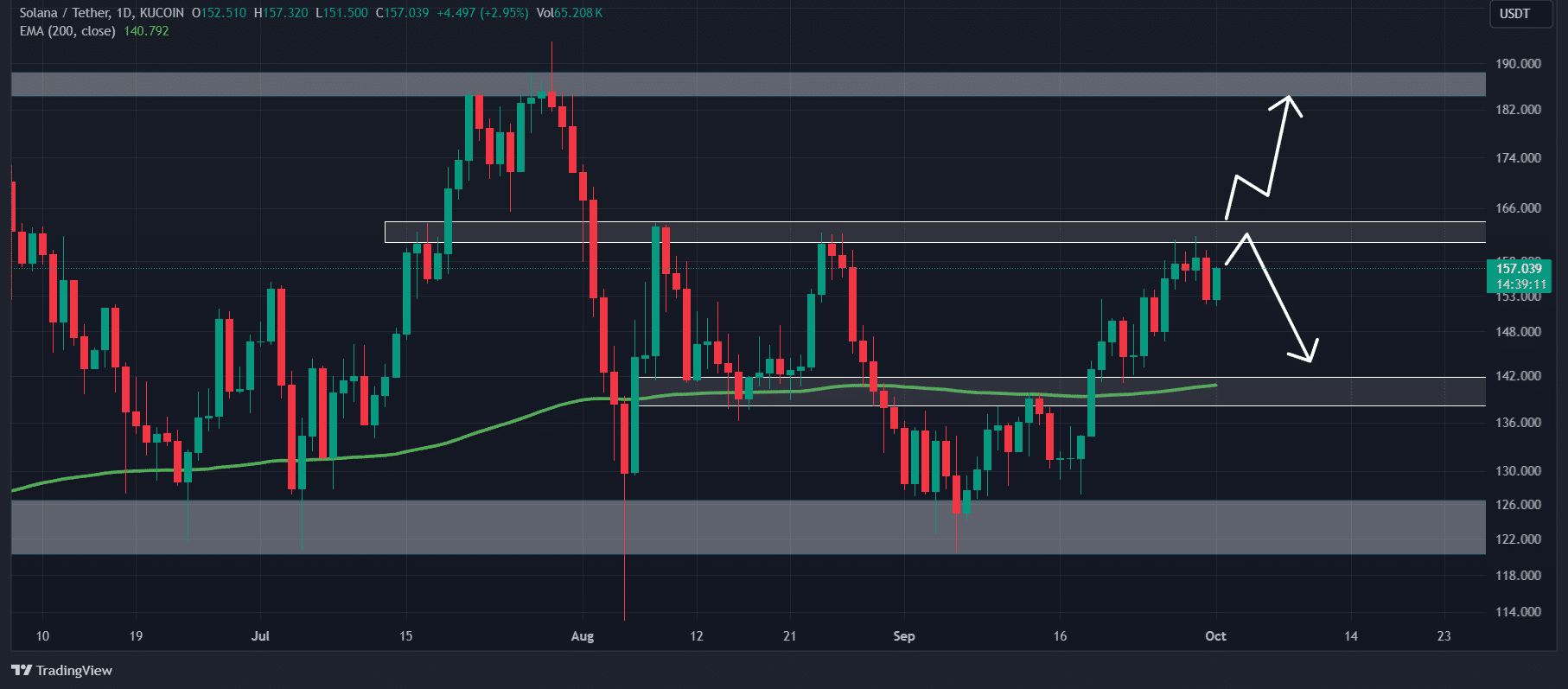

According to AMBCrypto’s technical analysis, SOL was in an uptrend as it was trading above the 200 Exponential Moving Average (EMA) on a daily time frame.

The 200 EMA is a technical indicator that is used to determine whether an asset is in an uptrend or downtrend.

Based on recent performance, there is a high possibility that SOL could initially reach the resistance level of $165.

If SOL breaches this resistance level and closes a daily candle above the $170 level, there is a strong possibility that the token could rally by another 15% in the coming days.

Bullish on-chain metrics

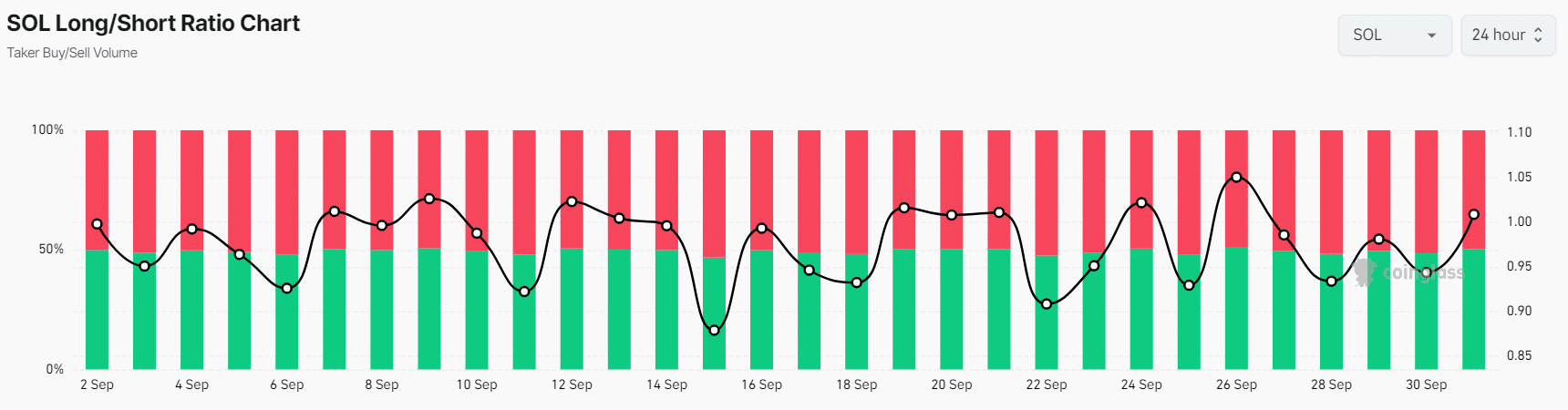

This positive outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, SOL’s Long/Short Ratio was 1.019 at press time, indicating a bullish market sentiment.

Additionally, its Futures Open Interest increased by 2.2% in the past 24 hours and continued to rise, suggesting that traders were potentially building long positions.

Read Solana’s [SOL] Price Prediction 2024–2025

At press time, SOL was trading near $157 after a price surge of 0.25% in the last 24 hours.

During the same period, its trading volume increased by 5.6%, indicating higher participation from traders and investors amid ongoing market reversal.