84% of Worldcoin holders in losses – What’s next for WLD prices?

- Worldcoin continues to plunge further with the recent $6.6 billion raise by OpenAI failing to buoy prices.

- The drop has led to wallets in losses spiking to 84% .

Worldcoin [WLD] price remained subdued on Thursday, the 3rd of October, as it tracked the performance of Bitcoin [BTC] and other altcoins. At press time, WLD traded at $1.56 after a 9% price decline in 24 hours. In the last seven days, Worldcoin has dropped by 25%.

Worldcoin’s recent price drop comes despite OpenAI raising $6.6 billion in fresh funding at a $157 billion valuation.

WLD tends to react to developments around OpenAI as the project is backed by OpenAI’s CEO Sam Altman. However, the coin has failed to react to this recent raise and instead, it has plunged to a weekly low as bears tighten their grip on price.

Worldcoin’s short-term trend turns bearish

Worldcoin has dropped below the 50-day Simple Moving Average (SMA) on the one-day chart confirming that the short-term trend has flipped bearish. The drop happened after the coin failed to defend a crucial support level at $1.59.

The Moving Average Convergence Divergence (MACD) line confirms this bullish hypothesis as it has crossed over below the signal line. At the same time, the MACD histogram bars have turned red suggesting that the downside pressure is strengthening.

If this decline fails to attract dip buyers and WLD continues trending lower, the next support level to be tested is the 1.618 Fibonacci level ($1.15).

Conversely, if the broader market recovers and WLD rallies, the next likely resistance is $1.59, which will flip the short-term momentum to bullish. Another key resistance level also lies at the 0.618 Fib level ($1.78).

Worldcoin wallets in losses spike to 84%

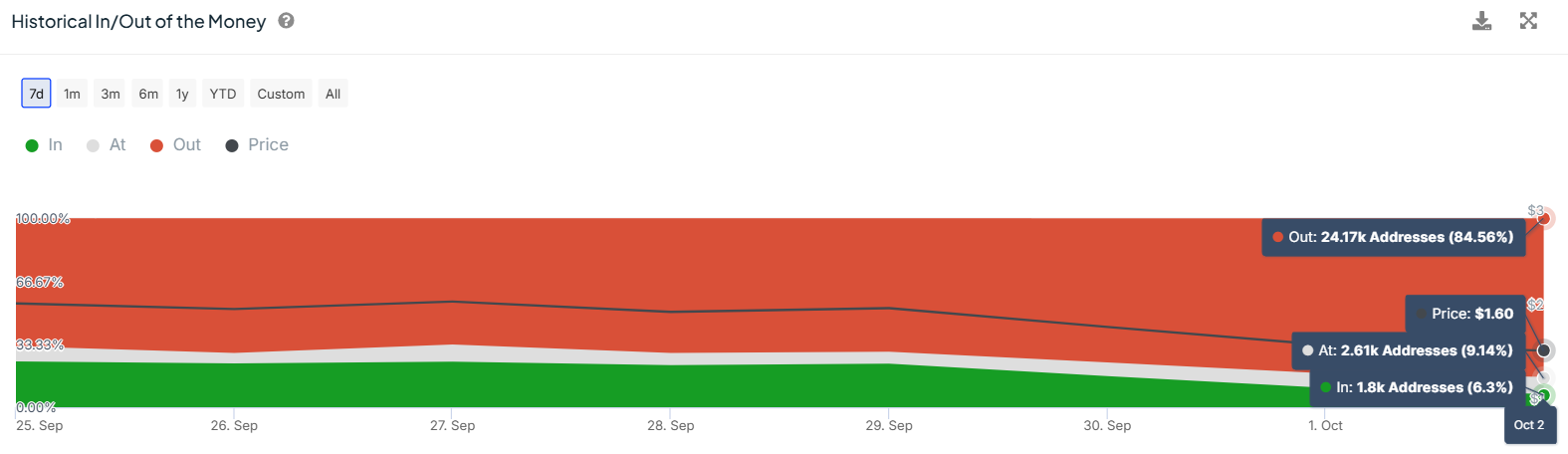

Data from IntoTheBlock shows that the recent price decline triggered an increase in the Worldcoin addresses that are in losses.

In the last seven days, the WLD addresses that are In The Money (in profits) have jumped from 19,300 addresses, equivalent to 68% of holders, to 24,100 addresses, equivalent to 84% of holders.

On the other hand, the wallets in profits have decreased significantly from 23% to 6%. As more traders go into losses, they could choose to sell to minimize risk. If this happens, it will increase the downward pressure on Worldcoin.

Derivatives data shows THIS

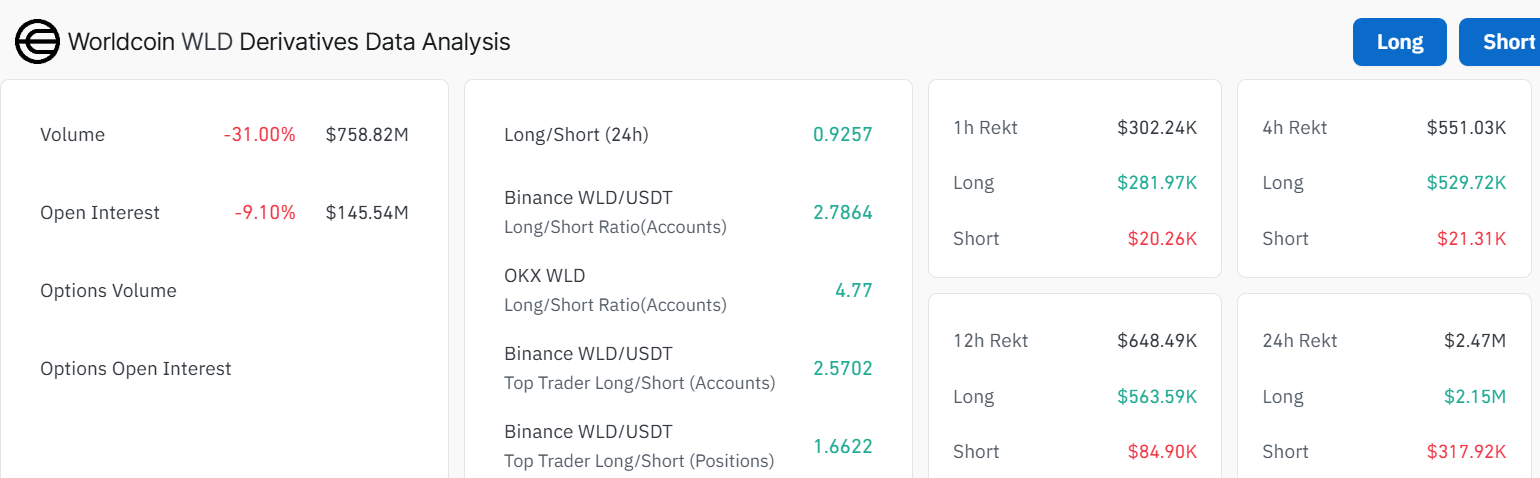

The derivatives market further heightens the bearish case against Worldcoin. According to Coinglass, open interest dropped by 9% in the last 24 hours suggesting that traders are closing their positions.

This bearish outlook could have been triggered by an influx of liquidations. At press time, WLD liquidations totaled to $2.47M. Out of this amount, $2.15 million were long liquidations.

The long/short ratio also stood at 0.925 at press time, showing a relatively neutral market.

Read Worldcoin’s [WLD] Price Prediction 2024–2025

However, this data shows that short positions were slightly more than long positions indicating that traders are bearish on WLD’s price performance.

Nevertheless, Worldcoin is not the only AI-related crypto that is in losses. At press time, the total market cap for AI cryptos was down by nearly 6% to $26 billion per CoinGecko. This could have also triggered WLD’s subdued performance.