88.7% of Ethereum blocks built by 2 entities – Decentralization at risk?

- Two block builders produced 88.7% of Ethereum blocks, sparking centralization concerns.

- Ethereum’s validator count rose 30%, boosting network decentralization and resilience.

Ethereum [ETH] has recently experienced a positive price surge. ETH was trading at $2,623 with a 0.23% gain over the past 24 hours, at press time.

The coin mounted an impressive 8.89% increase over the past week, according to CoinMarketCap.

However, despite this optimism, concerns about network centralization have emerged.

Centralization concerns surrounding Ethereum

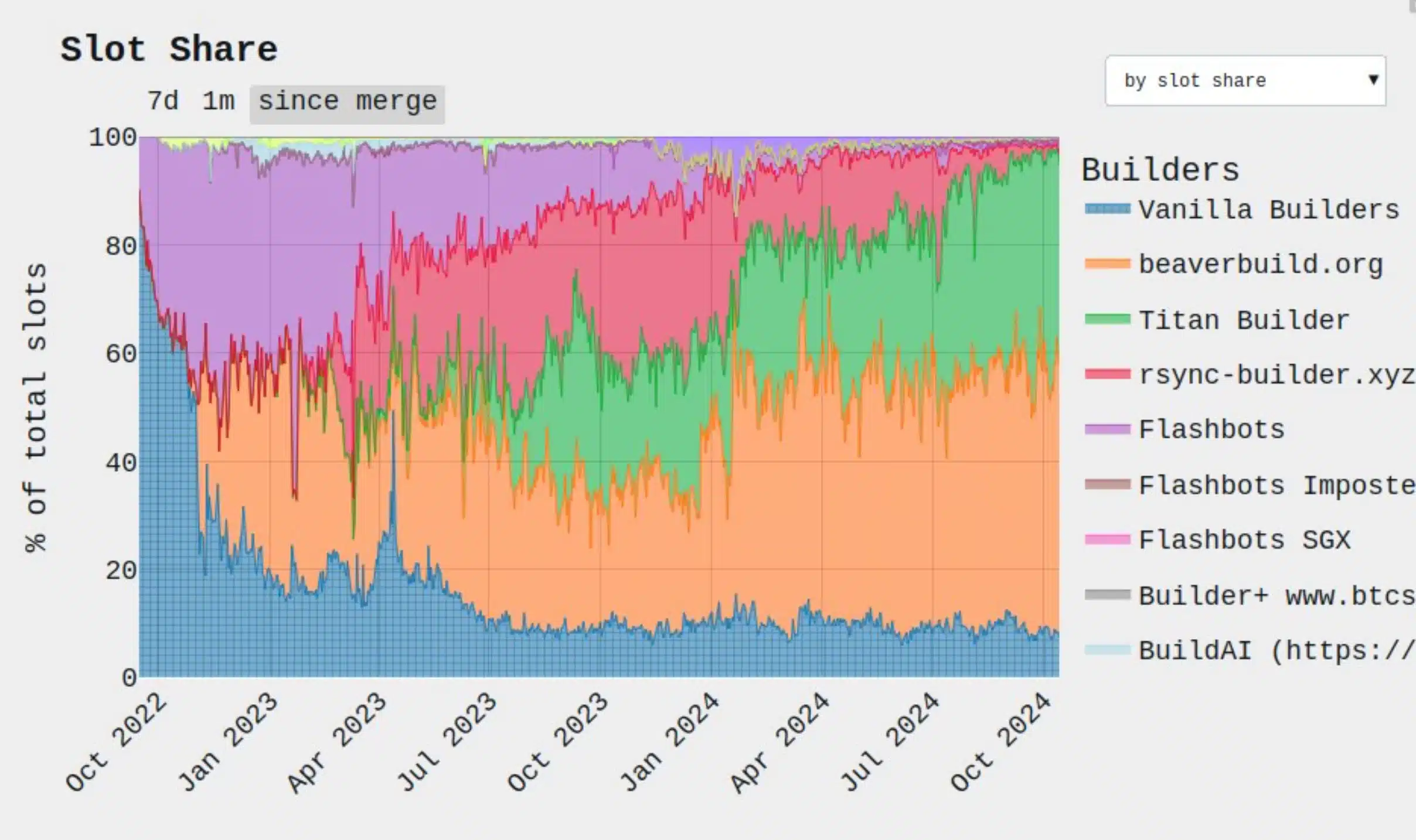

During the first two weeks of October, two Ethereum block builders produced a majority of the blocks on Ethereum. This raised alarms about the potential risks of centralization on the second-largest blockchain network.

This development has sparked a critical discussion regarding the long-term security and decentralization of ETH.

Offering further insights on the matter, Ethereum Foundation researcher Toni Wahrstätter noted,

“Over the past two weeks, two block builders, Beaverbuild and Titan Builder, have produced 88.7% of all blocks.”

He further highlighted,

“This trend is primarily driven by the rise of private order flow (XOF), sold exclusively by certain apps. XOF reduces genuine competition among builders in the block auction, leading to a smaller pool of shared transactions.”

Other execs weighing in

In a conversation with a publication, Ryan Lee, chief analyst at Bitget Research, pointed out that although two builders dominate, this does not inherently lead to major centralization concerns.

He said,

“In Ethereum’s underlying design, there is a proposer-builder separation, meaning the proposer cannot see the specific contents of the block proposed by the builder.”

He further noted,

“They only choose the most profitable block from the multiple blocks proposed by builders for validation and broadcasting.”

Lee highlighted that the structure of ETH’s block-building process limits the ability of block builders to prioritize or exclude specific transactions.

This decentralized mechanism ensures that neither builders nor validators have the authority to control which transactions are added to the blockchain.

As a result, concerns surrounding potential centralization within Ethereum’s network are alleviated, reinforcing the platform’s core decentralized principles.

What is the probable solution?

To address the centralization concerns stemming from the dominance of two block builders, Wahrstätter proposed enhancing ETH’s censorship resistance as a potential solution.

Strengthening the network’s resilience against censorship would help counterbalance the influence of a few dominant players, ensuring that Ethereum remains decentralized and resistant to manipulation.

This approach aims to maintain the integrity of the network while safeguarding its decentralized nature.

However, despite the concerns around block builder dominance, ETH’s validator count has surged by over 30% in the past year.

This growth, fueled largely by increased institutional interest, reflects a positive trend for the network’s decentralization.

This is because the rising number of validators indicates a broader distribution of power across the ecosystem, which may help counterbalance centralization risks and strengthen the network’s overall resilience.