$9.3B ERC-20 tokens flood exchanges: Impact on Ethereum?

- Deposits of $9.3 billion in ERC-20 stablecoins into major exchanges could signal a bullish Ethereum rally.

- Increased activity in Ethereum’s active addresses suggested rising retail interest in the asset.

Ethereum [ETH] is riding a wave of positive momentum, reflecting the broader cryptocurrency market’s recent gains.

Although Ethereum has not yet reached its previous all-time high, it has experienced a significant upswing. Over the past few days, the alt coin has surged by more than 8%, reaching a high of $2,872, at press time.

This marks a notable recovery, placing the asset approximately 42.7% below its record high of $4,878 from November 2021.

The recent gains signaled increasing investor interest and highlighted the alt coin’s resilience as it continues to attract market attention alongside Bitcoin’s recent upward movement.

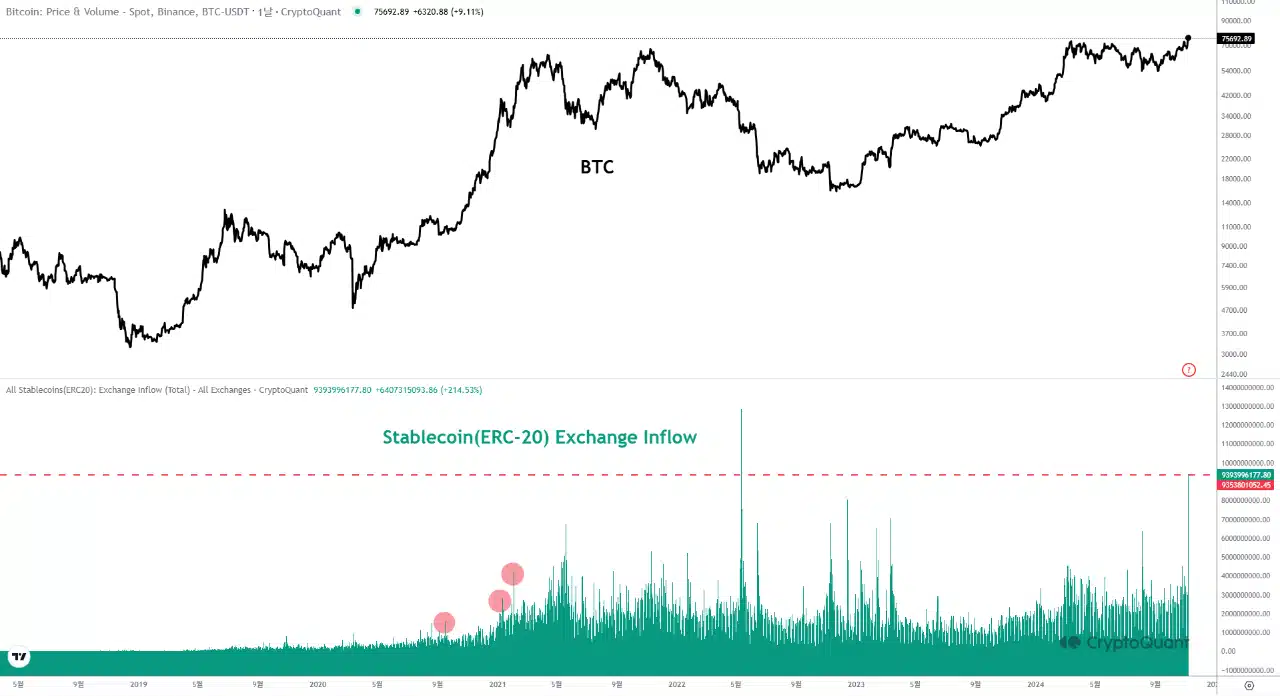

Meanwhile, an intriguing development within the Ethereum network has been identified by a CryptoQuant analyst known as Mac.D.

According to the analyst, in the wake of the U.S. presidential election results, a substantial $9.3 billion worth of ERC-20 stablecoins flowed into cryptocurrency exchanges.

This represents the second-largest influx of ERC-20 stablecoins since their inception.

Breaking down these deposits, Binance received around $4.3 billion, while Coinbase saw an inflow of about $3.4 billion. The remainder was distributed among smaller exchanges.

Historically, large inflows of this magnitude have correlated with bullish rallies in the market, as seen during the period between September 2020 and February 2021.

If this pattern holds, Ethereum and the broader market may be poised for another upward trend.

Ethereum’s rising retail interest and network activity

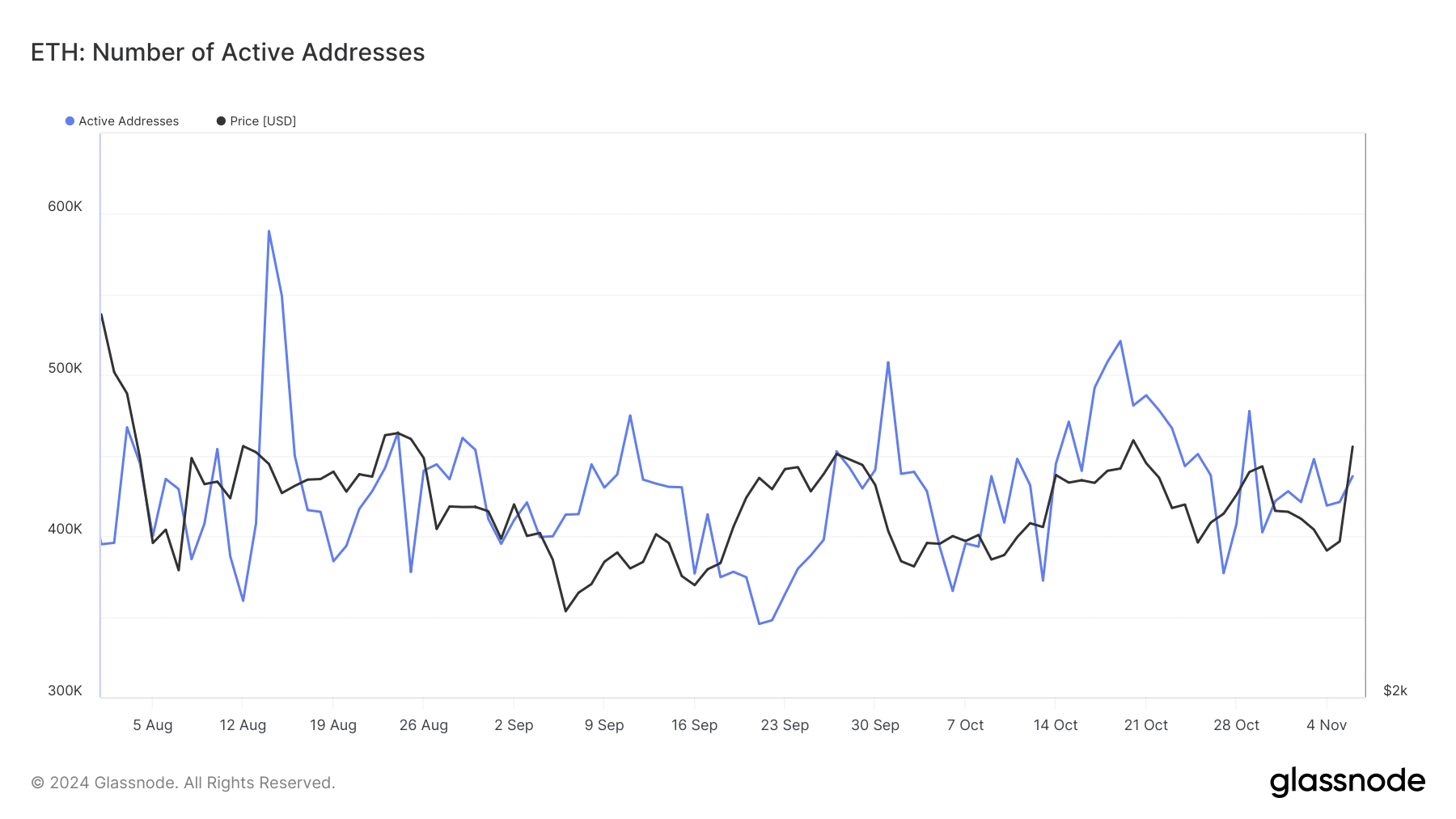

In addition to the surge of ERC-20 stablecoin inflows, another promising trend for Ethereum has emerged in its retail activity.

Data from Glassnode indicated a rise in Ethereum’s active addresses, a key metric for gauging retail interest and network utilization.

Following a dip below 400,000 active addresses in late October, the number has since climbed to over 430,000.

This increase reflects heightened activity on the network, suggesting renewed interest from individual participants and a possible uptick in network demand.

The growth in active addresses can have meaningful implications for Ethereum’s price trajectory.

Increased activity often signals higher demand and greater usage of the network, which can create upward pressure on the asset’s value.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Retail investors engaging more with Ethereum can drive liquidity and price stability while indicating growing confidence in the market.

This trend, combined with rising stablecoin inflows and strong exchange activity, paints an optimistic picture of Ethereum’s near-term potential.

![Ripple [XRP]’s subtle rebound – Will strong derivatives bets trump weak on-chain signals?](https://ambcrypto.com/wp-content/uploads/2025/04/E3CB2045-31A3-4BD4-B5BC-2142FF334BE1-400x240.webp)

![Shiba Inu [SHIB] price prediction - A 70% rally next after 300%+ burn rate hike?](https://ambcrypto.com/wp-content/uploads/2025/04/Erastus-2025-04-12T132907.604-min-400x240.png)