90K Bitcoin Futures open on Binance: What’s next for BTC?

- Open BTC Futures on Binance jumped from 85K BTC to 90K this week.

- BTC volatility is anticipated ahead of critical US inflation data and CZ’s jail release.

Binance [BNB] exchange has recorded a spike in Bitcoin [BTC] Futures open contracts ahead of key U.S. economic data and crypto-specific events.

The exchange saw a nearly 7% increase in Open Interest (OI) on the 23rd of September. This tipped BTC Futures to jump from around 85K coins to 90K at the time of writing.

Notably, former Binance CEO Changpeng Zhao (CZ) will be released from jail on the 29th of September.

This meant speculators, especially on the Binance exchange, took extra risks to bet on BTC. Perhaps they were convinced of a potential BTC price rally ahead of the US PCE Index (Price Consumption Expenditure) data.

Speculators’ BTC appetite surge

Market pundits are awaiting PCE data to gauge the possible pace of the Fed’s interest cuts in the future. So, BTC could react to the data.

Some market observers view this event as a potential catalyst for BTC price volatility. In short, the time between the 27th to 29th of September could see wild volatility for the largest cryptocurrency.

The sharp uptick in OI denotes increased market interest. By extension, it also underscores the bullish outlook of Futures market speculators.

However, it also exposes speculators to the risk of massive liquidations, which might induce further volatility and price swings for BTC.

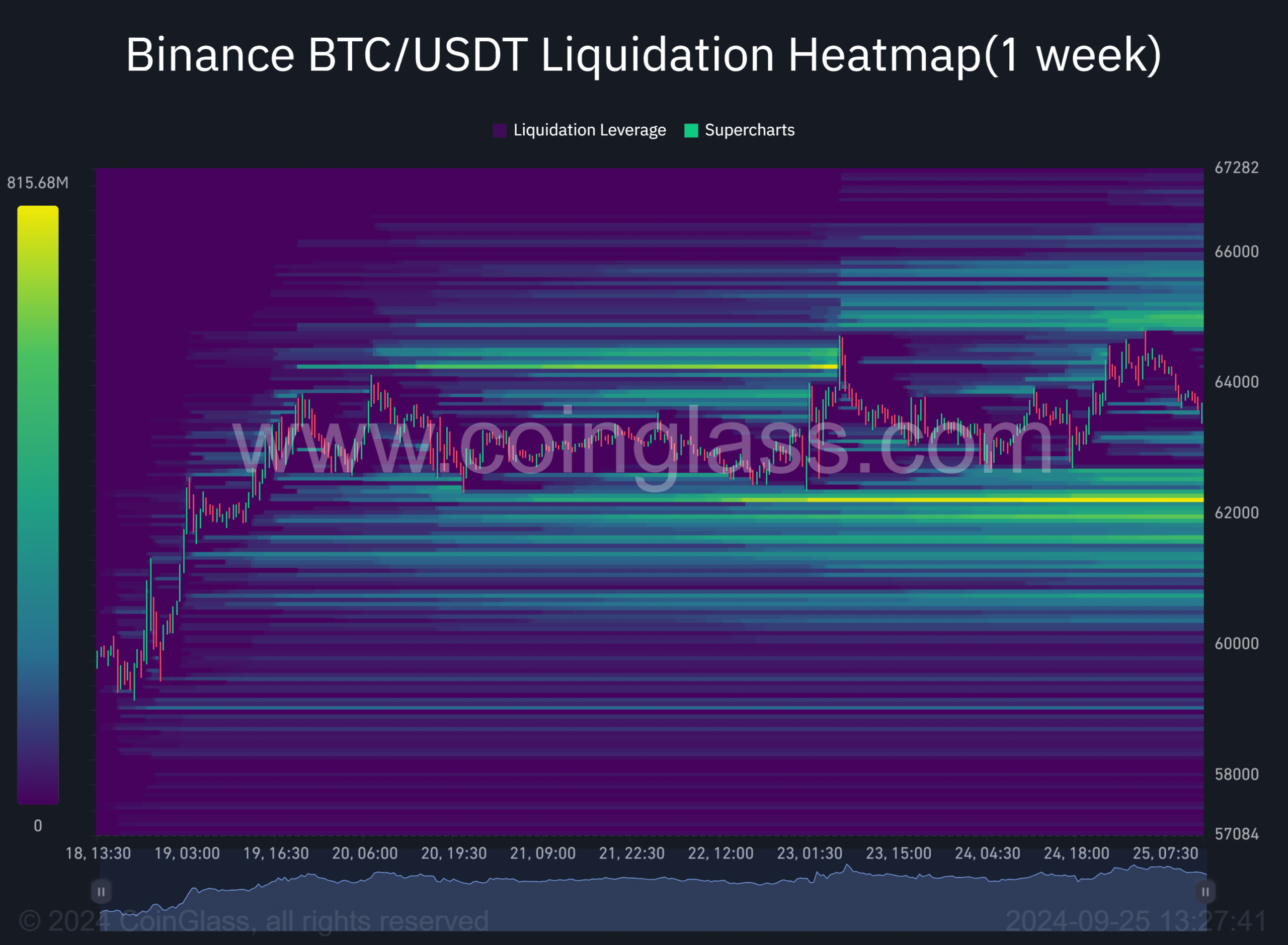

Per Coinglass’s 1-week liquidation map, key levels to watch were at $62K and $65K. Short positions were building up near $65K.

Besides, there were also significant long positions at $62K (as shown by the bright orange color).

A sharp blast above $65K could liquidate several short bets at the level, exposing bears to massive losses. Similarly, a wild retest of $62.2K area could reach over $800 million worth of long positions.

Bitcoin price action

Bitcoin’s value remained below $64,000, and it failed to surpass the crucial 200-day MA (Moving Average). The 200-day MA stood at $63.9K, at press time.

Per trader Daan Crypto, a strong move above the level and channel could mark a bullish market structure shift. This could accelerate BTC towards its ATH.

That said, such an upside move could trigger a short squeeze and expose bears to losses. It remains to be seen if these catalysts could tip BTC to clear its overhead hurdle at $65K.