Bakkt’s Open Interest cross a million; ICE CEO optimistic about BTC

Bakkt was supposed to be a haven for institutions or perhaps a gateway for institutions to get their hands on Bitcoin. However, the prodigal son’s performance didn’t seem to meet expectations; on the launch day, the price of Bitcoin declined rapidly. This put a negative spin on Bakkt’s launch.

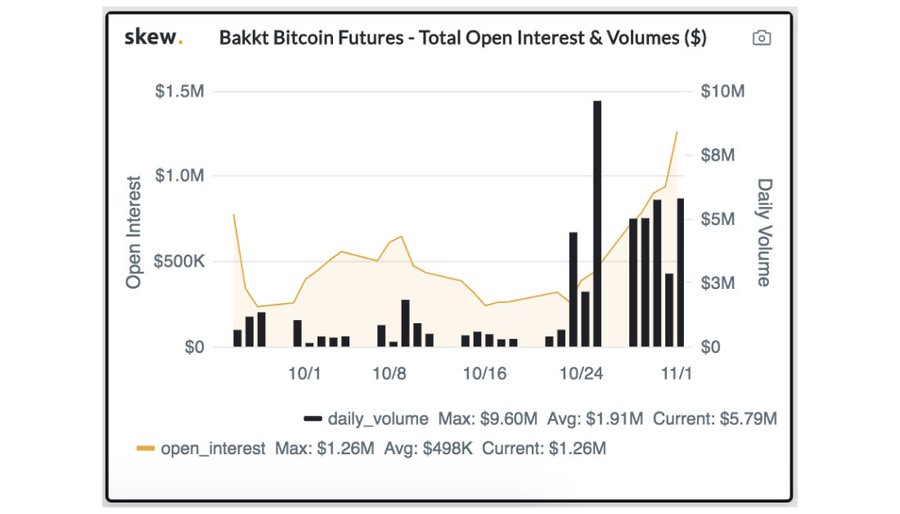

However, Bakkt has come a long way since its launch. The trading volume on Bakkt recently hit an all-time high of $ 10.3 million on October 25, 2019, it has been holding up consistently since then.

Skew Markets tweeted:

“Bakkt slowly taking off – total open interest just crossed $1mln with volumes also ramping up a quite a bit this week. Don’t bet against Jeff Sprecher!”

Source: Skew

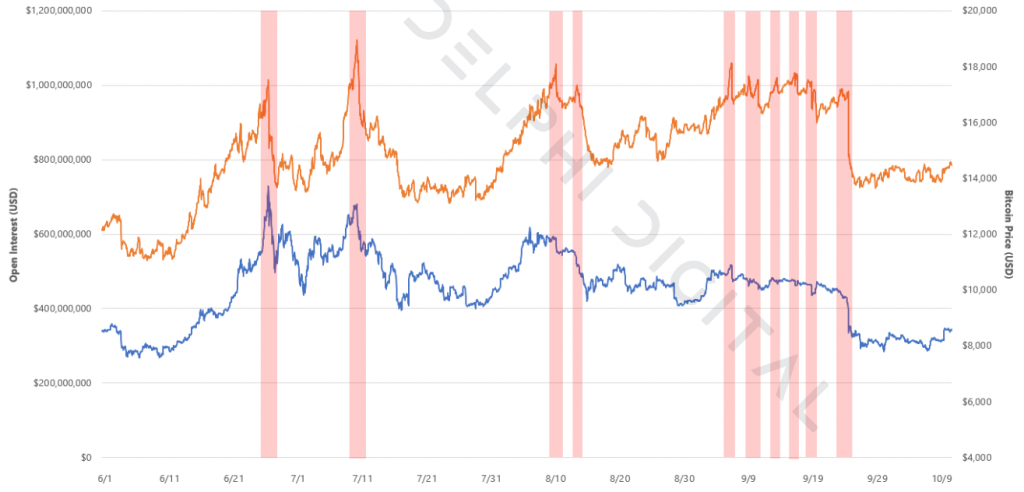

Apart from the trading volume, Bakkt’s total Open Interest reached a new all-time high of over $1 million. Open Interest (OI) represents number of perpetual futures contracts in existence, serving as a useful proxy for the amount of leverage in the market. Delphi Digital’s latest report suggested that Open Interest for Bitcoin repeatedly hit $1 billion, consequently resulting in the development of a new trading strategy.

Source: Delphi Digital

Recently, Jeff Sprecher, the CEO of Intercontinental Exchange (ICE) announced that Bakkt would be moving into Options Market for Bitcoin. This move by Bakkt, as explained by Sprecher was due to the lack of transparency in the market. With Bakkt moving into Options Markets it aims to provide transparency to the markets while providing a space for price discovery.

Sprecher also made it clear that their move in this direction was due to their belief that Bitcoin would be more than a store of value, i.e., it would transform into a payment system.