How is the accumulation in Chainlink’s market holding up?

The market is hot with cryptos’ prices going through the roof, with hardly any altcoins having a very rough time in the market recently. Chainlink’s native token, LINK, has also boomed with growth, despite its inconsistencies. In fact, LINK was returning 667% to its investors year-to-date. Although the price of the digital asset seemed to be faltering at press time, the Chainlink network has had an impressive year.

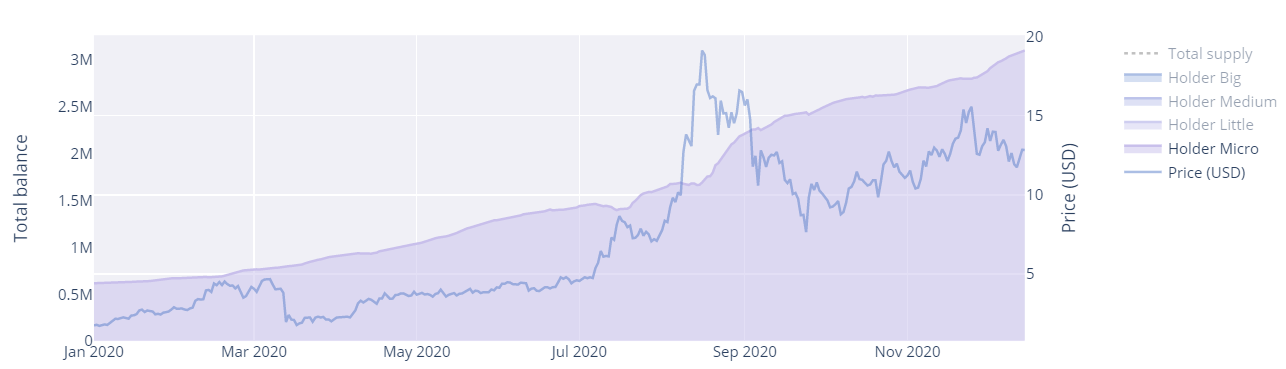

According to data provided by Nyctale, the buying pressure for the digital asset has been quite stable throughout the year. The following graph outlines the buying trends from Micro, Little, and Medium investors.

Source: Nyctale

A few observations can be made from the said chart. For starters, there was a peak witnessed in the middle of the DeFi speculative summer.

Further, when the sell-side of the market was checked out, a similar trend was visible. The selling has been quite stable with no major dips. However, there has been a slight increase in selling behavior lately due to the latest price hike.

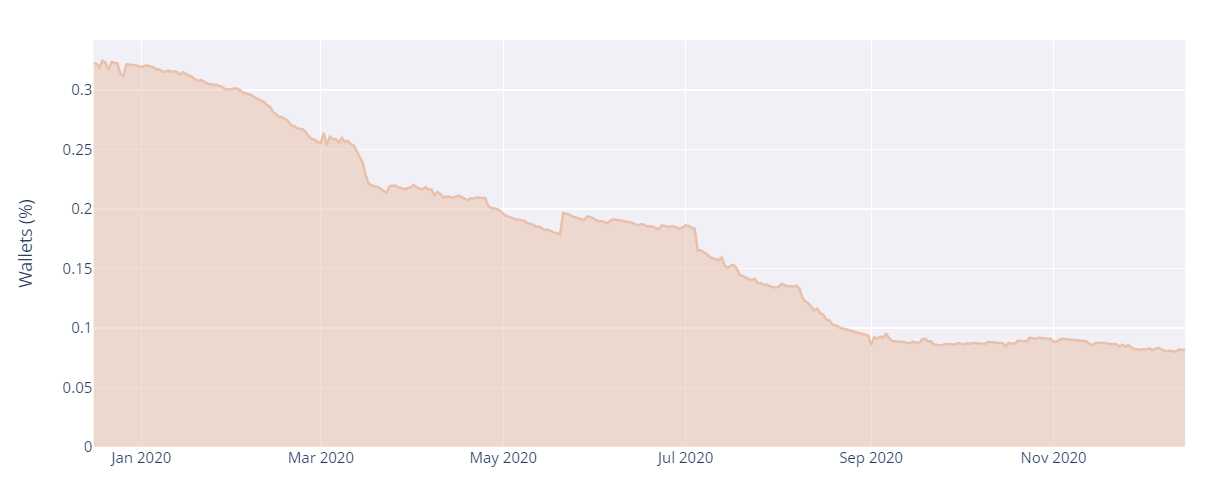

The Chainlink network has also seen a significant concentration of wealth. As per data, 90% of the supply is being held by 0.08% of all wallets. This is interesting since the value was close to 0.3%, until earlier this year.

Source: Nyctale

Such a trend in accumulation can be attributed to the market’s LINK marines. Until November, the top 100-non exchange whales had accumulated LINK tokens since last year, and the trend had continued even after its drop in September. At the time, Santiment had noted that LINK’s offline increase in tokens was reflecting confidence in the crypto-asset from those with most at stake.

The high whale accumulation, although non-ideal for LINK, turned out to be a depiction of traders’ trust in the market, something that did reap them grand profits. However, at press time, the value of LINK had begun to break down, with the coin losing almost 7% of its value in the last 18 days, a development that, once again, was at a time when BTC was topping. Nevertheless, the popularity of Chainlink’s oracles among DeFi protocols might just keep the project afloat.