Binance Coin goes past $47, sets a new ATH

Setting a new all-time high seems to be in fashion for many cryptocurrencies. Binance Coin joined the growing list as it rose past $47 in the early hours of Jan 18. However, after having breached the $47 level the coin experienced a pullback and was trading close to $46 at press time.

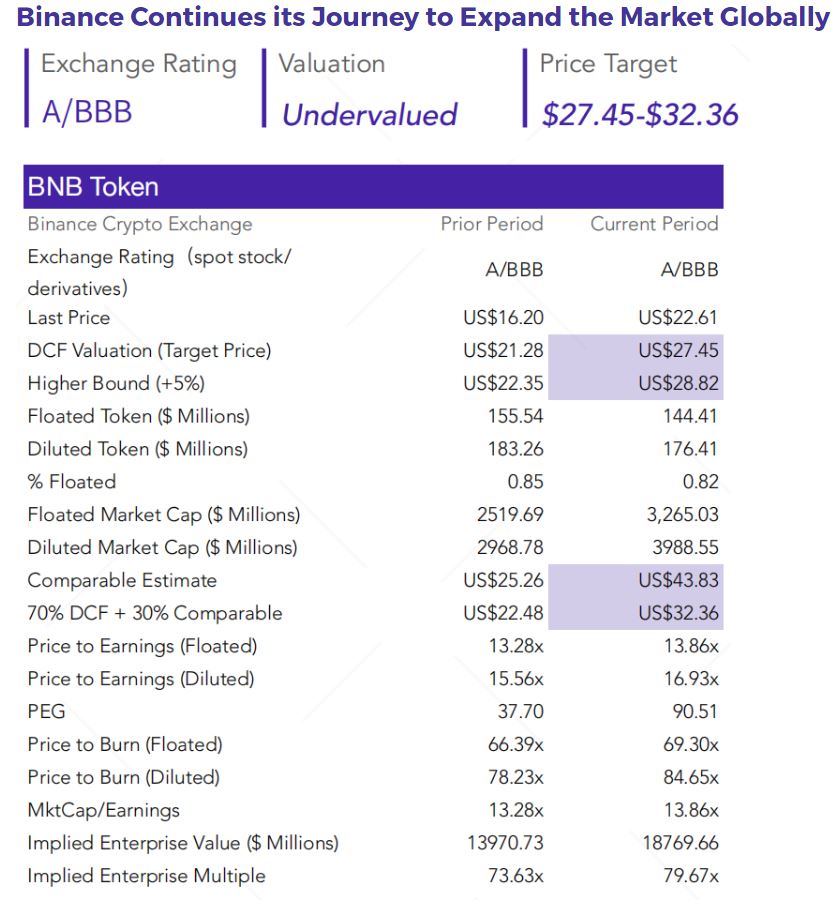

The coin held the 11th spot by market capitalization on CoinMarketCap, with a market cap of $6.5 billion. BNB has a YTD return of 168%, which compares favorably to some other popular exchange tokens such as OKB, with a 163% return. BitMax token has actually depreciated by 25.5%, white FTX Token has been a phenomenon with a YTD ROI of 308%. TokenInsight’s exchange token report from August, when BNB was priced at $16.2, noted that the digital asset was undervalued.

Source: TokenInsight

On the charts, Binance Coin has been in a long-term uptrend since early July, when it had a price of $15. The prior downtrend from the previous year’s high at $38.85 was confirmed to be broken when BNB began to rally upward in July 2020, and that momentum is yet to weaken. A move past $45 sets a short-term target of $50 for the bulls, which is also a psychological level of resistance.

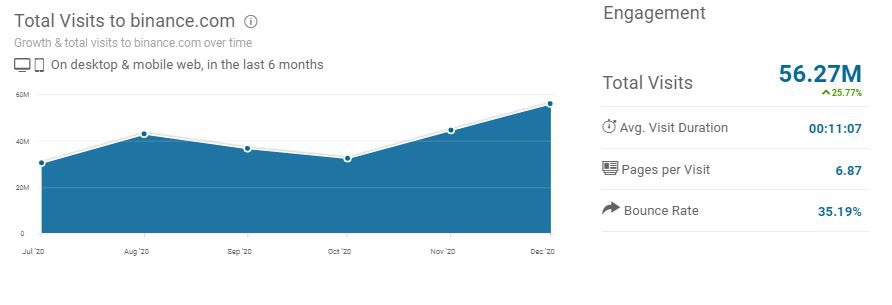

According to similarweb.com, the search volume for Binance and related keywords has been rising since October 2020, when it was at 32.5 million page visits to 56.3 million page visits in December.

Source: similarweb.com

On Jan 4th, Changpeng Zhao or CZ, the CEO of Binance, tweeted that the previous 24 hours had seen $80 billion in trading volume across both spot and derivatives on the Binance exchange. He admitted that ATH volumes could be an issue but promised to fix any errors that crop us as quickly as possible.

The performance of Binance as an exchange over 2020 has been remarkable. Binance acquisitions and partnerships in 2020 saw CoinMarketCap acquired in April, Swipe in July, and WazirX, acquired in November 2019, saw a 760% increase in monthly volume over the year.

Each quarter of 2020 saw BNB worth $218.96 million burned through the use of a smart contract function. Cumulatively it was nearly 6% of the BNB in circulation, to increase coin scarcity and eventually burn 100 million BNB.

Binance Coin has a strong use case as it can be utilized to pay fees of any sort on the Binance exchange. Considering the fact that Binance is a global giant in the crypto space whose influence is likely to grow even further, accompanied by the commitment to burning BNB, it might not be too long before $50 is breached as well.