Bitcoin at $300k achievable? this analyst thinks so

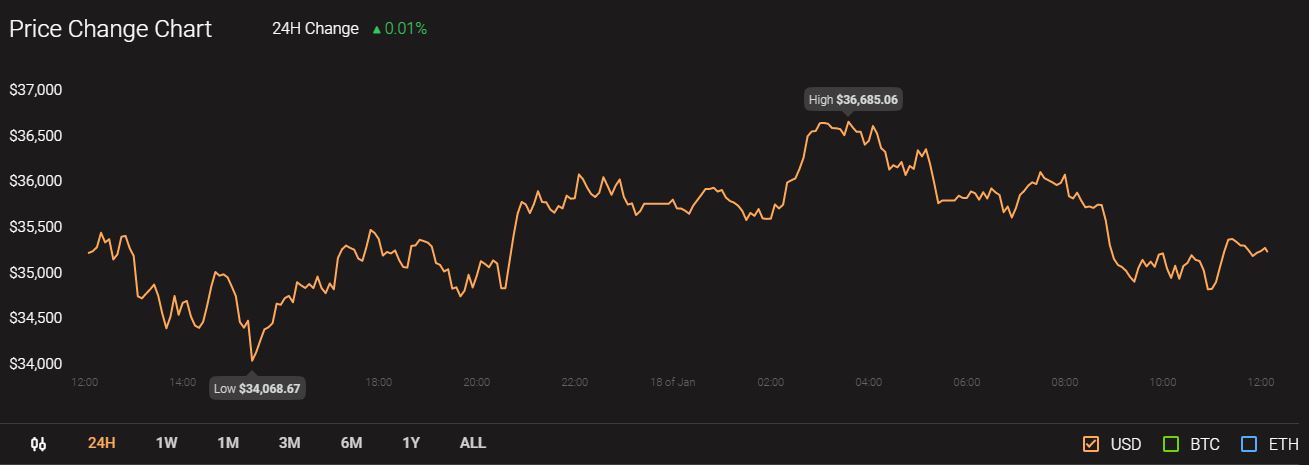

The 2021 bull run of Bitcoin has pushed the digital asset to an unknown territory with regard to price discovery. The current value of the digital asset has been dropping and reached $35k which is still a price level unseen during the previous bull run. There has been a consensus in the market that this bullishness in the cryptocurrency market may continue and the value of the largest digital asset’s price will continue to surge.

Source: CoinStats

Many analysts have taken the historic data available from 2018 to base their predictions on the potential upcoming trends in the market. Prominent crypto analyst Willy Woo also made one such observation about the market shakeout. While explaining the causes leading to an 85% drop in value for BTC in 2018, Woo suggested that “weak hands have to be tested and shaken out” as part of the price discovery mechanism for Bitcoin.

Woo added:

“Once the shake out of weak hands completes, the price discovery mechanism allows price to move upwards. This emerging asset class is driven by its global adoption as a digital age Store of Value network.”

Even though the bull market changes cycle to cycle, Woo believed that the price mechanism worked the same. Currently, we’re in a bull market, wherein the price of BTC is expected to soar higher than even the current ATH, and if Woo’s calculations are to be believed this top will be close to $200,000 to $300,000.

Woo appeared on Laura Shin’s Unchained podcast and explained his Top Cap model for price prediction based on moving averages. While explaining the workings of this model, he noted that historical data can be used to chart the movement of BTC’s price and on this basis, it was possible to guess where the arc was going. Woo stated:

“If we don’t arc upwards and we assume the top of the bull market is around December this year. Which, you know, it’s a fair estimate because all the bull market tops of the last two cycles have been around December, just before tax season. We’re going to go above $100,000 even if it doesn’t arc upwards. If we arc upwards and we’re up to $200,000 to $300,000… conservatively, I mean. Given the size of this rally, it’s going to push it higher.”

Calling Bitcoin mechanical, Woo noted that the Top Cap model had worked throughout the years of Bitcoin’s existence. This was not the first time, Woo appeared to be optimistic about Bitcoin’s price as he had previously also claimed that Bitcoin will surpass Gold’s market cap. However, in order to do that BTC price would need to hit $240,000 which was around Woo’s current estimate.

Although the technical indicators have been strong for the BTC price to surge to new levels, the level estimated by Woo will be an interesting journey, if the price mechanism and Top Cap model happen to be true.